NMP Next: Leading the Industry to What’s Next

If we could only put out this special section once each year, it would probably live in the issue where we focus on leadership and what it means to be a leader in an industry that seems to be dealing with change on a daily basis. Fortunately, we bring you NMP Next in every issue (making it a great value for those that support this sponsored section) and we’re always focused on the firms that are taking a leadership role in the mortgage business.

And make no mistake about it, leading in this business is different than just about any other. Leaders here often enjoy the unwanted attention of consumer groups, regulators and politicians, many of whom assume that if we’re doing well, we must be doing harm to someone else.

Over the years—especially the years following the financial crash and the subsequent foreclosure crisis—I’ve talked to many executives who, in any other business, would have been celebrated for their accomplishments, but who chose to remain quiet about what they were doing. It was very frustrating because what the leaders in our industry have always done is enable borrowers to afford to purchase homes, and consumers to profit from real estate investments. In the past, those stories were difficult to tell.

Fortunately, that’s starting to change. Executives here have learned to harness the same social media tools that detractors have used for years and are now attracting audiences of followers that understand what they do and appreciate it. More executives are standing up and talking about the innovations they are bringing to market and the new benefits they’re bringing to both individual consumers and entire communities. We’ll be telling you many of their stories here.

But we will also provide what we hope will be creative fuel to aid you in your own processes of innovation. These stories will come from different perspectives and often from outside of our industry.

If you like what you read here and feel like your company deserves to be covered in detail within this special section, reach out to Scott Koondel ([email protected]) or Beverly Bolnick ([email protected]) and find out more about sponsoring NMP Next. I cannot wait to learn more about how your firm is leading the industry.

The Rise of Artificial Intelligence and its Impact on the Mortgage Marketplace

The Rise of Artificial Intelligence and its Impact on the Mortgage Marketplace

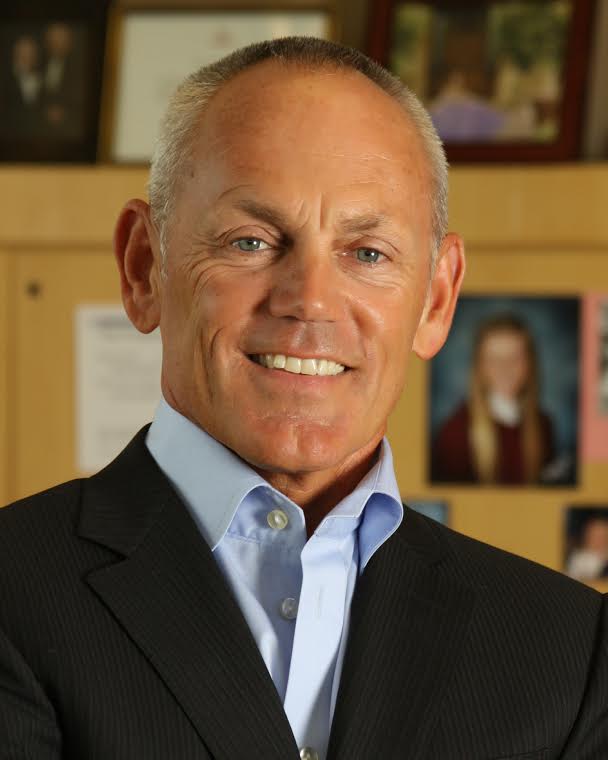

Samuel Jerrold Kaplan, Ph.D., author of Humans Need Not Apply: A Guide to Wealth and Work in the Age of Artificial Intelligence

Bringing in a Stanford educator who happens to be an expert in computer science to teach executives in the mortgage industry about automation seems … well, unnecessary. If anyone knows about the power of automated systems, it’s the home finance industry. These are the people who invented automated underwriting and then took it further with sub-prime automated underwriting. We can pull credit, order an AVM, get a tax transcript and send out the required disclosures seconds after getting the signed loan application—which we can get signed electronically. What do we need to know about computers?

Well, a lot as it turns out. Samuel Jerrold Kaplan, Ph.D., keynote speaker for the Mortgage Bankers Association’s Technology in Mortgage Banking Conference this past March, is a best-selling author, entrepreneur, technical innovator and futurist. He made his name working on tablet computers and founded a company that developed some of the technology used in the first smartphone and tablet PC. Ernst & Young made him their Emerging Entrepreneur of the Year in 1998.

