Rate Locks Hit Record Low For 2nd Straight Month

Both Black Knight’s OMM report and MCTlive! Lock volume indices show a 90% decline in YOY volume.

- According to Black Knight, overall rate lock volumes declined by 19.4% in December from a month earlier.

- According to MCT, total mortgage rate locks by dollar volume decreased 19.8% in December from November.

Mortgage origination activity, as measured by rate locks, fell for the ninth straight month in December to the lowest level in five years, according to Black Knight Inc.’s Originations Market Monitor report, released Monday.

A separate report, released last week by Mortgage Capital Trading Inc. (MCT), also found a steep dropoff in rate lock volume

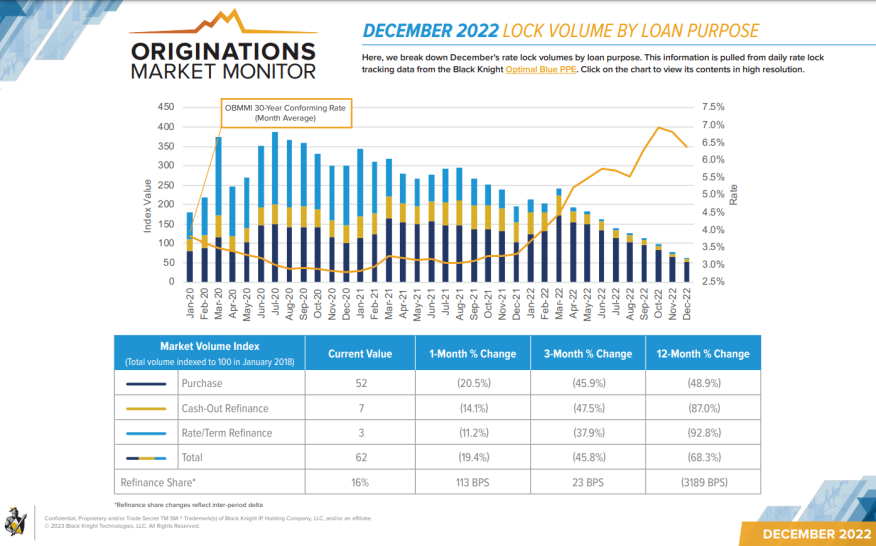

According to Black Knight, overall rate lock volumes declined by 19.4% in December from a month earlier as elevated mortgage rates kept buyers, sellers, and refinance candidates on the sidelines. The volume was the lowest in the five years since Black Knight has tracked the metric, the company said.

Overall lock volumes are down 45.8% over the last three months and 68.3% off last year’s levels, the company said.

The overall decline was driven by a 20.5% drop in purchase locks in December from a month earlier. Purchase locks are down nearly 46% over the past three months and nearly 49% year over year.

Refinance locks also fell month over month, with cash-out refis down 14.1% and rate/term refis down 11.2% from November. Both categories of refis are down significantly year over year, with rate/term refis down nearly 93% and cash-out down 87%, Black Knight said.

While the refi share increased slightly from November, they made up just 16% of December’s lock activity, the company said.

“Mortgage rates declined through the first half of December, but reversed course as the (Federal Reserve) doubled down on their stance of additional tightening in 2023,” said Kevin McMahon, president of Optimal Blue, a division of Black Knight. “The spread between mortgage rates and the 10-year Treasury yield narrowed another 22 BPS during the month to 264 BPS, 40 BPS off the recent high, but is still up 81 BPS for the year.”

Black Knight said its Optimal Blue Mortgage Market Indices (OBMMI) tracked 30-year rates, which fell to as low as 6.25% for the month before rebounding to finish December at 6.52%, down 6 bps from November.

“Using Black Knight’s McDash mortgage performance data to provide comparative history, December saw the fewest purchase locks in a single month since early 2014, and the fewest overall rate locks on record dating back to January 2000, when Black Knight began reporting origination metrics,” McMahon said. “The number of mortgage holders locking in a rate to refinance their existing mortgage also set a new record low for the fourth consecutive month.”

Other key findings of the Black Knight report include:

- Purchase lock counts — which exclude the impact of home price changes — were down 47% year-over-year, with total rate lock counts down nearly 70% over that same span.

- The number of mortgage holders locking in a rate to refinance hit a record low for the fourth consecutive month in December, and is now more than 50% below the previous record low set back in July 2000.

- Credit scores for cash-out refis rose 5 points to 691 — though that was still down 34 points over the past 12 months — and fell 4 points for rate/term refis, but remained unchanged for purchase transactions.

Black Knight’s Originations Market Monitor provides origination metrics for the U.S. and the top 20 metropolitan statistical areas by share of total origination volume. A look at the 20 metro areas is available here.

MCTlive!

The MCTlive! Lock Volume Indices report for December reported similar findings to the Black Knight report. According to MCT, total mortgage rate locks by dollar volume decreased 19.8% in December from November.

In addition, both the month-over-month rate/term refi lock figure and the purchase index rate lock figure decreased for the third consecutive month. Cash-out refis were down 23.5% in December from a month earlier, and were down 90% from a year earlier, the report said.

Rate/term refi volume also fell dramatically, down 17% in December from a month earlier and down 93.3% from a year earlier.

MCT noted that its rate lock activity indices are based on actual dollar volume of locked loans, not the number of applications. “Especially in a tight purchase market, MCT believes its methodology (using actual loans locked vs. applications) is a more reliable metric,” the company said.