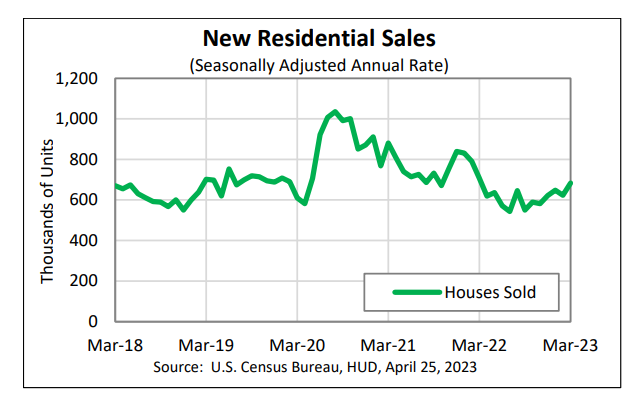

New Home Sales Surged Nearly 10% In March

Northeast saw a massive 171% spike in sales as buyers turn to newly constructed homes.

- New homes sold at a seasonally adjusted annual rate of 683,000, up 9.6% from February.

- The rate was the highest since March 2022.

- Median sale price $449,800, up 3.8% from February.

- Inventory was unchanged at 2.6-months' supply.

Sales of new single-family houses spiked nationwide in March, increasing nearly 10% thanks in part to a boom in sales in the Northeast.

The surge in sales of newly constructed homes appears to be a result of the lack of inventory of existing homes on the market.

According to estimates released jointly Tuesday by the U.S. Census Bureau and the Department of Housing and Urban Development, new single-family homes sold at an annual rate of 683,000, 9.6% above the downwardly revised February rate of 623,000. The estimated rate is the highest since March 2022, when the annual rate was 707,000.

March’s results beat analysts’ expectation of an annual rate of 307,000.

Following some significant revisions to previous monthly estimates, the annual rate has now increased in three of the past four months.

The Northeast saw far and away the largest increase in new homes sold during March, with a seasonally adjusted rate of 65,000 homes sold, a massive increase of nearly 171% from the revised 24,000 sold in February, and 27.5% more than the 51,000 annual rate a year earlier.

Both the West (+29.8%) and the Midwest (+6%) also saw month-to-month gains, while the South saw a 5.4% decline. All three of those regions also saw year-over-year declines — 11.3% in the Midwest, 9% in the West, and 3.3% in the South.

The seasonally adjusted estimate of new houses for sale nationwide at the end of March was 432,000. At the current sales rate, that represents a 7.6-month supply.

The new home sales report follows last week’s report on sales of existing homes, which slipped 2.4% in March from February and were down 22% from a year earlier, according to the National Association of Realtors.

While the inventory of unsold existing homes rose 1% in March from a month earlier to 980,000, that represents just a 2.6-month supply — unchanged from February, but up 2 months from March 2022. Owners of existing homes have been reluctant to place their homes on the market because the rate on their current mortgages is significantly lower than mortgage rates are now.

The 30-year fixed-rate mortgage averaged 6.39% as of April 20, according to Freddie Mac.

The median sale price of new houses sold nationwide in March 2023 was $449,800, up 3.8% from February and up 3.2% from a year earlier. The median price means half of all homes sold for more and half for less.

"Home sales are trying to recover and are highly sensitive to changes in mortgage rates," NAR Chief Economist Lawrence Yun said following the NAR’s report. "Yet, at the same time, multiple offers on starter homes are quite common, implying more supply is needed to fully satisfy demand. It's a unique housing market."

The median sale price for new single-family houses increased for the second consecutive month, but was still 6.2% below December’s median price of $479,500.

The average national sale price was $562,400, up 12.1% from February and up 10% from a year earlier.