Today, he specializes in artificial intelligence (AI). Last year, he published a book entitled Humans Need Not Apply: A Guide to Wealth and Work in the Age of Artificial Intelligence, which is probably what brought him to the attention of the MBA’s conference planners.

Kaplan started his address by defining AI, according to Google, as “The theory and development of computer systems able to perform tasks that normally require human intelligence, such as visual perception, speech recognition, decision-making, and translation between languages.” That message, he told the audience, falls short.

AI isn’t about developing computers that can do tasks that normally require human intelligence, or even humans. In fact, AI is about developing computers that do what humans would never want to do. A better definition of AI in action is Google itself. Google’s search protocols are not software tools that perform tasks that would ever require a human. Google search is about computers doing what Kaplan says computers always do, outperform humans.

He must have known the chilling effect that would have on his audience because he paused to let it sink in. Then, he splashed a familiar image up on the giant screens at the front of the room: An army of Terminator robots from the popular motion picture franchise. If it seems like AI is about building an army of intelligent computers that are capable of taking over the world, he said, that’s nonsense.

“This always makes me laugh,” Dr. Kaplan said. “If you were going to invent AI for the battlefield, wouldn’t you put eyes all around their heads so no one could sneak up on them?” The audience chuckled politely, but the idea of battlefield tech might have struck too close to home for many, given the new compliance systems the industry has been forced to bring online just to stay in business.

Over the course of the next hour or so, Dr. Kaplan took attendees on an interesting trek through the history of computer science. Later in the morning, he appeared on the exhibit hall floor to answer questions. He started by introducing us to John McCarthy (1927-2011), one of the founders of the AI discipline. In fact, it was McCarthy who coined the term “Artificial Intelligence.” He was the winner of the Turing Award, the U.S. National Medal of Science and the Kyoto Prize.

McCarthy thought about AI in terms of mathematical logic. That approach led to many of the advances we have made in computer science since then, including Big Blue, an IMB computer that bested the world’s best human chess player. This is the approach that allows us to put rules and regulations into computational form that a computer can understand. It helps the IRS navigate our incredibly complex tax law, puts a cop in the backseat of self-driving cars, and, he says, should allow the mortgage industry to shift the regulatory burden back onto regulators to make sure that the rules they create are consistent (forgive him, he’s not from our industry).

Mathematical logic was the first of three key concepts he shared with the audience. The other two were expert systems and machine learning. Together, these three legs form the foundation upon which modern AI is built. IMB Watson is an example of an expert system. Kaplan says Watson does for computational thinking what relational databases did for data. That system beat the best human Jeopardy player and has played a part in leading the newest generation away from human advisors. Millennials, he said, are more comfortable getting their information from online systems. This, he added, could be very good for Quicken’s Rocket Mortgage.

The third leg for modern AI is machine learning, which allows our computational systems to analyze and learn from real time data streams. The applications to our industry are massive, he said, and include better consumer credit information, more accurate property valuation and easier determination of the risk of default or prepayment.

Kaplan did a great job of keeping his audience engaged and many followed him into the exhibit all afterward for the Q&A. The fact that he’s a fellow at the Stanford Center for Legal Informatics likely contributed to his positive view of the power of computers to solve many of man’s problems, even if they do so in ways don’t fit every definition of Artificial Intelligence. Most mortgage executives will probably be less enthusiastic.

New technology implementations are difficult, expensive and often don’t deliver the promised results. Anyone in the audience who has been in the industry for more than a few years has experienced this first hand. Executives working here witnessed the sub-prime crisis, when sub-prime automated underwriting systems, set to match the requirements of Wall Street investors starving for product, started using the borrower’s vital signs as the most stringent requirement for loan approval (well, it wasn’t quite that bad, but you remember, right?). They also watched computerized equity trading systems piggyback on each other as stocks weakened, speeding up the devaluation process and throwing the market into panic.

