Fannie Mae and Freddie Mac exhibit contrasting risk trajectories, while purchase loans dominate in a high-interest rate environment.

Milliman Inc., a mortgage consulting and analytics firm, found that mortgage default risk increased in the second quarter of this year, but there was a difference between government-sponsored entities.

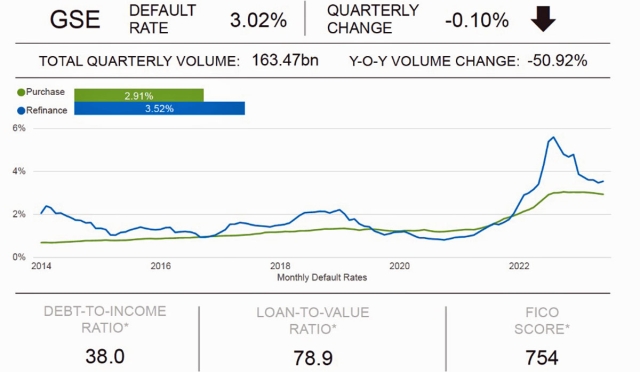

According to its Milliman Mortgage Default Index (MMDI), the mortgage default risk witnessed a decrease, settling at 3.02% for loans acquired in Q2 2023, a drop from the 3.12% recorded for loans in Q1 2023. Interestingly, the trends showed a divergence in the default risk trajectory for government-sponsored enterprise (GSE) acquisitions.

Freddie Mac acquisitions experienced an uptick in default risk, moving from 3.04% to 3.09%, attributed to an increase in borrower risk. Conversely, Fannie Mae acquisitions reported a drop in default risk from 3.17% to 2.96%, underpinned by a decrease in borrower risk. Fannie Mae's larger volume of acquisitions, predominantly purchase loans, in Q2 2023 ensured that the overall GSE default risk receded by 10 percentage points.

The market dynamics in Q2 also threw light on the mortgage volume patterns. As interest rates peaked at around 7%, the mortgage volume persisted at lower levels, with purchase loans constituting a significant 87% of all originations.

"Mortgage originations for both refinance and purchase loans are in line with 2019, similar to volume we saw pre-pandemic," said Jonathan Glowacki, a principal at Milliman and co-author of the MMDI. "The recent increases in interest rates have made rate/term refinance loans less attractive to home buyers, and about 68% of refinance originations in Q2 were cash-out refinance loans."