Foreclosures Down 16 Percent Year-Over-Year in Q3

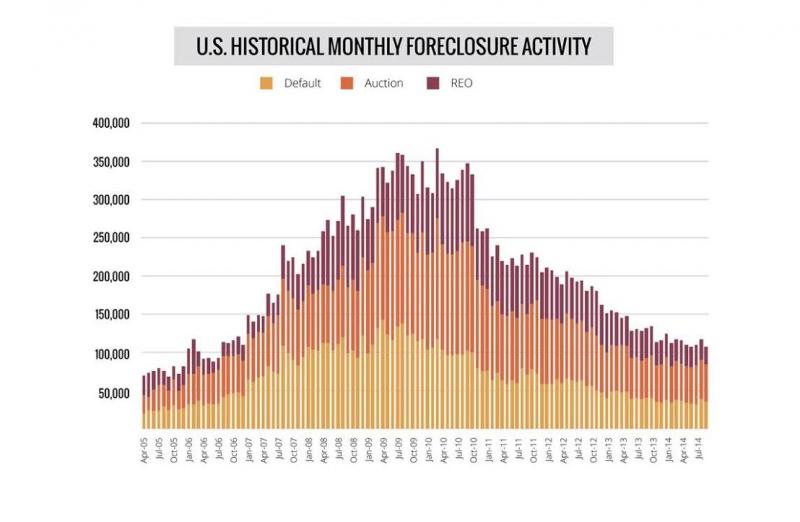

RealtyTrac has released its U.S. Foreclosure Market Report for September and the third quarter of 2014, which shows foreclosure filings—default notices, scheduled auctions and bank repossessions— were reported on 317,171 U.S. properties in the third quarter, down 16 percent from a year ago but up 0.42 percent from the previous quarter—the first quarterly increase since the third quarter of 2011.

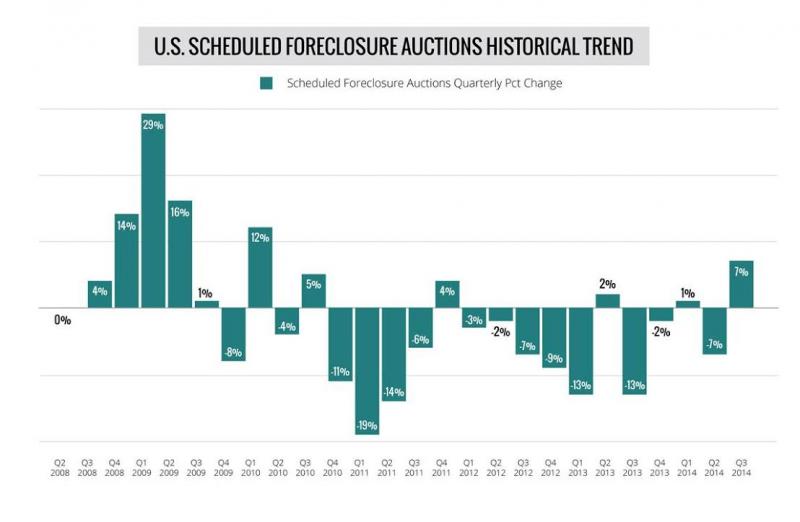

The quarterly increase in overall foreclosure activity was driven by a two percent increase in default notices (LIS, NOD) and a seven percent quarterly increase in scheduled foreclosure auctions (NFS, NTS). Meanwhile, bank repossessions (REOs) decreased 12 percent from the previous quarter.

A total of 106,866 U.S. properties had foreclosure filings in September, down nine percent from the previous month and down 19 percent from a year ago to the lowest level since July 2006—a 98-month low. September marked the 48th consecutive month where U.S. foreclosure activity decreased on a year-over-year basis.

“September foreclosure activity was back to pre-housing bubble levels nationwide, in large part thanks to a continued slide in bank repossessions,” said Daren Blomquist, vice president at RealtyTrac. “However, a recent rise in scheduled foreclosure auctions in many markets across the country shows lenders are continuing to clean house of lingering delinquent loans. This rise in scheduled auctions foreshadows a corresponding rise in bank repossessions and auction sales to third party buyers in the coming months.”

Other high-level findings from the report:

►Default notices (LIS, NOD) were filed on 103,179 U.S. properties in the third quarter, an increase of two percent from the previous quarter, but still down 11 percent from the third quarter of 2013—the ninth consecutive quarter where default notices have decreased on a year-over-year basis nationwide.

►Default notices in the third quarter increased from a year ago in 10 states, including Indiana (up 59 percent), Oklahoma (up 49 percent), Massachusetts (up 38 percent), New Jersey (up 19 percent), Iowa (up 12 percent) and New York (up two percent).

►Foreclosure auctions (NFS, NTS) were scheduled on 139,721 U.S. properties in the third quarter, an increase of seven percent from the previous quarter but a decrease of one percent from the third quarter of 2013—the 15th consecutive quarter where scheduled foreclosure auctions have decreased on a year-over-year basis nationwide.