It is conceivable that an expert system programmed to learn from the big data streams available to lenders today would return results that can only be interpreted as fair lending violations. As Kaplan pointed out, these systems can’t steer clear of gender, for instance. They will return whatever answer they feel is right, even if we wish it wasn’t. It may appear that the computer is denying a request for credit on the basis of race or gender or some other illegal borrower attribute, when in fact it’s because the system has identified a higher probability of default among people of the borrower’s height or television preferences or birth month. And how would our regulators deal with that?

In the end, computers are getting smarter, though Kaplan promises that without goals of their own they will never become the army of robotic doom that we read about in science fiction. Crunch Network contributor Mike Finley agreed last month when he wrote his post, “Be kind to artificial intelligence” on Techcrunch.com. He wrote:

“Artificial intelligence is the next obvious controversy. It’s around us every day, helping singles find a mate, or routing traffic or diagnosing disease. But will it one day take over like the Terminator? Make us obsolete and slothful like WALL-E? Enslave us like The Matrix? In a world of truly challenging problems like famine, terror and disease, it’s hard to argue that more intelligence will leave us worse off.”

In the end, the biggest obstacle to more intelligent systems, at least for our industry, may be the people who use them. As Finely put it, “How we perceive AI at work may not be so blatantly destructive — but still illustrates our unease. In 1934, Upton Sinclair wrote that people can’t understand new ideas if their livelihood depends on the old ones.”

Attendees listen in at the recent MBA Technology in Mortgage Banking Conference

Dr. Jerry Kaplan being interviewed by Michael Fratantoni, MBA chief economist and senior vice president of Research and Industry Technology, during the Q&A Session of the Technology in Mortgage Banking Conference

Disrupting the Mortgage Lender’s Database of Record

Disrupting the Mortgage Lender’s Database of Record

It’s not always easy to see trends coming, to know what’s most likely to impact your business next. But if you’re a mortgage lender who has been using your current loan origination system (LOS) for more than three years, it becomes much easier to guess. For the vast majority of originators, about every five years or so, they are working on implementing a new database of record.

Since I’ve been reporting on mortgage technology (since about 1997), I’ve read a number of pieces that attempted to explain why this happens so frequently here, as opposed to the servicing side where a huge swath of the market is still using Black Knight’s MSP and has been since Alltel released it as a DOS-based program for deployment on a bunch of green screens.

On the origination side, LOSs are less like platforms and more like sidearms. Every gunslinger has his favorite piece and when he comes to town, he brings his hardware with him. Every time a company changes the C-level executive in charge of the origination division, you can pretty much count on a new LOS making an appearance. But lately, it’s starting to look like the next person to weigh in on the technology decision won’t even work inside the mortgage company, rather it will be the consumer.

Fintech firms, many of which were simply tech firms before they discovered the fields of gold hiding in financial services, are expert at watching consumers and seeing what they are likely to want next. Will it be plowing virtual farms, pitching angry birds or crushing candies in a Tetris-like waterfall of smartphone-based color? Will it be reading a historic novel on their handheld or finding a historic mansion on Zillow’s app? Not only are most lenders not equipped to answer these questions, they don’t find them remotely relevant.

For mortgage loan originators, the customer base they serve includes real estate agents, financial planners and accountants, and investors. No one in this group is likely to spend a lot of time playing games on their phones. If they need financing for a project or want to buy an originator’s closed loans, they’ll use the phone, but probably to call them—something you can’t get a Millennial to do if you offer them money, a coffee shop gift card or hipster beard conditioner.

So, while some large LOS providers are pulling their software out from behind the lenders’ firewalls to store it on their own SaaS servers, a few are pushing their software out to consumers directly. Perhaps surprisingly, some of these players are actually from inside our industry.

Kyle: Save functionality. I can run rules without people waiting and let thousands of things happen in the background, rerun rules check tolerances, everything, and then bubble up if there are any exceptions. All is well and when you save, we check it all. Then you can revert back.

When you live in an LOS flat file system and do a loan, you go through the process to build a loan and you’re constantly going back in and changing your object, the record. You have to know what you’re changing. Now with our platform, I can do all kinds of what if scenarios without actually tainting the record. If I like it, then I can run rules around it and ask the consumer if we want to make this the new object.

