Realtor.com Releases Home Affordability Tool For Consumers

More than two-thirds (68%) of shoppers were surprised by what they could actually afford for their first home.

Now that interest rates are constantly changing and home prices are at all-time highs, understanding what you can afford has never been more important to consumers.

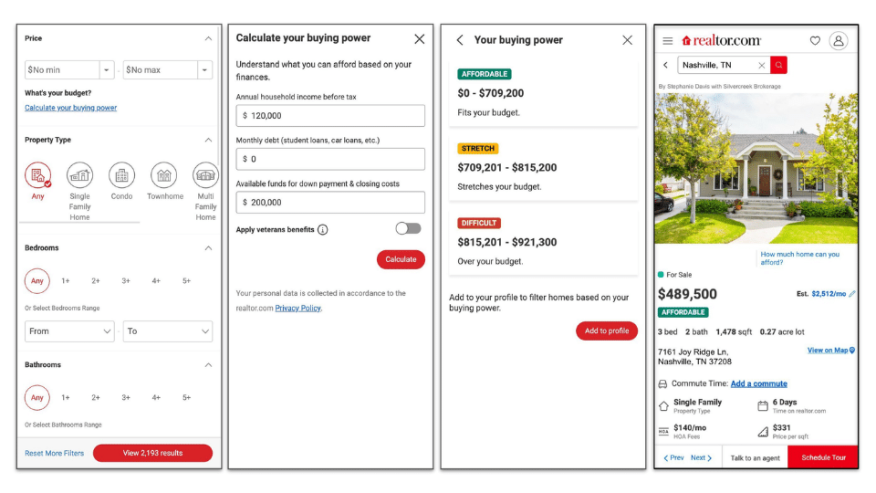

Realtor.com has introduced a new buying power tool to help home shoppers see whether a specific home is “affordable,” “a stretch,” or “out of reach.”

To give buyers a more objective view of their budget, the tool uses a home shopper’s specific financial details, current mortgage rates, taxes, insurance, and HOA fees to determine if the monthly payments will be comfortable.

This makes Realtor.com the first national home search site where shoppers can filter their search by selecting their desired affordability range.

Recent surveys found that more than two-thirds (68%) of shoppers were surprised by what they could actually afford for their first home. Additionally, 32% of recent buyers found it difficult to understand how changing mortgage rates affected their monthly payments, and 62% were surprised by closing costs. The affordability tool by Realtor.com can manage homebuyer expectations and prevent unhappy surprises from happening in the homebuying process, the company said.

"There is nothing more disappointing than falling in love with a home only to realize that you can't afford it, and nothing more exciting than realizing you can afford that dream home,” said Colleen Coyle, vice president, product management, for Realtor.com. “However, there are many factors that go into affordability. We introduced this tool to help shoppers better understand how much home they can afford and if specific homes fit their budget given their personal financial situation. This tool is especially important right now with rising interest rates — which can add hundreds of dollars to monthly payments and impact buying power.”

A home's affordability depends on much more than asking price. Many first-time homebuyers don’t realize the added cost of things such as HOA fees, taxes, and insurance, not to mention closing costs. The new buying power feature allows home shoppers to input their monthly income, debt payments, and savings to determine their budget. Users can save this information to their buyer profile and then search for homes that fit their budget.