Mortgage Rates Remain Steady

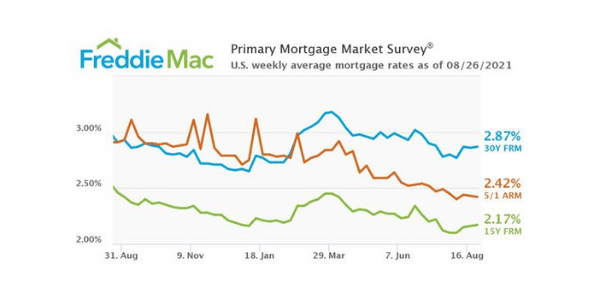

Today Freddie Mac released the results of the Primary Mortgage Market Survey (PMMS) which shows that the 30-year-fixed-rate mortgage (FRM) averaged 2.87%.

- The 30-year-fixed-rate mortgage (FRM) averaged 2.87%, slightly up from the previous week’s rate, 2.86%.

- The 15-year-fixed rate mortgage averaged 2.17%, down from last year's rate at 2.46%.

- The five year Treasury-indexed hybrid adjustable-rate mortgage (ARM) averaged 2.42%. Last year the ARM averaged 2.91%.

Today Freddie Mac released the results of the Primary Mortgage Market Survey (PMMS) which shows that the 30-year-fixed-rate mortgage (FRM) averaged 2.87%. The average is slightly up from the previous week’s rate, 2.86%.

“The tug-of-war between the economic recovery and rising COVID-19 cases has left mortgage rates moving sideways over the last few weeks,” said Sam Khater, Freddie Mac’s chief economist. “Overall, rates continue to be low, with a window of opportunity for those who did not refinance under three percent. From a homebuyer perspective, purchase application demand is improving, but the major obstacle to higher home sales remains very low inventory for consumers to purchase.”

The 15-year-fixed rate mortgage averaged 2.17% with an average 0.6 point for the week ending on August 26, 2021. During the same time period last year, the 15-year FRM averaged 2.46%.

The five year Treasury-indexed hybrid adjustable-rate mortgage (ARM) averaged 2.42% with an average 0.2 point, down slightly from last week’s 2.43%. During the same week a year ago, the ARM averaged 2.91%.

The PMMS is generally focused on conforming, conventional home purchase loans for borrowers who put at least 20% down and have trustworthy credit.

For more information and updates on mortgage rates, visit FreddieMac.com/blog.