The Right Investment in Learning

For the past eight years, building mortgage talent within the mortgage industry has been a roller coaster ride. It started with increased regulatory requirements followed by the bottom dropping out of the talent pool with the recession. As a result, the mortgage industry is just starting to embrace the value of talent management in operations. However, compared to corporate America as a whole, the mortgage industry has a long way to go before training is widely accepted as a core value supported by a mature strategy and meaningful investment.

Setting the stage

The SAFE Act of 2008 set the stage and forced lenders to establish regular training for loan originators. This Act at least placed a line item for education on the P&L for the sales team. The cost of sales training in general is easier to quantify through improved gross and net originations. Therefore, it holds a solid position in the budget. For operations, it’s a different story. At many lender shops today, setting aside funds in the budget to train processors, underwriters and closers is a tall order. The budget usually allows for only a basic set of self-study classes followed by throwing the person into the fire and shadowing a co-worker who doesn’t have time to provide real instruction.

The increased oversight by the Consumer Financial Protection Bureau (CFPB) has nudged lenders to recognize the need to increase the investment in training the operations team. Yet most lenders simply scramble to grab the easiest and cheapest self-study courses on the market in order to check the box and have certificates in the event of an audit. For many lenders, the need to close loans with the least amount of overhead puts pressure on the time and money available for education.

Learning maturity

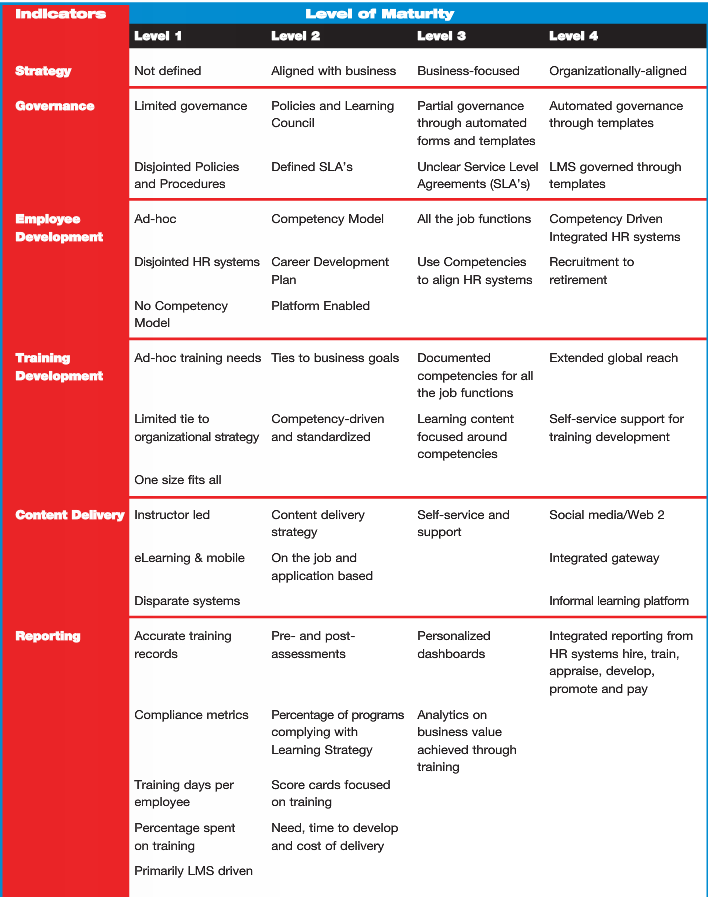

This constant pressure to close loans keeps much of the mortgage industry at Level 1 and Level 2 maturities in learning. Learning maturity is defined in many ways. A company is considered to be Level 1 Maturity when the strategy and governance are not defined and employee development is ad-hoc. Lenders at a Level 2 Maturity have a Learning Management System (LMS), but don’t fully leverage the analytics and are missing learning competency for all job functions. Companies at Level 1 and Level 2 Maturities have training development tied to business goals and just enough reporting to keep the CFPB at bay.

