2023 Conforming Loan Limit Tops $1M For High-Cost Areas

FHFA said the baseline conforming loan limit will increase 12% next year.

With home prices nationwide rising for a record 128 consecutive months, it’s no surprise the federal government will raise the limits for loans it will back by 12% in 2023.

What may shock some about the new conforming loan limit (CLL) values for mortgages to be acquired by Fannie Mae and Freddie Mac is that, for high-cost areas, the limit next year will exceed $1 million.

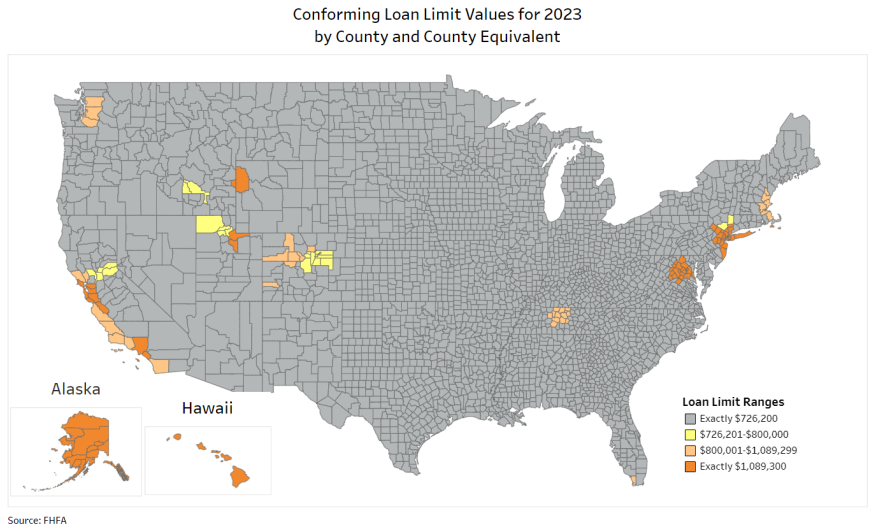

The Federal Housing Finance Agency (FHFA) announced the new limits on Tuesday, stating that for most of the United States the CLL value for one-unit properties will be $726,200, an increase of $79,000, or 12.2%, from $647,200 in 2022.

According to the FHFA, the Housing and Economic Recovery Act (HERA) requires the baseline CLL for the government-sponsored enterprises (GSEs) to be adjusted each year to reflect the change in the average U.S. home price.

FHFA also published its third quarter 2022 FHFA House Price Index report on Tuesday, which showed that house prices on average increased 12.21% between the third quarters of 2021 and 2022. The baseline CLL in 2023 will increase by the same percentage.

For high-cost areas — those in which 115% of the local median home value exceeds the baseline conforming loan limit — the new CLL value for one-unit properties will be 150 percent of $726,200, or $1,089,300.

HERA establishes the high-cost area limit in those areas as a multiple of the area median home value, while setting the ceiling at 150% of the baseline limit, FHFA said. Median home values generally increased in high-cost areas in 2022, which increased their CLL.

FHFA noted that special statutory provisions establish different loan limits for Alaska, Hawaii, Guam, and the U.S. Virgin Islands. In those areas, the baseline loan limit will also be $1,089,300 for one-unit properties.

Due to rising home values, the conforming loan limits will be higher in all but two U.S. counties or county equivalents., the FHFA said.

Earlier this month, the National Association of Realtors reported the median existing-home price for all housing types in October was $379,100,up 6.6% from October 2021 ($355,700), as prices rose in all regions. It marked 128 consecutive months — or 10.6 years — of year-over-year increases, the longest-running streak on record.