Mortgage Lending Standards Tighten

Investors reduced offerings of ARM, Non-QM loans; HELOCs up slightly.

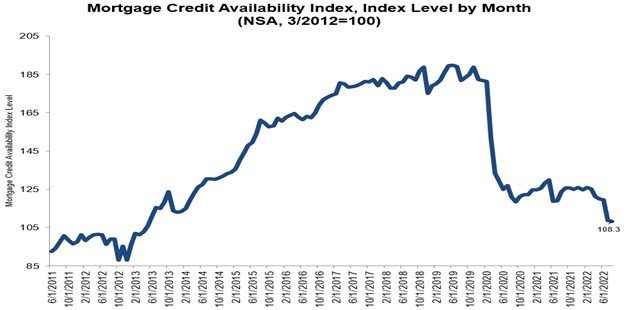

According to the Mortgage Credit Availability Index (MCAI) from Mortgage Bankers Association (MBA), mortgage lending standards fell in August by 0.5% to 108.3.

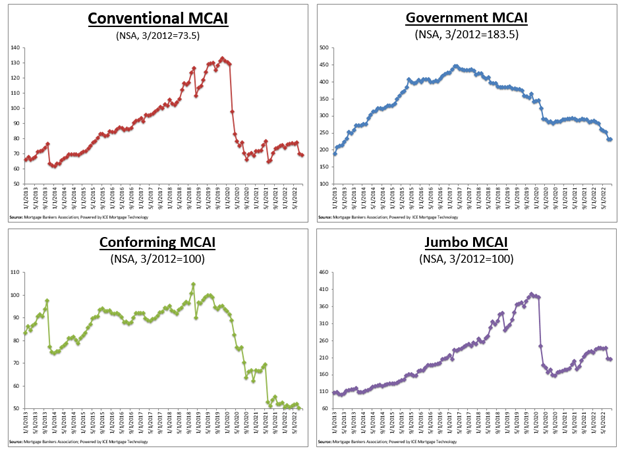

A decrease in MCAI indicates that lending standards are tightening, while increases in the index would indicate loosening credit. The index was benchmarked to 100 in March 2012. Conventional MCAI fell 1% while the government index remained unchanged. The Jumbo MCAI decreased by 0.7% and the conforming index fell by 1.2%.

The Government MCAI examines FHA/VA/USDA loan programs, while the Conventional MCAI examines non-government loan programs. The Jumbo and Conforming MCAIs are a subset of the conventional MCAI and do not include FHA, VA, or USDA loan offerings. The Jumbo MCAI examines conventional programs outside conforming loan limits, while the Conforming MCAI examines conventional loan programs that fall under conforming loan limits.

Mortgage credit availability fell in August as investors reduced their offerings of ARM and Non-QM loan programs, according to Joel Kan, MBA’s associate vice president of economic and industry forecasting.

“With overall origination volume expected to shrink in 2022, some lenders continue to streamline their operations by dropping certain loan programs to simplify their offerings. Additionally, with a worsening economic outlook and signs of cooling in home-price growth, the appetite for riskier loan programs has been reduced,” Kan said. “Slightly offsetting these trends, however, was a small increase last month in new HELOC products. With aggregate home equity still at elevated levels, HELOCs could benefit borrowers who might not want to give up on their current, low mortgage rate but do want to utilize their home equity to support other spending plans.”