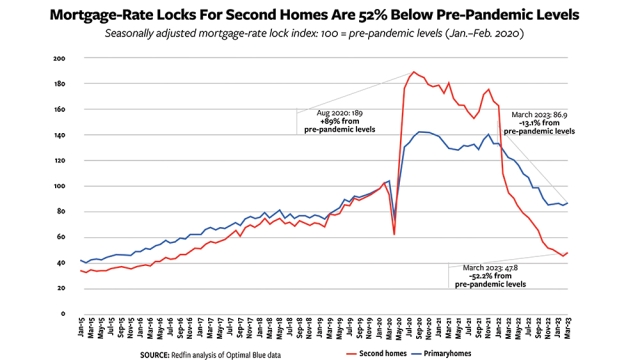

This analysis does not include cash purchases. We define “pre-pandemic levels” as January and February of 2020. We use early 2020 as a comparison point because it provides a baseline for mortgage demand before homebuyer activity fluctuated wildly during the pandemic.

Second-home demand is also down from a year ago and from January 2022, just before mortgage rates started rising from record lows. Mortgage-rate locks for second homes were down 49% year over year in March and down 71% from January 2022. Mortgage-rate locks for primary homes have dropped 29% year over year and 35% since January 2022.

The drop in second-home demand follows a meteoric rise during the pandemic homebuying boom. Mortgage-rate locks for second homes reached a peak of 89% above pre-pandemic levels in August 2020. At that time, many affluent Americans bought homes in vacation destinations, encouraged by low mortgage rates, remote work, and limitations on traveling from place to place.

A scarcity of new listings, elevated mortgage rates, still-high home prices, and persistent inflation, among other economic woes, are holding back demand for both primary and second homes.

“With housing payments near their all-time high; a lot of people can’t afford to buy one home right now, let alone a second,” said Redfin Deputy Chief Economist Taylor Marr. “Add the recent increase in loan fees, inflation, shaky financial markets, the end of pandemic-related financial stimulus, and many companies calling workers back to the office, and it’s simply a challenging time for most Americans to buy a vacation home.”

But there are still some second-home buyers out there, especially in popular vacation destinations. Redfin agent Van Welborn said some buyers are looking for vacation condos, especially in desirable neighborhoods.

“It’s mostly affluent cash buyers who don’t have to worry about high rates,” Welborn said. “They’re motivated to buy now because they think they can get a vacation home for under asking price — and in some cases, they’re right. There are fewer buyers looking to buy properties to be used as short-term rentals, though, as they’re finding that the market is saturated.”

“Despite a national cooling in residential real estate, we’re finding that the luxury real estate market is still in a league of its own,” Pacaso CEO and Co-Founder Austin Allison told Florida Originator Magazine previously. “High-net-worth buyers are not as reliant on financing, so they might be less deterred by rising rates, and we hear a lot from our buyers that they don’t want to wait for perfect market conditions — they are ready to enjoy the benefits of a second home now.”