S&P, FHFA Say Home Prices Continued To Climb In April

Home price indexes differ, though, on year-over-year results

- S&P: U.S. National Index posted a 1.3% month-over-month increase in April

- FHFA reported that house prices increased in April, rising 0.7% from March.

- S&P: House prices fell 0.2% in April from a year earlier, first annual decline in 11 years.

- FHFA: prices rose 3.1% in April from a year earlier.

Two separate, respected reports on housing prices in April were released today, but while they don’t agree on how prices behaved year over year, they do agree that prices continued to climb through the first four months of 2023.

S&P Dow Jones Indices released the latest results for its S&P CoreLogic Case-Shiller Indices for April, reporting that prices increased from March, accelerating in 12 markets.

Before seasonal adjustment, the U.S. National Index posted a 1.3% month-over-month increase in April, while the 10-City and 20-City Composites both posted increases of 1.7%, the report said.

After seasonal adjustment, the U.S. National Index posted a month-over-month increase of 0.5%, while the 10-City Composite gained 1.0% and 20-City Composites posted an increase of 0.9%.

The Federal Housing Finance Agency (FHFA) also reported that house prices increased in April, rising 0.7% from March, according to its seasonally adjusted monthly House Price Index (HPI).

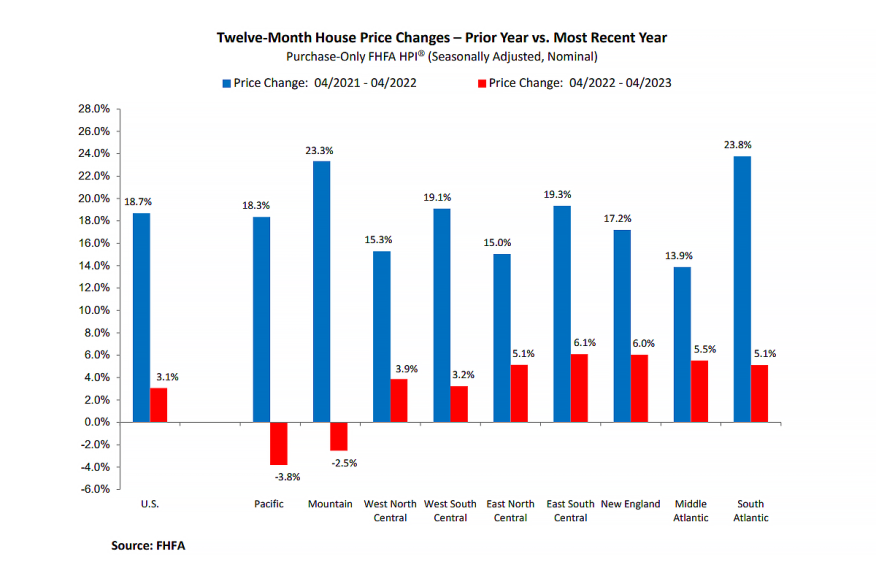

For the nine census divisions, FHFA said, seasonally adjusted monthly price changes from March to April ranged from +0.1% in the Pacific division to +2.4% in New England.

It’s the year-over-year data where the two reports part company.

The S&P CoreLogic Case-Shiller U.S. National Home Price NSA Index said house prices fell 0.2% in April from a year earlier, down from a year-over-year gain of 0.7% in March. According to this index, it was the first annual decline in prices since 2012.

The FHFA HPI, however, reported that prices rose 3.1% in April from a year earlier. The HPI uses seasonally adjusted, purchase-only data from Fannie Mae and Freddie Mac, which accounts for the discrepancy in the reports.

"The U.S. housing market continued to strengthen in April 2023," says Craig J. Lazzara, managing director at S&P DJI. "Home prices peaked in June 2022, declined until January 2023, and then began to recover. The National Composite rose by 1.3% in April (repeating March's performance), and now stands only 2.4% below its June 2022 peak. Our 10- and 20-CityComposites both gained 1.7% in April.”

Lazzara continued, "The ongoing recovery in home prices is broadly based. Before seasonal adjustments, prices rose in all 20 cities in April (as they had also done in March). Seasonally adjusted data showed rising prices in 19 cities in April (versus 14 in March).”

Realtor.com’s Chief Economist Danielle Hale says home price trends are “caught in a tug of war between stretched buyer budgets and limited inventory forcing competition, despite reduced affordability. With high mortgage rates keeping 1 in 7 homeowners from selling, new listings have lagged far behind what we’ve seen in prior years, pushing buyers to continue to bring their best offers even as home sales are 20% lower than at this time last year.”

Hale said Realtor.com’s revised 2023 housing outlook expects modest price cooling to continue, “as affordability slowly wins out.”

George Ratiu, chief economist at Keeping Current Matters, said the monthly price increases reflect the demand in the market.

“With growing foot traffic, home prices increased further in April, with the national index showing a 1.3% gain from March, a pick-up in momentum,” he said. “The same monthly improvement was seen across the 10- and 20-city indices. All 20 cities in the index posted higher monthly advances, with 12 of them notching accelerating gains. Miami, Chicago, and Atlanta posted the largest price gains.”

Real estate fundamentals remain out of balance, Ratiu said, “with demand still outpacing supply, and have a way to go toward [market] health.”

He added that the Federal Reserve’s monetary policy “means that interest rates are likely to remain elevated for the rest of the year. However, improving new construction is offering the promise of more options, while the return of seasonal patterns is reinforcing the view that we are moving in a promising direction.”