More Than 40,000 Permanent Loan Mods Reportedly Granted in August

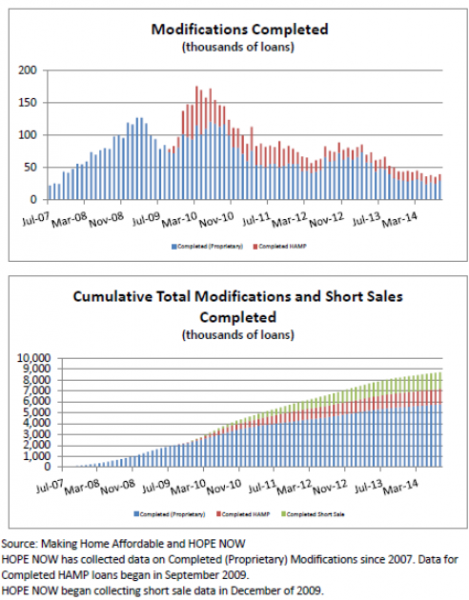

HOPE NOW has released its August 2014 loan modification data, which found that an estimated 40,000 homeowners received permanent, affordable loan modifications from mortgage servicers during the month. This total includes modifications completed under both proprietary programs and the government’s Home Affordable Modification Program (HAMP).

Total mortgage solutions outpaced foreclosure sales by almost five to one. For the month of August, the combination of total loan modifications, short sales, deeds in lieu and workout plans were approximately 163,000. This compares to approximately 34,000 foreclosure sales for the month. Since the beginning of 2014, mortgage solutions have outpaced foreclosure sales 1.28 million to 314,000, or approximately four solutions for every one foreclosure sale.

Of the permanent loan modifications completed in the month of August, an estimated 30,000 were through proprietary programs and 9,648 were completed via HAMP.

Completed foreclosure sales continued to decline in August, with approximately 34,000 for the month, compared to 38,000 in July—a decrease of 11 percent. This is the lowest monthly total reported since HOPE NOW began collecting data in 2007. This number of monthly foreclosure sales has been relatively consistent for most of 2014. By comparison, foreclosure sales were approximately 58,000 during the same month last year. Foreclosure starts declined as well this month, with 65,000 reported in August compared to 70,000 reported in July.

Delinquencies of 60 days or more were under two million for the sixth straight month—at approximately 1.89 million. This represented a slight increase (1.6 percent) from the previous month. Delinquency data is extrapolated from data received by the Mortgage Bankers Association for the second quarter of 2014.

Other Key Metrics: August vs. July

►Loan modifications: Approximately 40,000 completed in August vs. 35,000 in July—an increase of approximately 12 percent.

►Short sales: Approximately 9,300 completed in August vs. 11,000 in July—a decrease of 16 percent.

►Deed in-lieu: Approximately 2,400 completed in August vs. 2,500 in July—a decrease of seven percent.