Mortgage Fraud Risk In Q2 Fell 7.5% YOY

CoreLogic report, however, says certain types of fraud are increasing.

- The report found that 0.76% of mortgage applications — or 1 in every 131 applications — contained instances of fraud in the second quarter of 2022.

- Nonetheless, higher risks were recorded during months in the second quarter, particularly for certain types of mortgage fraud.

- Risks of income and property fraud posted the largest year-over-year increases in the second quarter, up 27.3% and 22.6%, respectively.

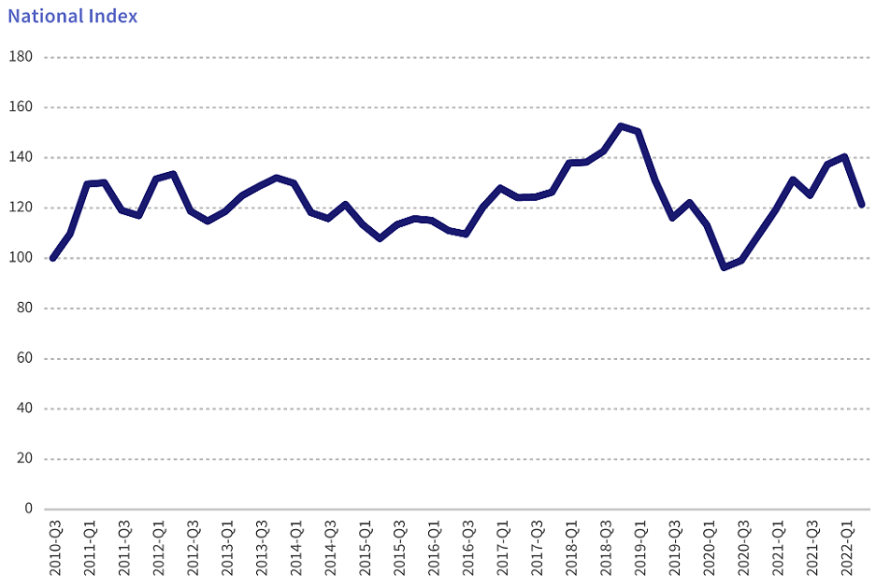

The risk of mortgage fraud decreased 7.5% in the second quarter from a year earlier, but for certain types of fraud the risk is growing, according to a new report.

CoreLogic, a global property information, analytics and data-enabled solutions provider, today released its quarterly Mortgage Fraud Report. The report found that 0.76% of mortgage applications — or 1 in every 131 applications — contained instances of fraud in the second quarter of 2022. That was down from 0.83%, or 1 in every 120 applications, in the second quarter of 2021.

Corelogic did note that the decline in the second quarter of this year follows a large increase seen in the same period in 2021 and is “partially due to the recalibration of CoreLogic’s scoring model in the first quarter of 2022.”

Since that update, the company said, higher risks were recorded during months in the second quarter, particularly for certain types of mortgage fraud.

Risks of income and property fraud posted the largest year-over-year increases in the second quarter, up 27.3% and 22.6%, respectively.

“This trend is perhaps not surprising,” Corelogic said in its report, “considering that purchase loans now account for more mortgage transactions than refinances, and that the former are more susceptible to fraudulent activity.”

Loan volume shrank dramatically in the 12 months ending June 2022, the report notes, as interest rates rose and the pandemic refi boom ended. Refinance volumes fell 69%, while purchase declined by 5%. Volume, purchase/refinance mix, and other segmentation resemble the market in the second quarter of 2018, the report states.

The only segments with volume growth were investment purchases (+12%), jumbo purchases (+5%), and VA purchases (+5%), yet each of these segments decreased in risk, the report said.

“Signs of a broader slowdown in the housing market are evident, as home-price growth decelerated for the second consecutive month,” Selma Happ, interim lead and deputy chief economist for CoreLogic. “Nevertheless, buyers still remain interested, which is keeping the market competitive — particularly for attractive homes that are properly priced.”

Segments with increasing risk included FHA purchases (+79%), multifamily/2- to 4-unit purchases (63%), multifamily/2- to 4-unit refis (+23%), and jumbo refis (+19%).

Nationally, five of the six mortgage fraud types CoreLogic tracks have shown increased risks since the second quarter of 2021, the report said. The exception was undisclosed real estate debt, which declined by 12%. In addition to income fraud and property fraud, the other types with increased risk include identity fraud (up 4.7% year over year); transaction fraud (+1.6% YOY); and occupancy fraud (+0.8% YOY).

Bridget Berg, principal of Corelogic’s Industry & Fraud Solutions, said income-fraud risk remains a top concern for lenders, “but there is a rising focus on property-value risk as home prices slow their growth and homes are taking longer to sell. CoreLogic data backs up those concerns, as our most predictive flags for both income and property frauds increased in the last year more than 20%.”

Report Highlights:

- The top five states for fraud risk increases were Rhode Island, South Dakota, Kentucky, New York and Nebraska. Less-populous states are prone to volatile index values, as small groups of higher-risk loans are more likely to move the index, Corelogic said. For example, Rhode Island’s 60% year-over-year fraud risk increase was in part due to a large share of government-backed loans, which have become riskier over the past year.

- New York moved into the top position for mortgage application fraud risk, with Florida, Rhode Island, Nevada, and Connecticut rounding out the top five.

The CoreLogic Mortgage Fraud Report analyzes the collective level of loan application fraud risk experienced in the mortgage industry each quarter. CoreLogic said it develops the index based on residential mortgage loan applications processed by CoreLogic LoanSafe Fraud Manager, a predictive scoring technology.