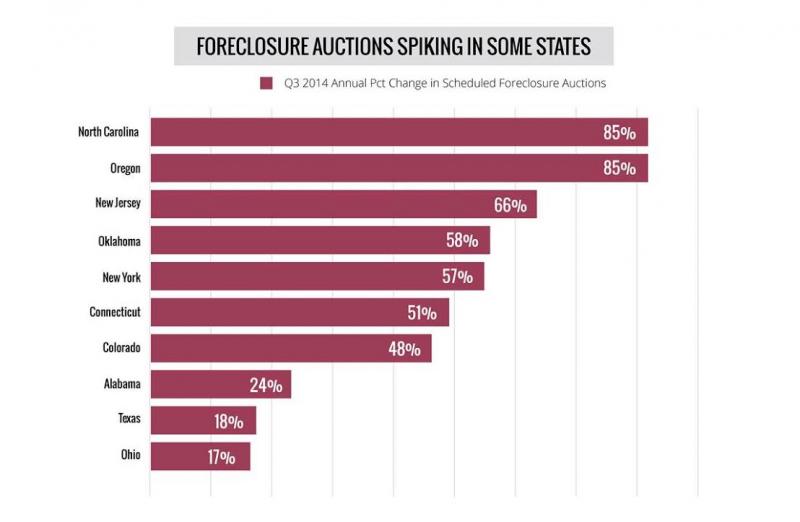

►Scheduled foreclosure auctions in the third quarter increased from a year ago in 22 states, including North Carolina (up 85 percent), Oregon (up 85 percent), New Jersey (up 66 percent), Oklahoma (up 58 percent), New York (up 57 percent), Connecticut (up 51 percent), Colorado (up 48 percent), Alabama (up 24 percent), Texas (up 18 percent), and Ohio (up 17 percent).

►Scheduled foreclosure auctions in the third quarter increased from the previous quarter in 32 states, including Michigan (up 34 percent), Maryland (up 30 percent), California (up 25 percent), Texas (up 25 percent) and Arizona (up 25 percent).

►Lenders repossessed (REO) 74,271 U.S. properties in the third quarter, a decrease of 12 percent from the previous quarter and down 38 percent from the third quarter of 2013—the 16th consecutive quarter where REOs have decreased on a year-over-year basis nationwide.

►REOs increased from a year ago in the third quarter in seven states, including Maine (up 24 percent), Maryland (up 19 percent), Oregon (up 13 percent), Georgia (up 11 percent) and New Jersey (up five percent).

►States with the five highest foreclosure rates in the third quarter were Florida, Maryland, New Jersey, Nevada, and Illinois.

►Metropolitan statistical areas with the five highest foreclosure rates in the third quarter were Orlando, Fla.; Atlantic City, N.J.; Macon, Ga.; Ocala, Fla.and Palm Bay-Melbourne-Titusville, Fla.

►U.S. properties foreclosed in the third quarter of 2014 were in the foreclosure process an average of 615 days, up seven percent from the previous quarter and up 13 percent from the third quarter of 2013 to the longest average time to foreclose since RealtyTrac began tracking in the first quarter of 2007.

►States with the longest average time to foreclose in the third quarter were New Jersey (1,064 days), Florida (951 days), Hawaii (937 days), New York (902 days) and Illinois (889 days).

A total of 58,589 Florida properties had a foreclosure filing in the third quarter of 2014, down four percent from the previous quarter and down 17 percent from a year ago, but the state still posted the nation’s highest foreclosure rate: one in every 153 housing units with a foreclosure filing.

Maryland foreclosure activity in the third quarter increased on a year-over-year basis for the ninth consecutive quarter, and the state posted the nation’s second highest foreclosure rate: One in every 204 housing units with a foreclosure filing.

New Jersey foreclosure activity in the third quarter increased on a year-over-year basis for the 10thconsecutive quarter, and the state posted the nation’s third highest foreclosure rate: One in every 218 housing units with a foreclosure filing.

Nevada foreclosure activity in the third quarter decreased 41 percent from a year ago, and Illinois foreclosure activity in the third quarter was down 20 percent, but the two states posted the nation’s fourth and fifth highest foreclosure rates. One in every 218 Nevada housing units had a foreclosure filing in the third quarter, and one in every 268 Illinois housing units had a foreclosure filing in the third quarter.

Other states with foreclosure rates among the nation’s top 10 highest in the third quarter were Georgia at sixth (one in every 297 housing units with a foreclosure filing); Delaware at seven (one in every 305 housing units); Ohio at number eight (one in every 306 housing units); Indiana at ninth (one in every 328 housing units); and South Carolina at 10 (one in every 334 housing units).

With one in every 117 housing units with a foreclosure filing in the third quarter, Orlando posted the highest foreclosure rate among metropolitan statistical areas with a population of 200,000 or more. A total of 8,052 Orlando-area properties had a foreclosure filing in the third quarter, down one percent from the previous quarter but up 16 percent from a year ago.

Third quarter foreclosure activity in the Atlantic City, N.J., metro area increased 51 percent from a year ago, giving the metro area a foreclosure rate of one in every 122 housing units with a foreclosure filing—second highest in the nation.

Third quarter foreclosure activity in the Macon, Ga., metro area increased 100 percent from a year ago, giving the metro area a foreclosure rate of one in every 127 housing units with a foreclosure filing—third highest in the nation.

Third quarter foreclosure activity decreased from a year ago in the Florida metro areas of Ocala and Palm Bay-Melbourne-Titusville, but the two cities still posted the nation’s fourth and fifth highest metro foreclosure rates in the third quarter.

The remaining five metro areas with top 10 foreclosure rates were all in Florida: Miami at sixth (one in every 137 housing units with a foreclosure filing); Jacksonville at number seven (one in every 140 housing units); Tampa at eight (one in every 148 housing units); Lakeland at nine (one in every 158 housing units); and Port St. Lucie at 10th (one in every 175 housing units).

Other metro areas with top 20 foreclosure rates in the third quarter included Rockford, Ill., at 11th (one in every 184 housing units with a foreclosure filing); Las Vegas at 14 (one in every 194 housing units); Trenton, N.J., at 15 (one in every 199 housing units); Baltimore at 17 (one in every 201 housing units); Columbia, S.C., at 18 (one in every 203 housing units); and Chicago at 19th (one in every 208 housing units).