Mortgage Rates Skyrocket To Highest Levels Since 2000

Homebuyers face affordability crisis as 30-year fixed rate hits 7.49%, amidst inflationary pressures and Federal Reserve uncertainties.

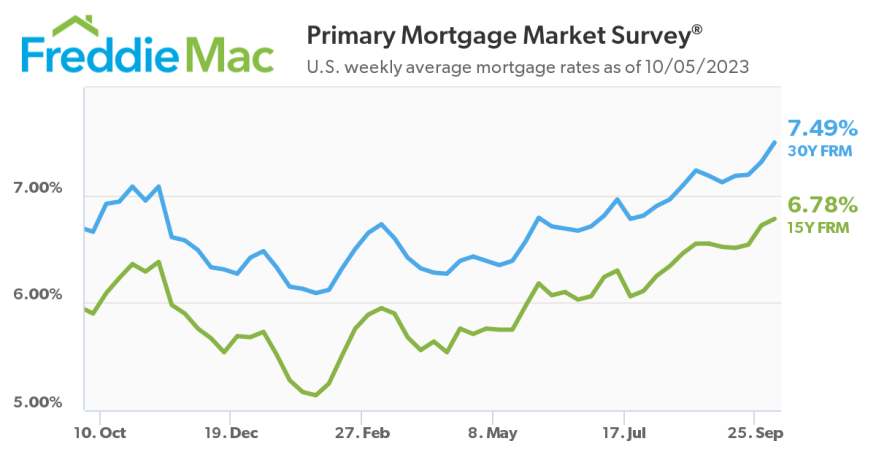

Mortgage rates saw a significant spike last week, reaching their highest level since December 2000, with the 30-year fixed-rate mortgage (FRM) averaging a whopping 7.49%, according to Freddie Mac.

This alarming climb is attributed to various factors, including changing inflation dynamics, fluctuations in the job market, and uncertainties surrounding the Federal Reserve's forthcoming decisions. Notably, the 10-year Treasury yield, which is crucial for mortgage rates, has experienced an upward swing, further fueling the rate surge.

“Mortgage rates maintained their upward trajectory as the 10-year Treasury yield, a key benchmark, climbed,” said Sam Khater, Freddie Mac’s chief economist. “Several factors, including shifts in inflation, the job market and uncertainty around the Federal Reserve’s next move, are contributing to the highest mortgage rates in a generation. Unsurprisingly, this is pulling back homebuyer demand.”

The report revealed:

- A week prior, the 30-year FRM stood at 7.31%, while a year ago, it was at 6.66%.

- The 15-year fixed-rate mortgage also escalated, averaging 6.78%, up from the previous week's 6.72%.

The rate surge is anticipated to strain potential homebuyers more financially, significantly increasing their monthly expenses in an already challenging market environment. Remarkably, the current 30-year mortgage rate has more than doubled from just 2.99% two years ago.

High property prices further exacerbate the affordability crisis due to a scarcity of home inventory. This, coupled with the rate spike, has resulted in a 21% drop in sales of previously owned homes for the first eight months of 2023 compared to the same duration in 2022.

According to the Mortgage Bankers Association, home loan applications have plunged to their lowest since 1996. Simultaneously, the median monthly payment recorded on these applications climbed to $2,170 in August, marking an 18% ascent year-over-year.

Reflecting the broader market sentiments, the weekly average rate for a 30-year mortgage has surpassed the 7% threshold since mid-August, with the most recent figure only slightly below the December 8, 2000, record of 7.54%.