Innovation from the inside

Innovation from the inside

I mentioned Jorge Sauri and his new company briefly last month. LendSmart is one of the companies that is focused on providing the borrower with a sense of control. Sauri has built borrower-facing process automation with built in document management designed to provide all of the information today’s borrowers are seeking while it allows lenders to get quality loan files started quickly. The goal is to put the lender’s LOS—or at least the front end of it—where the borrower is most likely to be. It’s smart if he can get lenders to buy into the idea.

Bill Dallas got around that problem by developing his new technology for his own loan origination company. The product is called intelligent Mortgage Platform (iMP) and was developed by his new firm cloudvirga. Dallas calls iMP the industry’s first comprehensive digital mortgage platform effectively alleviating the pain points, cost and time associated with the mortgage process.

cloudvirga CEO Bill Dallas sketches out his vision for the future of mortgage technology

Dallas, who you may know from his long tenure in the origination industry, most recently at Ownit, teamed up with Kyle Kamrooz and Mark Attaway to develop the new platform. He told me that he originally developed it for Skyline, a firm he was trying to build into what he calls “the next generation mortgage lender.”

One problem he faced was that the origination technology Skyline was using when he bought it was last generation tech. With cloudvirga, he set out to build something better and has, as of last month anyway, originated over $5 billion worth of mortgages on iMP.

“My costs in 2000 were $2,000 per loan; in 2006 they were $4,000 per loan and today, they are probably $8,000 per loan,” Dallas told me. “The solution was for us to try to lower our costs, integrate services, get to the cloud, go digital, use big data, be mobile and factor it for the purchase money market.”

No small task. When their current LOS wasn’t up to the task, the Skyline team started building their own. According to Dallas, they built it three times. The first time in C++, the second time on Microsoft’s .NET framework and finally on the latest web-based tech, Google’s Angular JS. Angular was designed to make it easy to build Model-View-Controller structured in web-friendly Javascript. Two way data exchange between the database and the consumer-facing view makes it easy to offer what-if scenarios that make mortgage borrowers feel like they have their hands on the wheel.

With cloudvirga, Dallas says Skyline is tackling the mortgage process with a platform that delivers an improved experience for consumers. Lenders are able to increase volume and reduce cost by streamlining and automating 50-60 percent of the front- and back-end processes. And by the way, the database isn’t flat.

Today’s LOSs are the gateways to databases made up of loan files, each of which can be modified by one person at any given time, generally dependent upon that person’s role and certain milestones built into the system. The result is a pipeline report where workers made decisions about what they will work on next, perhaps based on the easiest task or the person they are most willing to help at the moment.

Dallas told me this is crazy and it’s the primary reason that compliance is a nightmare and loans take 49 days to close. In a flat file world, anyone who changes the loan record must know what they are doing and that it is compliant. A better approach is to load the rules into the system, split the work into parallel workflows and let the software respond to events, like the completion of a task, intelligently routing the work to the next station. By doing this, Dallas claims he can do 40 percent of the work of originating a loan in 45 minutes.

As the work is being completed, the rules are running in the background, checking and rechecking tolerances and loan program guidelines and if exceptions occur they bubble up. As the loan changes, a record is stored, allowing the lender or borrower to go back to it if necessary. When everyone approves changes, the new record is saved into the database of record. Dallas says this approach speeds up everything. Which saves money. His team estimates that every day they can shave off the loan origination cycle will save the lender $55.

“If you can save 20 days per loan, that’s significant,” Dallas said.

Going deeper into the LOS

I hope to go deeper into cloudvirga in a future story. Because the LOS is so important to the industry, any real innovation that our industry achieves in the future will be either helped or hindered by this technology platform. What cloudvirga if offering is interesting because it opens the door to rethink the LOS into something more akin to what today’s consumers seem to be embracing online.

For now, I’ll leave you with Kyle Kamrooz's thoughts:

“Consumers want the mortgage process to be painless, simple, cheaper, transparent at all times; lenders want to reduce overall cost to produce and increase loans per full time employee or FTE. It’s a digital workflow engine that has been thought through for the 21st Century. Systems should be driving workflow, not people driving workflow. This is a movement to totally change mortgage lending and we are passionate about solving this problem.”

