Nearly 43% Of Home Sellers Are Making Concessions To Buyers

Redfin says that’s nearly double the rate a year earlier.

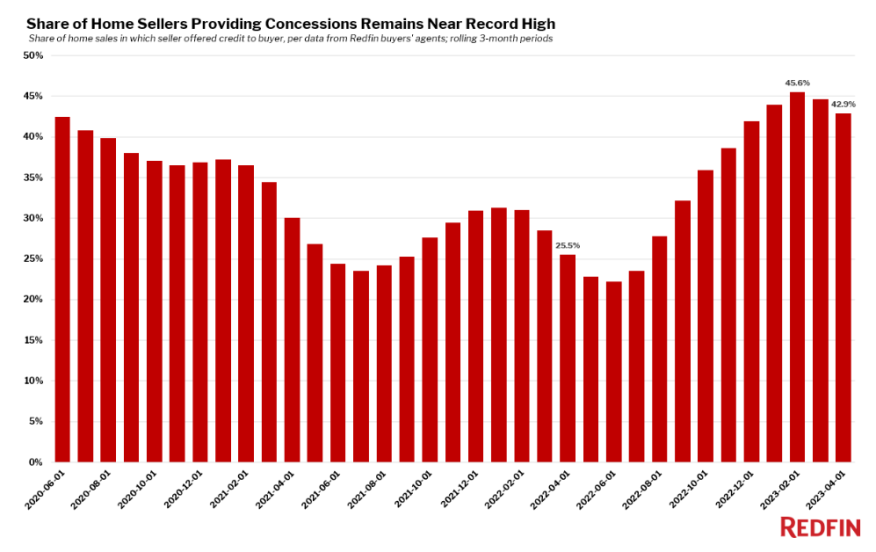

- Sellers gave concessions to buyers in 42.9% of U.S. home sales during the three months ended April 30, up from 25.5% a year earlier.

The share of home sellers giving concessions to buyers in the three months ended April 30 slipped back from the record high set in a similar period that ended in February, but the rate remained nearly double where it was a year earlier, Redfin said Thursday.

According to the report from the Seattle-based online brokerage, home sellers gave concessions to buyers in 42.9% of U.S. home sales during the three months ended April 30, up from 25.5% a year earlier.

Redfin said the rate was just shy of the 45.6% record-high hit in the three-month period ended Feb. 28.

The share of home sellers providing concessions — which can include money toward repairs, closing costs, and mortgage-rate buydowns — inched down from February’s peak due to typical seasonality, Redfin said.

Concessions become less common in the early spring because that’s when more buyers typically enter the market, increasing competition and giving sellers more power, Redfin said. This spring, however, concessions posted a smaller decline than the past two years because high mortgage rates have made it necessary for sellers in cooler markets to take extra measures to attract and secure buyers.

The likelihood of a seller giving a concession dropped 6% from February to April, compared with 18% drops during the same period in 2021 and 2022, Redfin said. This spring’s smaller drop corresponds with reduced homebuyer competition, with 46% of offers written by Redfin agents facing a bidding war in April, down from 59% a year earlier.

Sellers are throwing in freebies to woo buyers at a higher frequency than last year for several reasons:

- Buyers backing out of the market. Many house hunters have put their buying plans on hold because rising mortgage rates have made homeownership more expensive. While home prices have fallen 4% from a year ago, that’s not enough to offset the cost of higher rates, with monthly mortgage payments at a record high. Lack of supply Another factor dampening demand is the lack of supply, with fewer people listing their homes for sale as they hold onto comparatively low mortgage rates.

- Motivated sellers. Many people who are listing their homes are moving because they need to; maybe they got a divorce or secured a new job in a different state. Those sellers may be willing to provide concessions because they need to sell their home quickly.

- Homebuilders offering freebies to attract buyers. There was a surge in homebuilding during the pandemic as builders tried to capitalize on the moving frenzy, especially in pandemic homebuying hotspots. Now that rising rates have pushed many buyers out of the market, builders are trying to sell off their backlog of inventory by offering perks like money toward the buyer’s closing costs, gift cards and even free cars.

While buyers have the upper hand in some markets, that’s not the case everywhere. In some areas, there are so few homes for sale that homebuyers face competition. When buyers are involved in a bidding war, they typically won’t win if they ask for concessions.

“High mortgage rates and low supply have thrown the housing market out of whack, and each deal is different,” said Redfin agent Shauna Pendleton in Boise, Idaho. “Some buyers are asking sellers for the sun, the moon, and the stars in addition to offering below the asking price, and some are requesting no extras because they’re so motivated to secure one of the few homes on the market.”

Pendleton said the one consistency in the market right now is homebuilders handing out freebies.

“Most builders are offering concessions equal to about 3% of the sale price — which gets credited to buyers at closing — to offload properties,” she sid. “Buyers are using the extra cash to cover closing costs or buy down their mortgage rate.”

Accepting Less Money

Just over one in seven (15.7%) home sellers dropped their asking price in addition to providing a concession to the eventual buyer during the three months ended April 30, Redfin said. That’s nearly four times the share of a year earlier (4.2%).

Roughly one in five (20.5%) of homes that sold during the period had a final sale price below the asking price in addition to a concession, up from about 7% a year earlier. Also, about one in 10 (9.4%) had all three — a concession, a price drop, and a final sale price below the original list price. That’s up from just 2.2% a year earlier.

Those shares have all inched down from record highs set in February, which is typical for the spring buying season. This year’s declines, though, are actually smaller than the declines in 2021 and 2022, Redfin said.

Concessions Up In Former Boomtowns

Tampa, Fla., saw a bigger year-over-year jump in seller concessions than any other metro Redfin analyzed, it said. Sellers in Tampa gave concessions to buyers in 58% of home sales during the three months ended April 30, up from 12% a year earlier.

The next-biggest increases were in Nashville, Tenn. (49%, up from 5.6%); Salt Lake City, Utah (46.8%, up from 12.3%); Seattle (45.7%, up from 11.7%;) and Raleigh, N.C. (64.6%, up from 31.2%).

The share of sellers giving out concessions rose over the last year in all of the metros it analyzed, Redfin said.

Sellers in Phoenix gave concessions to buyers in 68.5% of home sales in the three months ended April 30, the highest share of all the metros Redfin analyzed and nearly double 35.9% a year earlier.

San Diego (66.1%), Raleigh (64.6%), Las Vegas (59.1%), and Denver (58.1%) rounded out the top five. Like the metros where concessions rose most, these are all places where homebuying demand skyrocketed during the pandemic and is now waning.