The table below illustrates the indicators and the characteristics at each level of maturity.

Where does your organization fall on the grid? If you have an LMS, then you at least have one foot toward being at Level 2. The areas many mortgage companies lack for full Level 2 status are aligning the training with business goals, service level agreements (SLAs) with defined objectives and competency-driven training development that is competency-driven.

Defining the objectives within SLAs is a key component. Each position in the mortgage manufacturing process should have defined SLAs such as turnaround times, number of days between key points in the loan process etc. Training should be aligned to help individuals achieve these SLAs as well as their individual performance improvement plans.

Lack of L&D investment

It takes planning and investment to move up each level in learning maturity. It is common to see a mortgage lender of 200-300 employees have only one person dedicated to administering the LMS, as well as content management. The cost of the LMS and typical administrator salary is an investment per employee as low as $400-$600 per employee. By comparison, research published by Bersin by Deloitte in the WhatWorks Brief Corporate Learning Factbook 2015: Benchmarks, Trends, and Analysis of the U.S. Training Market, showed that learning and development spending per employee for Level 1 Maturity, across a mix of industries, at $956 per employee. This illustrates how far behind the mortgage industry is in its commitment to investing in talent management.

Another interesting point in the publication is the drop in training spending during 2008 and 2009. The mortgage industry was no exception here and we are still feeling the gap in knowledge and experience today.

Setting up

Once an organization grows beyond 150 employees, managing the talent, LMS and building the right content for a mortgage operation requires a team. A “super administrator” of the LMS is a must-have position for a company with 150- 250 employees. This “super admin” will still need the support of the LMs provider in times of hiring and when system customizations are needed. A good LMS provider will offer support services to add a variable cost component that facilitates peak times and change management.

The same size organization needs to leverage out-of-box self-study content that can be customized into an affordable and easy software program. Oftentimes a training topic needs only simple adjustments to help learners apply the knowledge to their specific process. This is another opportunity for a content provider to support the organization without having to take on full time staff.

The tipping point when company specific content becomes critical is 250-300 employees. When the company is smaller, it can still manage with existing team leads conducting training using Webinar formats. However, once the numbers hit the 250-300 range, or growth occurs rapidly over 200 FTE, the staff changes, volume, and market shifts create an ongoing need to onboard team members quickly. At this point, the super administrator is constantly managing people and reports and has little time to pay attention to content. The managers at the company have no time to develop training and team members are in need of a clear path to grow from one job function to the next. The number of job functions also increases at this tipping point. Where there used to be a processor, there is now a set up clerk, disclosure desk as well as junior and senior processors. Learning content must fit the role in a very specific way in order to have effective seat time and develop knowledge that can be quickly applied on the job. Here, a content manager is needed to coordinate out of box resources, and serve as project manager to outsource content development.

Becoming Level 3 and 4 Maturity

There are a few lenders who have embraced Level 3 and Level 4 Maturities and have fewer than 500 employees. It is amazing to see the dedication from the staff and the efficiency and customer service throughout the organization.

For a company of 500-plus employees, spending $950-$1,300 per employee represents an average $500,000-$650,000-plus annual investment in learning and development. Keep in mind, this investment calculation should not include mandatory SAFE Act training unless the content in the training is evaluated and aligned specifically with company goals. If the loan originator is selecting his/her own courses, then chances are it’s about checking a box and not contributing to their overall growth.

It takes an investment in the right LMS, having a strong LMS administrator, dedicated content managers, and experienced outsource service partners to create a true talent management system.

Alice Alvey is senior vice president at Indecomm, leading the Indecomm-Mortgage U Division, Internal QA and Compliance. She continues to conduct consulting engagements, create customized mortgage training programs, as well as develop compliance product and procedure manuals. She is the author of Indecomm’s FHA Practical Guide and VA Practical Guide. She may be reached by e-mail at [email protected].

This article originally appeared in the August 2016 print edition of National Mortgage Professional Magazine.