That’s way disrupters talk. At NMP Next, we like it.

A Critical Tool for Trend Spotters

A Critical Tool for Trend Spotters

One of the risks reporters face when they dig too deep into the stories of so-called innovators is that not everyone who believes they are innovating actually are doing so. It’s easy to get caught up in our own hype sometimes and it’s really easy for a publication to publish stories about dreams when they think they’re actually bringing you stories about accomplishment. Naturally, we’re very careful about that and even though most of the companies you read about here are sponsoring the section, they still have to let us uncover actual stories about their leadership exploits. Thus far, it’s working well, but this is one of the tools we use to guard against hype. It might be something you can use.

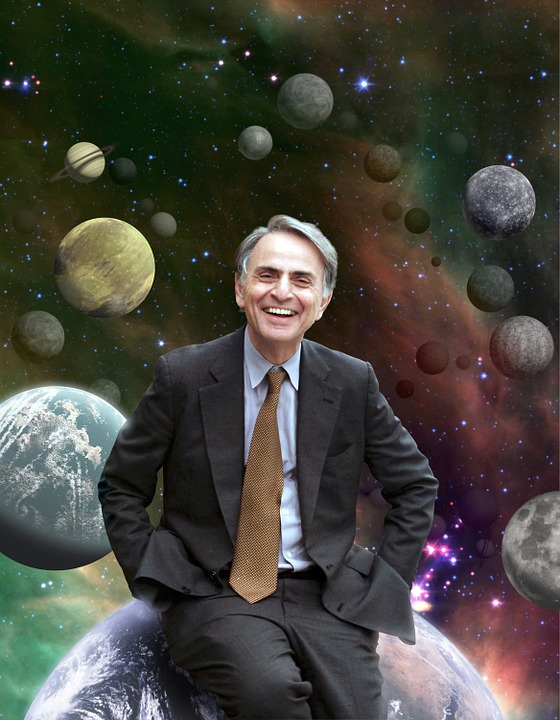

First, a tip of the hat to Open Culture. This website is an example of what’s best about an open and free internet. Creative individuals flock to this website for inspiration, creative ideas and a glimpse into popular trends that might impact the future. Recently, the website offered up an excellent piece based on a book by Carl Sagan entitled “The Fine Art of Baloney Detection.”

In his book, Sagan provides a framework that he used to separate fact from fiction (two worlds that he was equally comfortable in). I encourage you to find out more on Open Culture or in his book, but here are a few of his rules that we live by at NMP Next:

1. Facts should be independently confirmed when possible.

2. Arguments from “authorities” carry little weight.

3. Avoided attachment to a hypothesis just because it’s yours.

4. Remember Occam’s Razor: when the data explain a number of hypotheses, choose the simpler.

This is important in our industry because trends are based on data and data hits our industry like a California mudslide. Making sense of the information we have is challenging, which is why we’ll see one expert telling us that prices are rising while another cries out the warning of the next bubble. Knowing exactly what trendline is suggested by the data we have is challenging. Taking action on that information can be scary. But it’s what leaders do every day.

I miss Carl Sagan.

For True Technology Innovation, Steal Successful Ideas From Another Industry

For True Technology Innovation, Steal Successful Ideas From Another Industry

By Thomas Ward Lynch

Industry cross-benchmarking is nothing new, but it’s time that the mortgage banking industry revisit the practice. Looking past the artificial boundaries of the banking industry can yield surprisingly positive results. The requirements: An open mind and strong leadership.

As early as 2001, the healthcare industry was studying how to bring greater efficiency to the operating room. Their cross-benchmarking model was the airline industry. And how did the airline industry begin to gain efficiency in the mid-90s? They too looked to another industry to slash their downtime and boarding to half the original time. The find a better model, the airline industry studied racing team pit crews on race day.

First, airlines identified the most expensive part of their business process, which was the downtime at the gate. They needed ideas on how to more quickly clean the plane and board the next set of passengers.

Pit stops are lightning fast. Airlines began to organize their cleaning crews and flight attendants to be in complete sync with the deplaning and the onboarding of passengers, just like pit crews are with their racecar drivers.

