Mortgage Rate Lock Volume Surged 43% In March

'This continues to be an incredibly rate-sensitive housing market.'

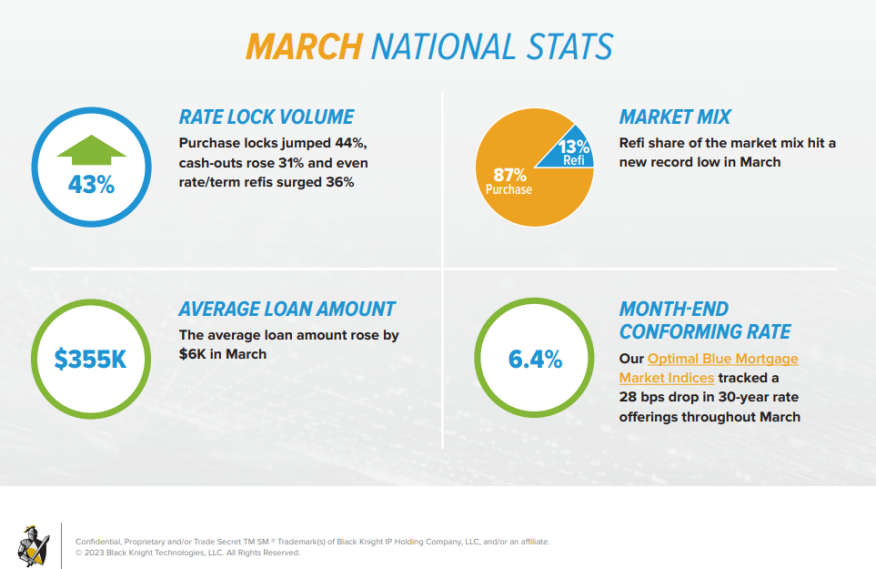

- Lock volumes increased across the board, with purchase locks increasing 44%, well above the 30% average February-to-March gain seen across the past five years.

- Cash-out refinances were up 31% and rate/term locks grew by 36%, but both remain historically low.

- The Optimal Blue Mortgage Market Indices from Black Knight tracked 30-year rates as they climbed to the highest levels of the year in March, reaching 6.8%.

The overall dollar volume of mortgage rate locks rose 43% in March from a month earlier, according to a report from Black Knight, which said that the surge exceeded the typical spring increase.

According to Black Knight’s Originations Market Monitor report for March 2023, the increase was led by a sharp month-over-month rise in purchase locks — up 44% — as well as increases in cash-out refinances (+31%) and rate/term refis (+36), which had been hovering near historic lows. The month-over-month increase in purchase locks was well above the 30% average February-to-March gain seen across the past five years, Black Knight said.

Despite the rebound, refinance locks fell to just 13% of the month’s activity, a new low for this cycle, due to the disproportionate increase in purchase locks, the report states.

But even with the month-over-month gains, purchase lock counts — which exclude the impact of home-price changes — remain well below both last year’s (-37%) and pre-pandemic (-12% against March 2019) levels, the report states.

“This continues to be an incredibly rate-sensitive housing market, and March’s rate lock activity perfectly illustrates this dynamic,” said Andy Walden, vice president of enterprise research at Black Knight. “Early in the month, when rates started their climb back toward 7% — reaching 6.8% in the process — we saw pronounced downward pressure on originations. In the wake of uncertainty in the banking sector and investors’ flight to the safe haven of U.S. Treasuries, rates came down roughly a quarter of a point. The result? Another quick surge in originations, particularly in the purchase market.”

Walden said it’s not unusual for rate locks to surge in March as the spring homebuying season approached, but said, “this year’s rise outpaced what we typically see on a seasonal basis.”

He continued, “A cooling market lacking the multiple bids and all-cash offers of the recent past has made sellers more receptive to FHA offers. That, combined with a recent reduction in FHA mortgage insurance premiums and a mid-month increase in the FHA-to-conforming spread, made FHA loans comparatively more attractive.”

The FHA share of rate locks increased to more than 20% of the pipeline in March, up from 18% at the beginning of the year and 12% a year ago. The conforming loan share of rate locks was 59.9%, while the nonconforming loan share was 11.7%, the VA loan share was 11.6%, and the USDA share was 0.7%.

Of the top 20 metro statistical areas, the New York-Newark-Jersey City, N.Y.-N.J.-Pa. Area led with a 61.1% increase in rate lock volume from a month earlier. It was followed by the Chicago-Naperville-Elgin, Ill.-Ind.-Wis. area (+56.2%); the Washington-Arlington-Alexandria, D.C.-Va.-Md.-WVa. area (+49.4%); Dallas-Fort Worth-Arlington, Texas area (+48.8%); and the Miami-Fort Lauderdale-West Palm Beach, Fla. area (+43.3%).

Black Knight’s monthly Originations Market Monitor report provides origination metrics for the U.S. and the top 20 metropolitan statistical areas by share of total origination volume.