What The Latest Mortgage Credit Potential Index Tells Us About The Mortgage Market

There is potential energy in today’s market that can make lenders more money, if they only know how to tap it.

SPONSORED CONTENT

The spring home-buying season is upon us. This is the time of year when we expect mortgage activity, spurred by new home sales, to pick up. Given the data, this is exactly what we expect.

Will consumers respond to favorable market signals and take the leap? It’s a matter of potential energy.

Potential Energy in the Housing Market,

And Where to Find It

Like a boulder precariously balanced at the top of a mountain, the mortgage market is poised to break free. All it will take is a little nudge from lenders to get it rolling.

How do we know this? We measure it.

CreditXpert analyzes millions of mortgage credit inquiries each month. We use our proprietary predictive analytics engine to help thousands of mortgage loan originators highlight the potential score increase their applicants may be able to achieve within 30 days by completing a custom action plan.

The Mortgage Credit Potential Index™ (MCPI) is a unique, monthly supply-side view of mid-score mortgage inquiries. No one else in the industry has this data. We give it away to the industry every month.

The MCPI highlights the percentage of inquiries that may be able to increase their initial score by at least 20 points within 30 days by completing a custom action plan.

The MCPI helps lenders monitor monthly shifts in inquiry volume by 20-point band so they can develop a strategic approach to serving new market segments and understand the role credit potential could play in expanding access to homeownership, increasing buying power and offering competitive rates.

Here is what the March data told us.

Increasing Demand Points to a Normalizing Market

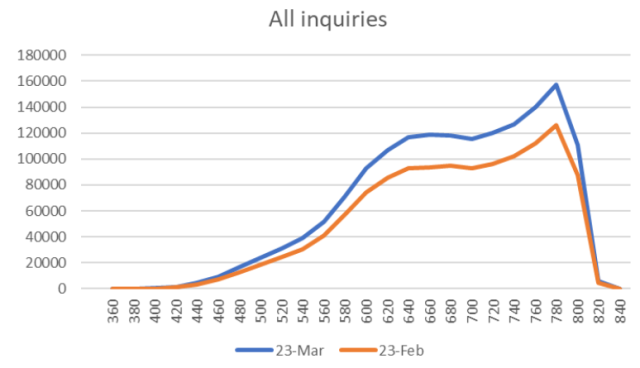

Looking at total inquiries in March versus total inquiries in February, two things are apparent:

The first thing we notice is that the pattern is the same for both February and March data. The potential energy we’re seeing in the market is in the same credit bands for both periods, but the degree is different based on increasing applicant demand in March.

This is exactly what we would expect to see in a normal spring home-buying season — increasing demand, uniform across all credit bands.

The second insight made clear in our MCPI data is that the increase in demand is significant and actionable for lenders. March saw substantially more activity and potential energy that lenders can turn into new business.

There is some anecdotal evidence in the market that this is happening, one notable example here from CNBC, but this data shows exactly where across the consumer credit spectrum the increase in demand is happening.

Closer Look at the Potential Energy In the Market

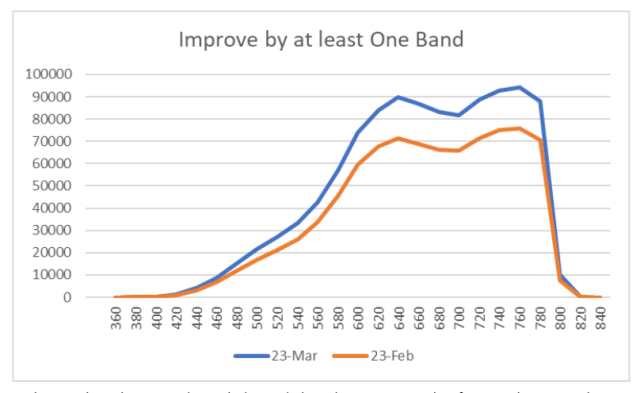

Knowing where the inquiries are coming from is good. Knowing how many of those making inquiries could qualify if they didn’t or get a better deal if they did is strategic. The MCPI provides this data to the industry.

Looking at the February and March data side by side, we can see that far more borrowers have the potential to raise their credit scores in March, but since the patterns line up almost perfectly, we can attribute this increase to the overall higher volume of applicants.

It’s important to note that this increase in activity is occurring in spite of the fact that applicants are being offered higher interest rates. In other words, it’s not a shift in the economy we’re witnessing. Rather, it’s the spring home-buying season coming into focus.

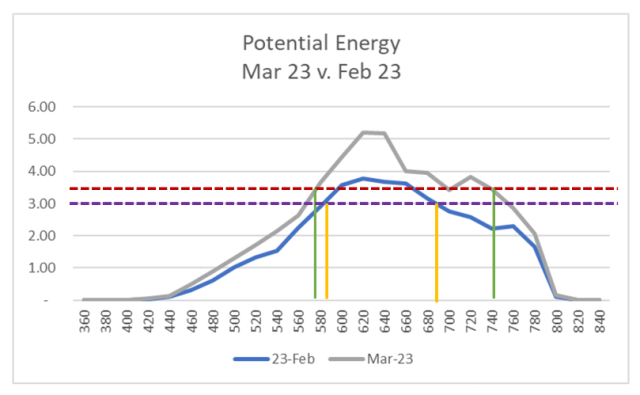

And yet, if we look more closely at the potential, we see one interesting difference between the February and March data that could constitute a strategic advantage for lenders who notice it.

The "Zone of Opportunity" expanded a great deal between February and March 2023.

In February, the Zone was bounded by the dotted, horizontal purple line and the two solid, vertical yellow-orange lines. Those with credit scores between about 590 and 685 had the most potential for improvement in February.

Lenders who focused on helping borrowers in that region improve their credit likely won more business in February.

But contrast that with the zone we find in the March data.

Bounded by the dotted, horizontal red line and the two solid green lines, the new zone includes all mortgage applicants with a credit score between ~570 and ~740. These were the applicants who had the greatest potential for improvement.

That’s a 20-point expansion on the low end and a 55-point expansion on the top end. Measuring the area under the curve reveals a lot of business that smart lenders will tap into this spring.

We May be Operating in a Normalizing

Real Estate Market

In summary, despite home prices that stubbornly refuse to go down and interest rates that are still more than double what they were a year ago, consumers are doing what they have always done in the spring; they are house hunting.

Are you ready to do more business this spring? The key to turning potential buyers into new borrowers lies in helping them get the best deal they qualify for, and that can only happen when they maximize their credit scores.

The MCPI highlights the volume of mid-score mortgage credit pulls by 20-point credit bands between 360 and 850. When compared to prior months and years, the MCPI serves as an indicator of changes in query volume. It points to strategic opportunities for lenders.

For example, of the 6.36 million total credit pulls between 640 and 759 CreditXpert analyzed in 2022, 75% could have increased their score by at least one 20-point band within 30 days, just by completing a custom action plan.

Find out more by contacting CreditXpert today.