The next time you’re on a flight, notice what is happening from the moment the seat belt light goes off. You are bid farewell while the attendants are cleaning up behind you. The next flight’s provisions are being loaded before you even get off the plane. And nearly all airlines now board in groups (another incentive to be at the gate ahead of time).

Imagine that kind of synchronicity happening in your workplace.

By engaging in cross-benchmarking (researching an award-winning racing team), airlines now keep a tighter schedule, which means more flight hours logged, higher profits, competitive rates and more satisfied customers.

The mortgage banking industry certainly could use cross-benchmarking engagements to improve its processes, customer interaction and agility.

The internal resistance will no doubt come from the strict regulation which now guides every process and that cannot be changed. Challenge that notion with the fact that every industry is now heavily regulated and there is always room for improvement in business processes that can lead to higher customer satisfaction and profitability, and customer loyalty (all factors that have reached record lows in the mortgage banking industry).

The first step is to do exactly what the airlines did: Identify the most expensive part of your business process and how it is costing the organization. The requirement is that it must be a core business problem, not a lofty mission statement. Narrow that down to no more than five bullet points. If you can write the core business problem on the back of a cocktail napkin, you know you’ve got it.

Second, start looking beyond the mortgage banking industry. Look at Energy & Utilities; Retail; Transportation; and Manufacturing. There are some game-changing innovations happening in these industries right now.

It’s very likely the solution involves a technology implementation, but it will only be successful if the technology is tied directly to solving the core business issue.

Transforming your organization is challenging, but not impossible. Tighten your resolve, apply the innovation, and see new success.

Thomas Ward Lynch is CEO and co-founder of Empire Media Partners. He is a skilled I/T Influencer Relations professional with more than 25 years of experience in the tech ecosystem. He investigates and summarizes trends, key industry messaging and the collective focus of the I/T industry on a global scale. He may be reached by e-mail at [email protected].

Next in NMP Next

Next month will be a busy one for many in our industry. The spring buying season will give way to the summer buying season and, if the pundits are to be believed, we’ll see an even stronger purchase market. Mortgage executives will busy for much of the summer, as we have a number of interesting events coming up over the next couple of months.

In June, the Mortgage Bankers Association (MBA) will hold its Secondary Market Conference in New York City. The National Notary Association will hold its Annual Conference. October Research will put on NS3 down in Charlotte. The MBA of New York will hold its Strategic Lending Conference, and out in Oregon, the Great Northwest Mortgage Expo will take place on the 21st. So much for summer vacation.

For our part, we’ll be working on bringing you some great stories in June. Now that we have a couple of months under our belts, we’re ready to start going deeper on the leading companies that are supporting this special section. Among the first to appear will be Ernst Publishing, Class Appraisal and Freedom Mortgage.

I’m looking forward to taking readers deeper into the inner workings of Ernst Publishing. What started as a California firm that sold giant phone book sized lists of closing cost information for jurisdictions all across the country, 25 years later has become the leading provider of closing cost and real estate fee information in the country. It’s technology is core to the systems in use by all 10 of the nation’s top banks, all 5 of the top title underwriters and 9 out of 10 originators nationwide and has been used on over 1 billion transactions! So, while most may already know about Ernst, only some know how the firm is making it easier for lenders and settlement agents to be TRID compliant. In the meantime, find them on Twitter at @ErsntInfo.

If you know much about social media, you probably know Class Appraisal as one of the nation’s fastest growing and respected Appraisal Management Companies. The company has an awesome Twitter account at @ClassAppraisal. I was visiting with Marketing Director Brian Dietderich the other day and while I’m not certain yet how much I’ll be able to tell you about what they’re doing, let me just say that this firm is taking transparency to a level seldom seen in our industry, despite the lip service just about everyone is always willing to pay to the concept. I’ll bring you the story soon.

And I’m particularly looking forward to Freedom’s story. Having the lenders and servicers that are leading our industry stand up and accept the recognition they deserve for the hard work they do has been too long in coming. So, watch for that.

Until next time, keep innovating and let us know if you want to share your stories here in the future.

Rick Grant is NMP special features editor for NMP Next and National Mortgage Professional Magazine. He may be reached by e-mail at [email protected].