Q3 Mortgage Originations Fell 62% YOY

Milliman Mortgage Default Index shows dramatic drop, led by 87% decline in refis.

A dramatic drop in refinancing mortgage helped shrink mortgage origination in the third quarter, as interest rates continued to rise, according to a new report.

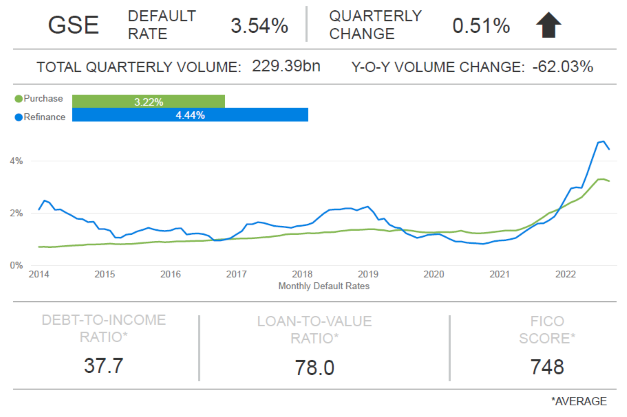

Milliman Inc. on Friday released its Milliman Mortgage Default Index (MMDI) for the third quarter of 2022, which showed that total mortgage acquisition volume for Fannie Mae and Freddie Mac was down 62% year over year. The decline was driven by an 87% drop in refinance activity year-to-date, the report showed.

“This large change in the composition of loans is having a similar impact on the default risk of originations,” the report states. “Generally, purchase mortgages have higher risk attributes relative to refinance loans.”

The MMDI is a lifetime default rate estimate calculated at the loan level for a portfolio of single-family mortgages. For the index, Milliman Inc. said, default is defined as a loan that is expected to become 180 days or more delinquent over the life of the loan. The results of the MMDI reflect the most recent data available from Freddie Mac and Fannie Mae, with measurement dates starting from Jan. 1, 2014.

The index value of the MMDI was 3.54% for loans originating in the third quarter, compared to 3.02% for originations in the second quarter, the report states.

An expected slowdown in home price growth over the next several years is expected to be another driver of increased default risk, for both purchase and refinance originations.

“Over 2022 Q3, our latest MMDI results show that mortgage risk increased for Freddie and Fannie acquisitions,” the report states.

It said the MMDI consists of three components: measures for borrower risk, underwriting risk, and economic risk.

- Borrower risk measures the risk of the loan defaulting due to borrower credit quality, initial equity position, and debt-to-income ratio.

- Underwriting risk measures the risk of the loan defaulting due to mortgage product features such as amortization type, occupancy status, and other factors.

- Economic risk measures the risk of the loan defaulting due to historical and forecasted economic conditions.

In the third quarter, each of these risk measures were higher than in the previous quarter, it said.

Borrower Risk

For government-sponsored enterprise (GSE) loans, borrower risk was 1.61% in the third quarter, up from 1.57% in the previous quarter, with purchase loans making up about 80% of total originations compared to 62% in the earlier quarter.

“When compared to refinance loans, purchase loans are correlated with higher borrower risk as it is typical for the borrowers to have lower credit scores and higher loan-to-value ratios,” the report states. “Thus, an increase in borrower risk is expected.”

Underwriting Risk

This represents additional risk adjustments for property and loan characteristics, such as occupancy status, amortization type, documentation types, loan term, and others.

The report states that the underwriting risk “after the global financial crisis remains low and is negative for purchase mortgages, which were generally full-documentation, fully amortizing loans. For refinance loans, a greater portion of originations are cash-out refinance loans (as opposed to refinancing for more favorable rate and/or length-of-loan terms) given recent robust home-price growth.”

Cash-out refinance loans are assigned a greater default risk and are contributing to increases in underwriting risk, the report states.

Economic Risk

For GSE loans, economic risk increased to 1.91% in the third quarter from 1.39% in the previous quarter.

“Actual home price appreciation has been robust from 2014 through 2022, which has resulted in embedded appreciation for older originations,” the report states. “This results in reduced default risk for older cohorts. For more recent cohorts, we anticipate slower home price growth (or negative growth for some local geographies), which contributes to increases in economic risk for recent origination years.”

Milliman Inc. said the MMDI reflects a baseline forecast of future home prices, and should the actual or baseline forecasts diverge from the current forecast, future publications of the MMDI would change accordingly.