Zillow: Experts Say Home Prices Will Grow Steadily Starting In ‘24

Economists surveyed by Zillow predict home-price slide will end this year.

- The panel forecasts prices to slide 1.6% in 2023.

- Growth over the following four years is expected to average 3.5%.

- New home sales are expected to decline to near 2016 levels this year.

- Sales of both new and existing single-family homes are expected to slide in 2023.

Home prices nationally should bottom out in 2023 then return to a more normal growth rate, according to a Zillow survey of housing experts released Thursday.

Economists and housing experts polled in the latest Zillow Home Price Expectation (ZHPE) survey expect home prices to fall 1.6% through December 2023. Affordability challenges are still dragging down demand for homes — lower mortgage costs in January translated into sales that tracked pre-pandemic trends, but higher rates in February have since dampened buyers' enthusiasm, Zillow said.

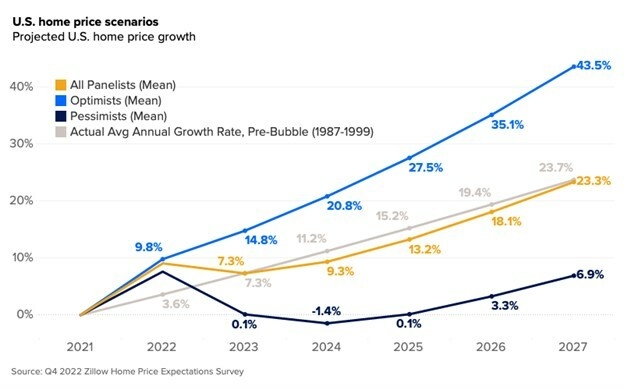

Starting next year, however, the panel foresees price growth picking back up, at an average clip of 3.5% per year through 2027 – the same rate that prices grew in the relatively stable period from 1987-99, before the housing boom and bust cycle in the 2000s.

Zillow's latest in-house forecast calls for typical U.S. home values to be nearly flat, rising 0.2% over the course of 2023. The largest declines are forecast in expensive California metros.

Zillow Senior Economist Jeff Tucker said the housing market is resetting.

“Though we're seeing early signs of renewed buyer interest early this year, prices should generally flatten out in 2023, helping buyers to catch up," Tucker said. "The sheer number of people in the first-time homebuyer age range and a lack of inventory should limit price declines. A return to more normal growth would be welcome after the rollercoaster ride that home prices have been on lately."

Sales of existing homes are forecast to fall to 4.2 million in 2023, up slightly from November and December's seasonally adjusted annual rate of sales, but lower than 5 million sales in 2022.

New construction — which is also expected to see sales decline this year — will likely play an expanded role to meet the need for inventory, Tucker said. Existing homeowners have been reluctant to list their properties and builders are giving buyers some significant financial incentives to help overcome affordability constraints, Zillow said.

The panel also expects mortgage rates to trend downward after the first quarter. Asked when rates for 30-year fixed loans will be highest between now and 2025, nearly two thirds (63%) pointed to the first quarter of 2023. A distant second was the second quarter of 2023 at 22%, and subsequent quarters earned 6% or less.

Falling rates are far more helpful for affordability than falling home prices, at least at the scale of recent movements, Zillow said. The median respondent projected a 6% rate for 30-year fixed-rate mortgages at the end of 2023.

"The majority of experts are now predicting an outright decline in U.S. home prices in 2023," said Terry Loebs, founder of Pulsenomics. "Although mortgage rates have moderated and are expected to remain close to the 6% level at year-end, the 2022 rate spike — and the record-high mortgage costs it ushered in — continues to shake home price expectations and market psychology."

The latest edition of the Zillow Home Price Expectations Survey surveyed 117 housing market experts and economists Dec. 5-15, 2022. It was conducted by Pulsenomics LLC on behalf of Zillow Inc.