Zillow: Home Values Hit Record Peak In June

But tide for buyers could be turning as homes take longer to sell.

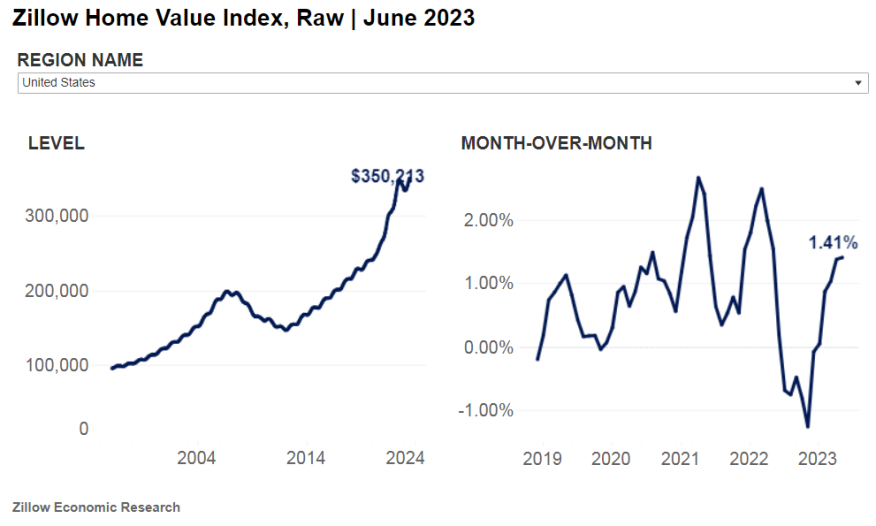

- The typical U.S. home value topped $350,000 for the first time, eclipsing the previous peak last July.

- The number of homes coming onto the market is closer to a normal October than a typically faster-paced June.

- Homes took a day longer to sell than in May, a sign that competition could be waning.

The typical home value topped $350,000 for the first time ever in June as strong demand from buyers continues to collide with reluctant sellers, Zillow said Wednesday.

According to the Zillow Market Report, the typical U.S. home value rose 1.4% from May to June, continuing a four-month hot streak. The new peak value of $350,213 is almost 1% higher than last June, and barely edges out the previous Zillow Home Value Index record set in July 2022.

"Homebuyers have persisted this spring despite daunting affordability challenges and record-low inventory," said Zillow Senior Economist Jeff Tucker. "Demand typically begins to ease in the summer, and there are signs that competition is waning, but large price declines are unlikely until more homeowners list their homes for sale."

Affordability remains the key to market strength, Zillow said, as lower-priced metro areas posted the largest monthly gains: Chicago; Buffalo, N.Y.; New Orleans; and Hartford, Conn., all notched 2.1% monthly growth, with Detroit close behind at 2%. Those markets all have typical home values lower than the national average.

As in May, home values rose from the previous month in all 50 of the largest metro areas. The slowest monthly growth was in Austin, Texas, (0.4%), followed by Jacksonville, Fla., Memphis, Tenn.; San Antonio, Texas; and Birmingham, Ala., which all saw 0.8% increases.

The flow of new homes for sale ticked up 2.4% month over month, but the annual deficit grew, now standing at 28% fewer listings than a year ago. June is usually one of the best months for fresh inventory, Zillow said, but this year only 376,500 new listings entered the market. That's closer to levels seen in the slower months of February and October than to average new listings in June (505,100), according to Zillow data reaching back to 2018.

The lack of new listings has haunted the housing market for nearly a year, and higher mortgage rates remain the chief suspect. Rates at 6.8% this week (the highest since November, up from 5.1% a year ago and 3% two years ago) make it especially costly for homeowners — most of whom have a mortgage well below today's rates — to borrow for their next home purchase.

Another explanation, Zillow said, could be that homeowners are holding out for higher prices. Home values have steadily increased since January in much of the country but remain below peaks reached last summer in many markets.

"It could be that some homeowners have been waiting until prices set new highs in their market before opting to cash in their chips," Tucker said.

The pool of existing homes for sale is lower than any June since at least 2018, Zillow said. It's down 10% from last year and is a whopping 45% below June 2019.

Potential buyers could see some slight relief on the horizon, as a few metrics indicate demand and competition are cooling. Sales measured by newly pending listings dipped almost 5% from May to June, following seasonal trends seen in 2022 and before the pandemic, when accepted offers crested in May.

Listings also lasted longer in June, 11 days before the typical listing went pending, compared to 10 in May. But that's still a much faster market than in 2019 when listings went pending in 21 days.