NAR: Pending Home Sales Jumped 8.1% In January

It was the second straight monthly increase, and the largest since June 2020.

- Pending home sales increased for the second consecutive month, up 8.1% from December 2022.

- Month-over-month, contract signings raised in all four major U.S. regions.

- Pending home sales dropped in all regions compared to one year ago.

Pending home sales increased for the second straight month in January, surging 8.1% — the largest monthly gain since June 2020, the National Association of Realtors (NAR) said Monday.

All four U.S. regions posted monthly gains but saw year-over-year drops in transactions.

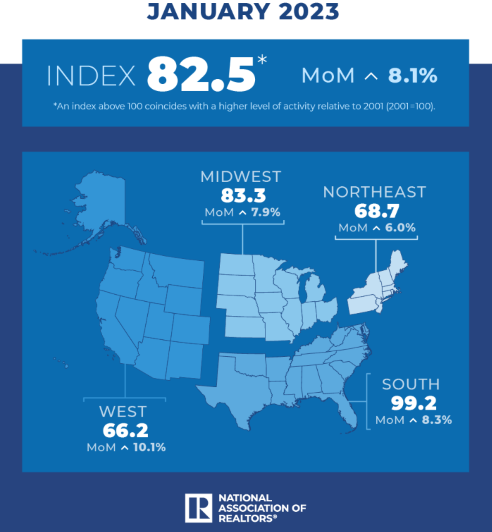

NAR said its Pending Home Sales Index (PHSI) — a forward-looking indicator of home sales based on contract signings — improved 8.1% to 82.5 in January, while year-over-year, pending transactions dropped by 24.1%.

An index of 100 is equal to the level of contract activity in 2001.

“Buyers responded to better affordability from falling mortgage rates in December and January,” NAR Chief Economist Lawrence Yun said.

NAR said it anticipates the economy will continue to add jobs throughout 2023 and 2024, with the 30-year fixed mortgage rate steadily dropping to an average of 6.1% in 2023 and 5.4% in 2024.

With an improving interest rate environment and job gains, Yun still expects annual existing-home sales to drop 11.1% in 2023, to a total of 4.47 million units, before jumping 17.7% in 2024 (5.26 million units). NAR projects new-home sales will fall 3.7% year-over-year in 2023 before growing 19.4% in 2024.

“Home sales activity looks to be bottoming out in the first quarter of this year, before incremental improvements will occur,” Yun said. “But an annual gain in home sales will not occur until 2024. Meanwhile, home prices will be steady in most parts of the country with a minor change in the national median home price.”

NAR also predicted that median existing-home prices will be stable compared to the previous year for most markets — with the national median home price decreasing by 1.6% in 2023, to $380,100, before regaining positive traction of 3.1% in 2024, to $391,800.

It estimates median new-home prices will increase by 1.3% in 2023, to $461,000, and by 2.8% in 2024, to $474,000, due to higher costs of land and construction materials.

By Region

- The Northeast PHSI rose 6% from last month to 68.7, a decline of 19.8% from January 2022.

- The Midwest index grew 7.9% to 83.3 in January, a drop of 21.1% from one year ago.

- The South PHSI increased 8.3% to 99.2 in January, dipping 24.7% from the prior year.

- The West index elevated 10.1% in January to 66.2, diminishing 29.3% from January 2022.

“An extra bump occurred in the West region because of lower home prices, while gains in the South were due to stronger job growth in that region,” Yun added.

First American Deputy Chief Economist Odeta Kushi agreed.

“Mortgage rates declined in December and January, and buyers responded. All four U.S. regions posted monthly gains in pending-home sales in January,” she said. “Mortgage applications also pointed to an uptick in demand in these months, but are now trending lower as rates have ticked up.”

Kushi said there are interested buyers on the sidelines who are “ready to jump in when the payment-to-paycheck calculation pencils out and when inventory is sufficient. However, higher mortgage rates reduce house-buying power and keep existing owners rate-locked in, preventing supply from reaching the market.”

She added, “The green shoots of spring home-buying are beginning to sprout, but the recent uptick in mortgage rates may have clouded that outlook.”