Fannie Mae and Freddie Mac offer a new refinance option for eligible borrowers with incomes at or below 80% of the area’s median income.

A new Fannie Mae program allows borrowers to refinance with New American Funding, the independent mortgage lender. Eligible borrowers must have mortgages backed by either Fannie Mae or Freddie Mac with incomes at or below 80% of the area’s median income.

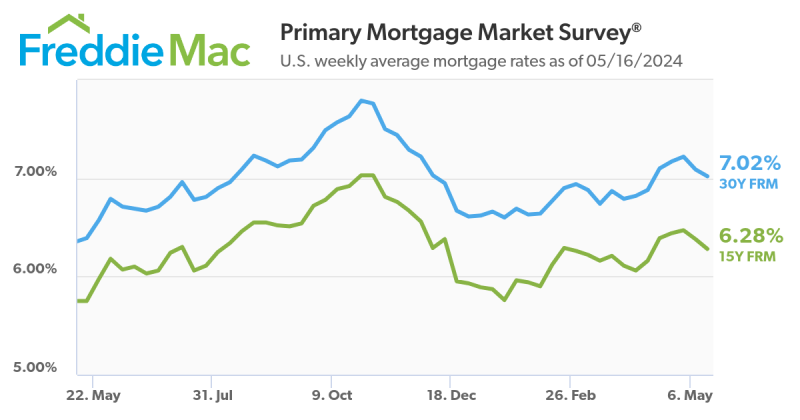

The Fannie Mae ReFi program requires eligible borrowers to receive a savings of at least $50 on their monthly mortgage payment and a reduced interest rate of at least 0.50%.

In order to qualify, borrowers must show they paid their mortgage in the past six months and have not missed more than one payment in the last 12 months. They also need a mortgage with a loan-to-value ratio lower than 97%, a debt-to-income ratio below 65%, and a credit score as low as 620.

Borrowers can determine if they’re eligible for the program by checking out Freddie Mac’s Loan Look-Up Tool and Fannie Mae’s Mortgage Loan Look-Up. The program is for fixed-rate mortgages only, offers limited cash-out options, and features loan limits up to the conforming limits.

For more information on the Fannie Mae ReFi program, click the link provided.