U.S. Pending Home Sales Plunge 7.1% in August

All four national regions report a slump in monthly and annual transactions, emphasizing the need for better rates and increased housing inventory.

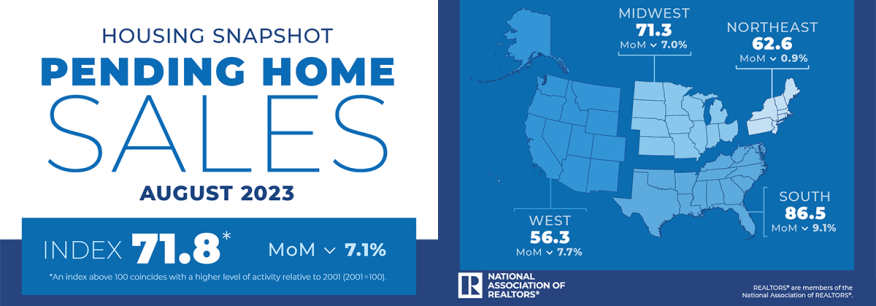

Pending home sales across the U.S. saw a substantial 7.1% decrease in August, according to the National Association of Realtors (NAR). This dip in sales occurred across all four major U.S. regions, each registering losses in both monthly and year-over-year transactions.

Lawrence Yun, NAR's chief economist, attributed the decline to the uptick in mortgage rates, which surpassed 7% starting in August.

"Some would-be homebuyers are taking a pause and readjusting their expectations about the location and type of home to better fit their budgets," Yun said.

The Pending Home Sales Index (PHSI), a forward-looking gauge based on contract signings, plummeted 7.1% in August, standing at 71.8. This figure marks an 18.7% year-over-year decline. To provide perspective, an index value of 100 corresponds to the contract activity level witnessed in 2001.

Yun emphasized the pressing need for a change in the current housing scenario: “It’s clear that increased housing inventory and better interest rates are essential to revive the housing market.”

First American Deputy Chief Economist Odeta Kushi said based on pending home sales it looks like the economy will end the year with 4 million in sales.

"The last time we went below 4 million was in the depths of the Great Financial Crisis between July and October 2010. Higher mortgage rates are to blame for the weakness in home sales," Kushi said.

Breaking it down by region:

- The Northeast region witnessed a PHSI of 62.6, which is a 0.9% decrease from the previous month and an 18.2% drop compared to August 2022.

- In the Midwest, the index stood at 71.3, reflecting a 7.0% monthly decline and a substantial 19.1% fall from a year earlier.

- The South registered a PHSI of 86.5, representing a 9.1% monthly and a 17.6% annual decline.

- Lastly, the West saw its index decrease to 56.3 in August, down 7.7% from the previous month and a whopping 21.4% compared to August 2022.