Mortgage Application Payments Fell 2.9% In December

The median payment fell to $1,920 in December from $1,977 in November.

- The PAPI measures how new monthly mortgage payments vary across time — relative to income — using data from MBA’s Weekly Applications Survey (WAS).

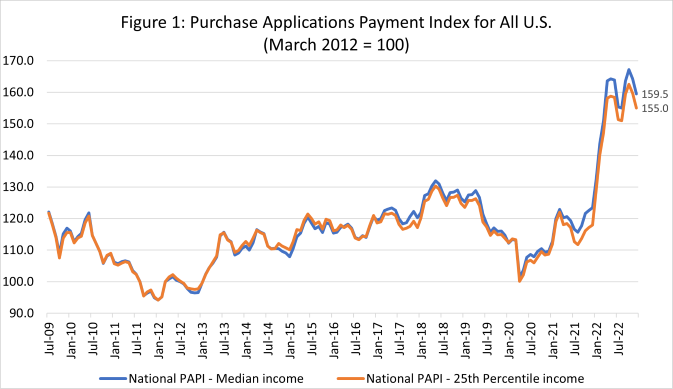

- The national PAPI was 159.5 in December, down 2.9% from 164.2 in November and a further decline in the PAPI since a series high in October 2022.

Home affordability improved in December, with the national median payment applied for by purchase applicants decreasing nearly 3%, the Mortgage Bankers Association (MBA) said Thursday.

According to the MBA’s monthly Purchase Applications Payment Index (PAPI), the median payment fell 2.9% to $1,920 in December from $1,977 in November.

The PAPI measures how new monthly mortgage payments vary across time — relative to income — using data from MBA’s Weekly Applications Survey (WAS).

The latest release includes a new dataset on applications for newly built single-family homes from MBA’s Builder Application Survey (BAS) data, the organization said. The new index — based on the BAS — is the Builders’ Purchase Application Payment Index (BPAPI).

“There was a slight improvement in homebuyer affordability last month as mortgage rates fell by 37 basis points from November,” said Edward Seiler, MBA's associate vice president, housing economics, and executive director, Research Institute for Housing America.

“While overall homebuyer affordability did increase, the median purchase application payment amount last month increased nearly $3,000 to $300,000,” Seiler said. “With inflation cooling slightly, MBA expects both mortgage rates and home-price growth to soften, which along with cooling inflation, should help bring more prospective buyers into the market during the spring homebuying season.”

The December BPAPI showed the median mortgage payment for purchase mortgages from the builders’ survey was $2,399 in December, up 35% from $1,770 a year earlier.

An increase in MBA’s PAPI — which indicates declining borrower affordability conditions — means that the mortgage payment to income ratio (PIR) is higher due to increasing application loan amounts, rising mortgage rates, and/or a decrease in earnings. A decrease in the PAPI — which indicates improving borrower affordability conditions — occurs when loan application amounts decrease, mortgage rates decrease, and/or earnings increase.

The national PAPI was 159.5 in December, down 2.9% from 164.2 in November and a further decline in the PAPI since a series high in October 2022.

Compared to December 2021 (123.5), the index jumped 38.8% in 2022. For borrowers applying for lower-payment mortgages (the 25th percentile), the national mortgage payment decreased to $1,279 in December from $1,289 in November.

Other Key Highlights:

- The national median mortgage payment was $1,920 in December, down from $1,977 in November and from $2,012 in October. Mortgage payments increased $534 in 2022, equal to a 38.8% increase.

- The national median mortgage payment for FHA loan applicants was $1,602 in December, down from $1,631 in November and up from $1,070 in December 2021.

- The national median mortgage payment for conventional loan applicants was $1,954, down from $1,994 in November and up from $1,447 in December 2021.

- The top five states with the highest PAPI were: Nevada (259.2), Idaho (248.4), Arizona (219.2), Utah (213.9), and Florida (204.7).

- The top five states with the lowest PAPI were: North Dakota (102.1), Vermont (105.0), Washington, D.C. (106.6), Connecticut (109.9), and West Virginia (115.0).

- Homebuyer affordability increased for Black households, with the national PAPI decreasing from 164.2 in November to 159.5 in December.

- Homebuyer affordability increased for Hispanic households, with the national PAPI decreasing from 157.0 in November to 152.5 in December.

- Homebuyer affordability increased for White households, with the national PAPI decreasing from 165.4 in November to 160.6 in December.