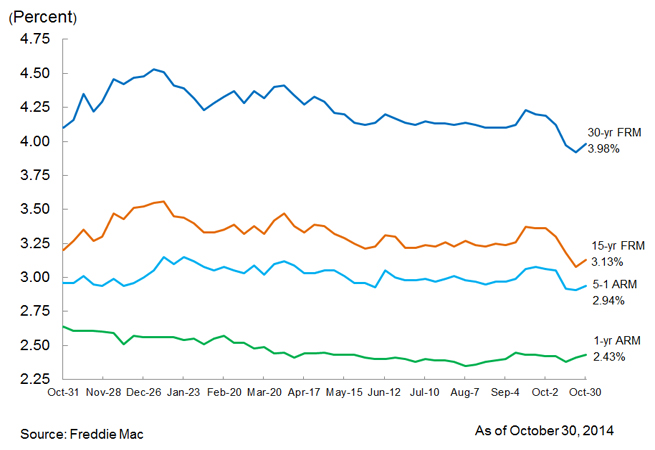

Mortgage Rates Rebound, Remain Below the Four Percent Mark

Freddie Mac has released the results of its Primary Mortgage Market Survey (PMMS), showing that average fixed-rate mortgages (FRMs) moved higher across the board this week, rebounding from the lowest rates of the year of 3.92 percent. This week, the 30-year FRM averaged 3.98 percent, with an average 0.5 point, up from last week when it averaged 3.92 percent. A year ago at this time, the 30-year FRM averaged 4.10 percent. Also this week, the 15-year FRM averaged 3.13 percent with an average 0.5 point, up from last week when it averaged 3.08 percent. A year ago at this time, the 15-year FRM averaged 3.20 percent.

"Mortgage rates grew across the board this week, rebounding from the lowest rates of the year," said Frank Nothaft, vice president and chief economist, Freddie Mac. "New home sales grew at an annual rate of 467,000 sales in September, the fastest rate observed during the recovery. Meanwhile, the National S&P Case-Shiller House Price Index grew at a seasonally adjusted annual rate of 0.4 percent in August."

The five-year Treasury-indexed hybrid adjustable-rate mortgage (ARM) averaged 2.94 percent this week with an average 0.5 point, up from last week when it averaged 2.91 percent. A year ago, the five-year ARM averaged 2.96 percent. The one-year Treasury-indexed ARM averaged 2.43 percent this week with an average 0.4 point, up from last week when it averaged 2.41 percent. At this time last year, the one-year ARM averaged 2.51 percent.