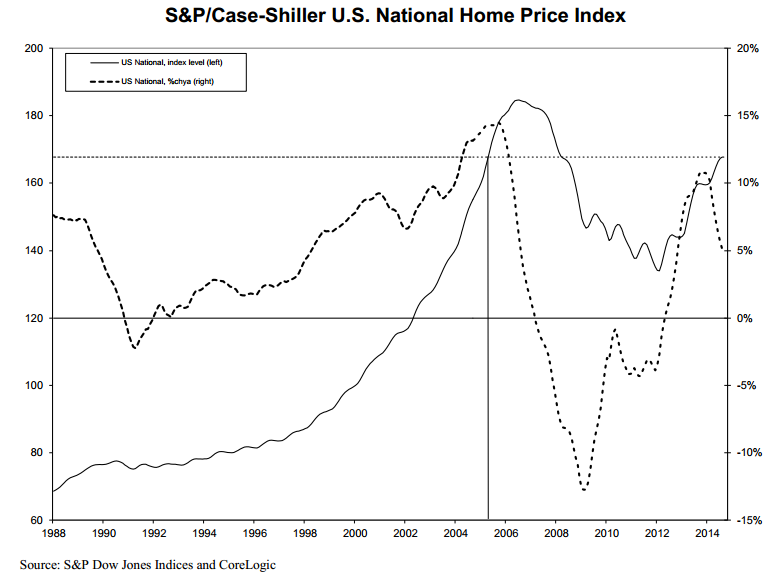

S&P/Case-Shiller Data Confirm Deceleration in Home Prices

Reasons to be optimistic about a return to housing vibrancy received a setback in the latest data released Tuesday by S&P Dow Jones Indices for its S&P/Case-Shiller Home Price Indices.

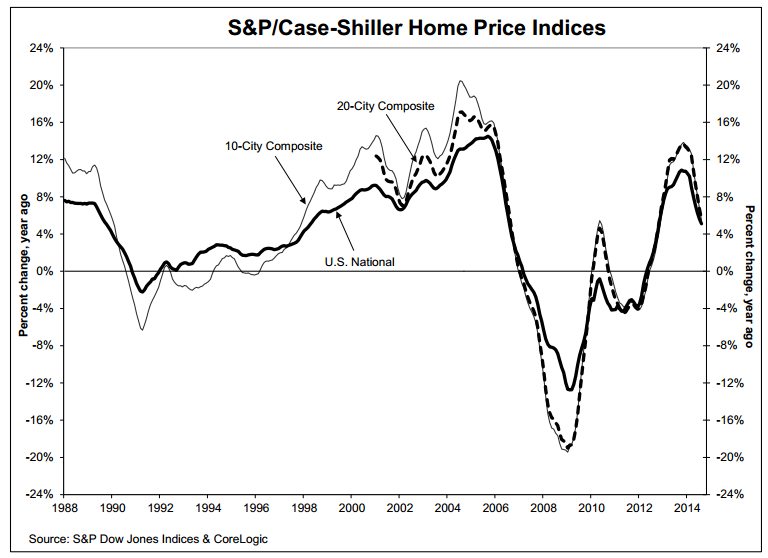

Citing data through August 2014, the S&P/Case-Shiller Home Price Indices’s 10-City Composite gained 5.5 percent year-over-year and the 20-City Composite gained 5.6 percent on a year-over-year basis. However, both composites were down from the 6.7 percent reported for July. The National Index gained 5.1 percent annually in August, down from 5.6 percent in July.

On a monthly basis, the National Index and Composite Indices showed a slight increase of 0.2 percent for the month of August. Detroit led the cities with the gain of 0.8 percent, followed by a three-way tie with Dallas, Denver and Las Vegas at 0.5 percent each. But gains in those cities were offset by a decline of 0.4 percent in San Francisco followed by declines of 0.1 percent in both Charlotte and San Diego.

The S&P/Case-Shiller data found that as of August 2014, average home prices for the metropolitan areas within the 10-City and 20-City Composites returned to their autumn 2004 levels. All cities except Cleveland saw their annual gains decelerate, with Las Vegas showing the most weakness in its year-over-year return: a drop from 12.8 percent in July to 10.1 percent in August. San Francisco posted 9.0 percent in August, down from its double-digit return of 10.5 percent in July. All cities except Boston and Detroit posted lower monthly returns in August compared their returns reported for July. San Francisco showed its largest decline since February 2012: it was the only city with negative monthly return two months in a row (from -0.3% in July to -0.4% in August).

“The deceleration in home prices continues,” said David M. Blitzer, chairman of the Index Committee at S&P Dow Jones Indices. “The Sun Belt region reported its worst annual returns since 2012, led by weakness in all three California cities – Los Angeles, San Francisco and San Diego. Despite the weaker year-over-year numbers, home prices are still showing an overall increase, as the National Index increased for its eighth consecutive month.”

Still, Blitzer pointed to more positive aspects in his data.

“Despite softer price data, other housing data perked up,” he continued. “September figures for housing starts, permits and sales of existing homes were all up. New home sales and builders’ confidence were weaker. Continued labor market gains, low interest rates and slower increases in home prices should support further improvements in housing.”