Mortgage Lenders See AI As Key To Operational Efficiency

Fannie Mae Survey: 73% of lenders now prioritize operational efficiency through AI and ML, marking a significant shift from 42% in 2018.

The latest Fannie Mae Mortgage Lender Sentiment Survey highlights a burgeoning interest among lenders to integrate Artificial Intelligence (AI) and Machine Learning (ML) in the mortgage industry, primarily aiming at operational efficiency.

The drive for operational efficiency using AI and ML has surged, with 73% of lenders citing it as their motivation for operational efficiency, a significant rise from 42% in Fannie Mae's 2018 survey. The potential applications of these technologies encompass automating manual processes, risk management, fraud detection, and more.

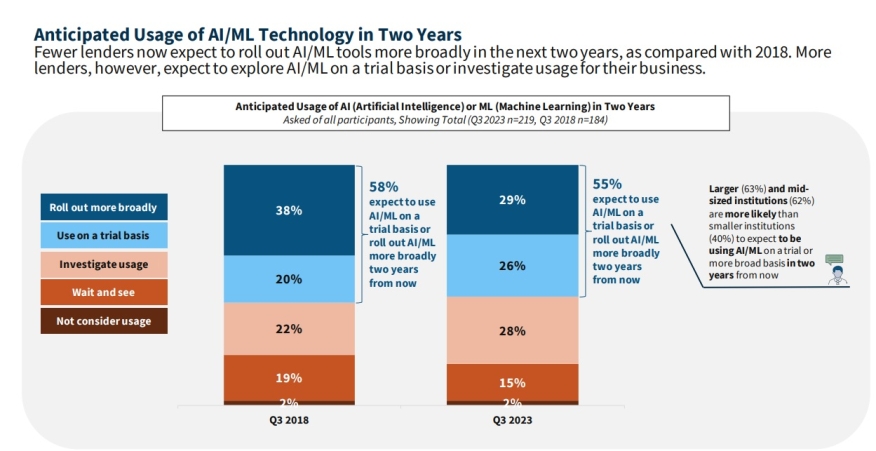

Notably, the survey indicated that 22% of lenders have begun to deploy AI or ML technologies on a trial or limited basis, marking a considerable growth from the 13% recorded in 2018. When polled about the most beneficial AI applications, lenders emphasized compliance, underwriting, and property valuation.

"The latest results indicated that lenders most value AI applications that might help automate this sort of data processing and identify potential anomalies. Given the rising costs of today's business environment, AI applications intended to improve operational efficiency are clearly highly valued by lenders and could function as a starting point among industry stakeholders to encourage wider adoption," Peter Ghavami, vice president of modeling and data science at Fannie Mae, said.

This year's survey, conducted between Aug. 1 and Aug.14, collected responses from 242 senior executives representing 219 lending institutions, which included mortgage banks, depository institutions, and credit unions.

Lenders proposed several AI application ideas for government-sponsored enterprises (GSEs) to develop, such as appraisal automation, borrower income and employment verification, data reconciliation, standardization, and compliance management.

The challenges facing lenders keen on AI/ML adoption remain consistent with those observed in 2018. The primary barriers include the intricate integration with current infrastructure, the perceived lack of a proven success track record, and the associated high costs. Mortgage banks, in particular, find integration complexity more daunting than depository institutions. Additionally, data security and privacy concerns have intensified since 2018.

Despite AI and ML's pervasive growth, the survey suggests that lenders' familiarity, current adoption rate, and challenges concerning these technologies have largely remained static over the past five years. About 65% of lenders in 2023 confirmed their familiarity with AI/ML, mirroring the 63% from 2018.

"Regardless, as these technologies mature, we expect humans and AI/ML to play to their respective strengths within the mortgage industry, with the latter likely to handle more of the back-end processing and the former continuing to build and maintain the customer relationships necessary to drive sales," Ghavami said.