Connecticut-based mortgage giant shines with a 60% surge in MSR portfolio, leveraging niche products and strategic acquisitions despite industry headwinds.

The Connecticut-based Planet Financial Group, LLC, parent company of national mortgage lender and servicer Planet Home Lending, LLC and Planet Management Group, LLC, reported remarkable growth in the third quarter of 2023 due mostly to its servicing gains.

"This is a challenging market, no doubt about it," CEO and President of Planet Financial Group Michael Dubeck said. "We're proud to be holding steady during these tough times."

Planet's Mortgage Servicing Rights (MSR) portfolio marked a substantial increase, ending at $90.56 billion in September 2023, up a whopping 60% from last September. Origination volume for September 2023 reached $20.35 billion, a 3% rise from September 2022.

"Our experience in niche products, including renovations, manufactured housing, HELOANs, and USDA, allows us to customize delivery and underwriting options to meet our customers' needs," said Dubeck. "That flexibility and value-added services increase efficiency, which is critically important to our partners during challenging markets."

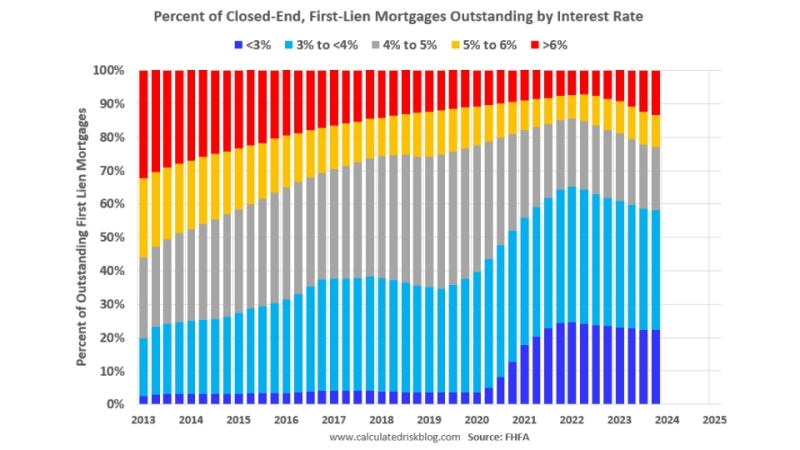

However, retail direct originations in September 2023 were $972 million, down 51% from September 2022's volume of $1.98 billion. Retention originations decreased to $365 million, 56% lower than September 2022's $830 million. The company's Distributed Retail channel originated $607 million in home loans at September 2023, a decrease of 47% compared with $1.15 billion last September. Planet's recapture rate for purchase loans reached 34.1%, buoyed by the efforts of both retail divisions.

"In the face of unprecedented times in our industry, Planet remains resolute in our commitment to innovation and unwavering excellence, and persistently dedicated to providing vital support to our borrowers, clients and lending partners," Dubeck said. "Together, we can overcome formidable challenges."

The company made several strategic acquisitions in 2022, including acquiring Homepoint's delegated correspondent channel for $2.5 million in cash. Last year it had already integrated most of Homepoint's clients into its platform.

The company has managed to maintain its solid performance in managing early payment defaults and serious delinquencies, with its government and conventional total delinquency rates falling significantly below the nonbank industry averages.