Ohio Bank Paying $9M To Settle Redlining Complaint

DOJ says 100 of 101 Park National Bank MLOs were white, and it willfully bypassed minority areas.

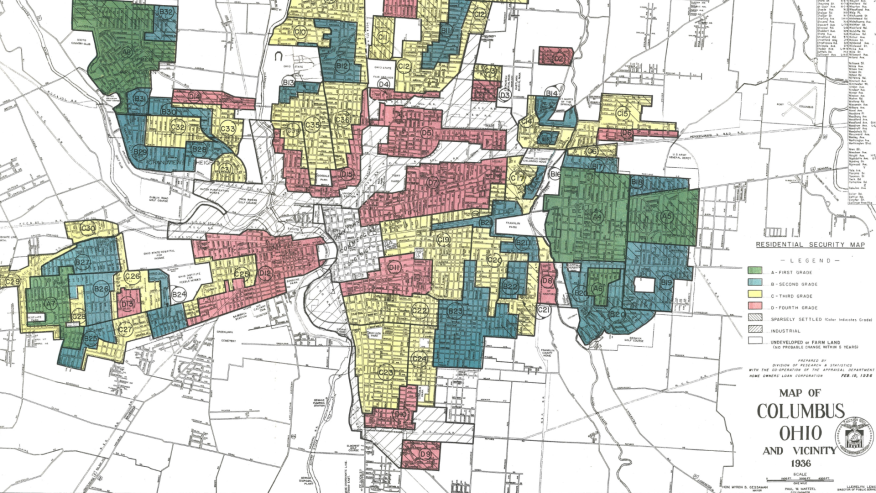

Park National Bank (PNB) will soend $9 million to settle redlining allegations in minority neighborhoods in Columbus, Ohio, under a settlement with the U.S. Department of Justice.

It is the sixth redlining settlement under the DOJ’s Combatting Redlining Initiative, which was launched in October 2021.

In the settlement, the DOJ said PNB, headquartered in Newark, Ohio, relied on its branch network, mortgage lenders concentrated in majority-white neighborhoods, and internal referrals to originate home loans in the Columbus lending area. Among the DOJ’s findings, from 2015 to 2021, all but one of the 101 mortgage lenders PNB employed in the lending area were white.

Experts in mortgage law say this is an important redlining case for mortgage originators because it points to a financial institution ignoring non- and limited-English speakers.

Between 2015 and 2020, DOJ said, the bank’s “Mortgage Banking Policy was intentional and willful, and structured PNB’s lending operations to serve the credit needs of residents of majority-white neighborhoods, but not the credit needs of residents of majority-Black and Hispanic census tracts in the Columbus Lending Area. In 2021, PNB revised the policy to state that the bank ‘originates residential mortgage loans by leveraging the communities that [it] serve[s] and residential mortgage loan originators (MLO).’”

The DOJ said PNB worked cooperatively to settle the issue. In a statement, the bank denied any wrongdoing.

“While we disagree with any suggestion that intentional discrimination took place, we are united with the DOJ in our commitment to ensuring equal access to credit for all consumers,” Park Chairman and CEO David Trautman said. “Park strongly condemns discrimination in any form. We will continue to serve our customers and our communities with the integrity and compassion that have been our hallmark for the past 115 years.”

The DOJ complaint said during the relevant time period, PNB made a total of 9,602 HMDA-reportable residential mortgage loans in the Columbus Lending Area. Of these loans, only 88, or .92%, were made to residents of majority-Black and Hispanic census tracts. By contrast, during the same time period, PNB’s peers made 6.98% of their HMDA loans to residents of majority Black and Hispanic census tracts in the Columbus Lending Area.

Writing at JD Supra, attorneys from the national law firm Troutman Pepper said this is an important issue for mortgage originators to track.

“[The] inclusion of allegations related to failing to serve [limited English proficiency (LEP)] consumers, and the fact that part of the remediation involves having at least one Spanish-speaking loan officer, represents a variation on redlining that we have not seen before, and adds an element of self-evaluation that mortgage lenders may wish to engage in to assess their exposure to redlining claims,” the firm said.

The law firm also reported that this appears to be the first time an LEP-related allegation has been made as part of a DOJ redlining case.

Under the proposed consent order, which is subject to federal court approval, Park National has agreed, among other things, to do the following:

- Invest at least $7.75 million in a loan subsidy fund to increase access to credit for home mortgage, improvement, and refinance loans, as well as home equity loans and lines of credit, in majority-Black and Hispanic neighborhoods in the Columbus area; $750,000 in outreach, advertising, consumer financial education, and credit counseling initiatives; and $500,000 in developing community partnerships to provide services to residents of majority-Black and Hispanic areas that expand access to residential mortgage credit;

- Open one new branch and one new mortgage loan production office in majority Black-and Hispanic neighborhoods in the Columbus area; ensure that a minimum of four mortgage lenders, at least one of whom is Spanish-speaking, are assigned to serve these neighborhoods; and maintain the full-time position of Director of Community Home Lending and Development, who is responsible for overseeing lending in majority-Black and Hispanic areas; and

- Conduct a Community Credit Needs Assessment, a research-based market study, to help identify the needs for financial services in majority-Black and Hispanic census tracts in the Columbus area.