Mortgage Credit Availability Dips In January

MBA says mortgage credit decreases even as rates are forecast to decline.

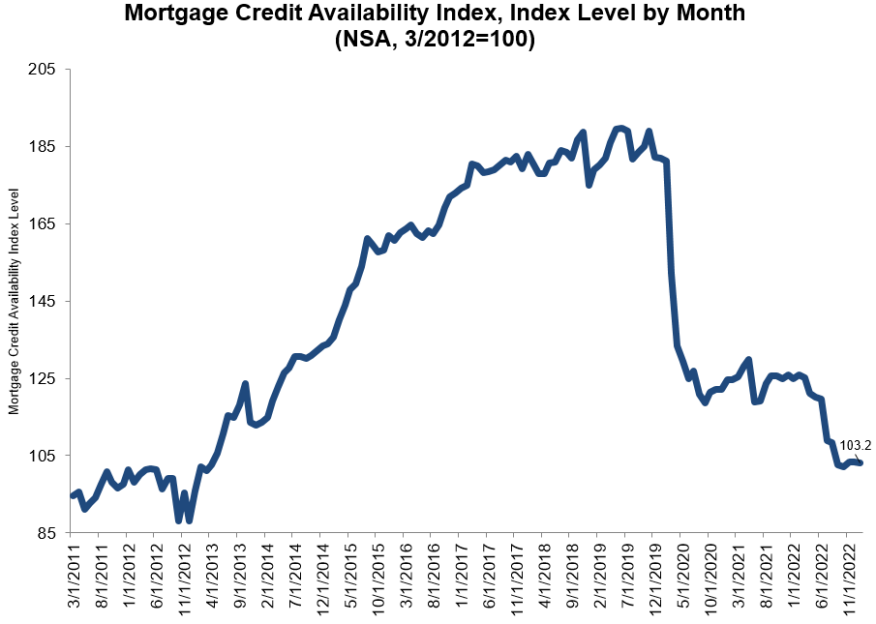

Mortgage credit availability fell slightly in January, according to the Mortgage Credit Availability Index released Thursday by the Mortgage Bankers Association (MBA).

The index fell 0.1% to 103.2% in January. The decline indicates that lending standards are tightening, the MBA said.

The conventional index decreased 0.3% and the jumbo portion of that decreased 0.4%, while both the conforming portion and government index remained unchanged.

“Mortgage credit availability was essentially unchanged in January and remained close to its lowest level since 2013,” said Joel Kan, MBA’s vice president and deputy chief economist. “Similar to December 2022, the availability of credit has been driven lower by declining originations and shrinking industry capacity as lenders have streamlined their operations to cope with lower volumes.”

While mortgage rates declined during the month of January, the share of adjustable-rate mortgages fell slightly.

Kan said there has been a revival of mortgage application activity over the past month and they are forecasting that rates will continue to decline as housing activity gradually picks back up with the Spring buying season on the horizon.

The Mortgage Credit Availability Index (MCAI) provides the only standardized quantitative index that is solely focused on mortgage credit. The index is calculated using several factors related to borrower eligibility (credit score, loan type, loan-to-value ratio, etc.). These metrics and underwriting criteria for over 95 lenders/investors are combined by MBA using data made available via ICE Mortgage Technology and a proprietary formula derived by MBA to calculate the MCAI, a summary measure which indicates the availability of mortgage credit at a point in time. Base period and values for total index is March 31, 2012=100; Conventional March 31, 2012=73.5; Government March 31, 2012=183.5.

To learn more about the ICE Mortgage Technology platform click here.