Mortgage Rates On The Rise: 30-Year FRM Nears 8%

Freddie Mac's survey highlights concerns for homebuyers and builders; introduces tool to aid with down payments amidst soaring rates

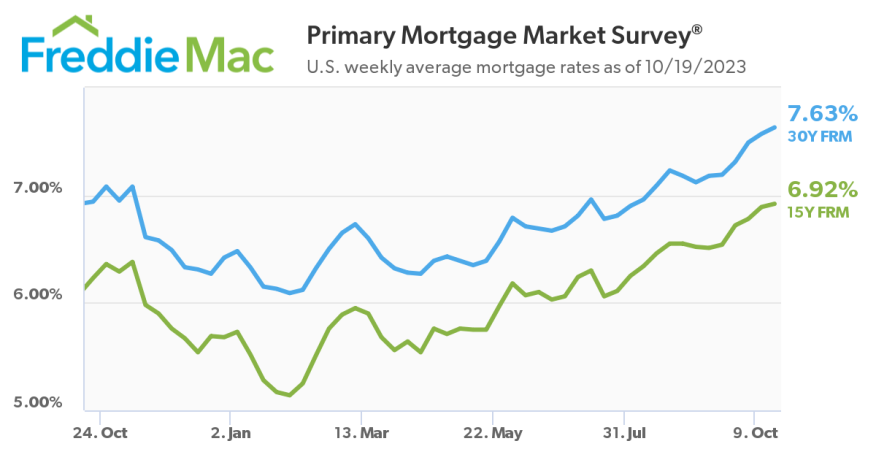

Freddie Mac's Primary Mortgage Market Survey, which reports on the previous week's mortgage rates, found the 30-year fixed-rate mortgage (FRM) climbed to an average of 7.63%.

Several rate tracking sites reported 8% for the 30-year fixed-rate starting Wednesday.

“In this environment, it’s important that borrowers shop around with multiple lenders for the best mortgage rate," Freddie Mac's Chief Economist Sam Khater said. "With research showing down payment is the single largest barrier to first-time homebuyers attaining homeownership, borrowers should also ask their lender about down payment assistance."

Freddie Mac's newly launched DPA One tool aims to simplify this process. It facilitates both lenders and prospective homebuyers in identifying and leveraging nationwide down payment aid programs.

“Not only are homebuyers feeling the impact of rising rates, but home builders are as well. Incoming data shows that the construction of new homes rebounded in September, but as rates keep rising, home builders appear to be losing confidence. As a result, we expect construction to trend down in the short-term," Khater said.

Key takeaways from the survey:

- As of Oct. 19, 2023, the 30-year FRM has escalated to an average of 7.63%, marking an increase from the previous week's 7.57%. Comparatively, the rate stood at 6.94% during the same period last year.

- The 15-year FRM has risen to 6.92%, a slight surge from last week's 6.89%. This rate was recorded at 6.23% a year ago.