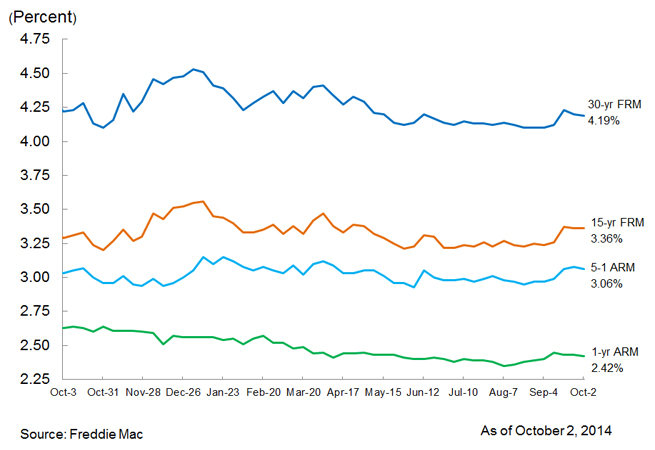

Nationwide Fixed-Rates Drop Slightly to 4.19 Percent

Freddie Mac has released the results of its Primary Mortgage Market Survey (PMMS), showing average fixed-rate mortgages (FRMs) flat to slightly down amid positive data on GDP, but mixed housing reports. The 30-year FRM averaged 4.19 percent, with an average 0.4 point for the week ending Oct. 2, 2014, down from last week when it averaged 4.20 percent. A year ago at this time, the 30-year FRM averaged 4.22 percent. The 15-year FRM this week averaged 3.36 percent with an average 0.5 point, unchanged from last week. A year ago at this time, the 15-year FRM averaged 3.29 percent.

"Mortgage rates were flat to slightly down across the board as GDP was revised up from 4.2 percent to 4.6 percent for the second quarter and the S&P/Case-Shiller National House Price Index was up a seasonally adjusted 0.2 percent for July and up 5.6 percent from the prior July," said Frank Nothaft, vice president and chief economist, Freddie Mac. "Pending home sales data were less optimistic, though, down one percent in August."

The five-year Treasury-indexed hybrid adjustable-rate mortgage (ARM) averaged 3.06 percent this week with an average 0.5 point, down from last week when it averaged 3.08 percent. A year ago, the five-year ARM averaged 3.05 percent.

The one-year Treasury-indexed ARM averaged 2.42 percent this week with an average 0.4 point, down from last week when it averaged 2.43 percent. At this time last year, the one-year ARM averaged 2.64 percent.