Carson: We Need to “Revisit the Way We Do Things”

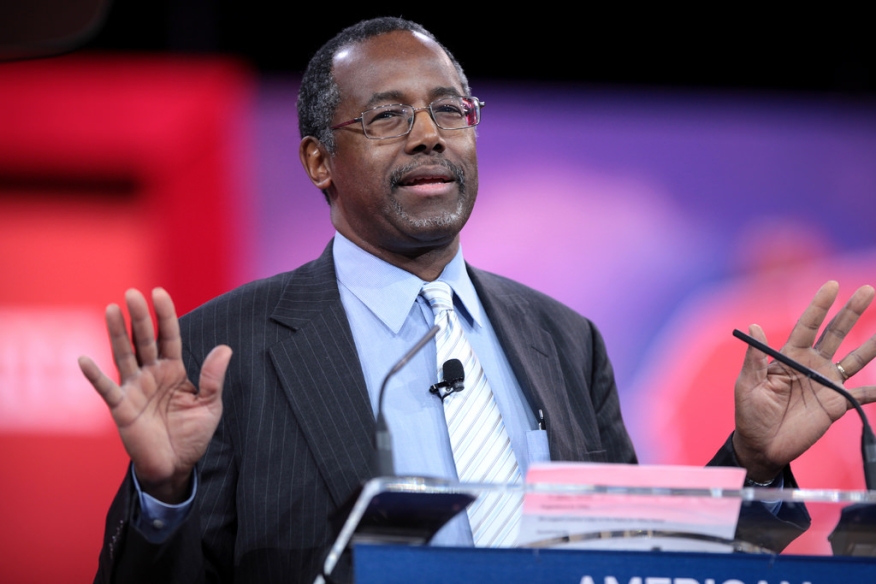

Dr. Ben Carson, the retired neurosurgeon nominated by President-Elect Trump to become the next Secretary of the U.S. Department of Housing & Urban Development (HUD), presented himself before the Senate Banking Committee this morning with a challenge to use HUD as a tool to bring a new sense of empowerment to the American people.

In testimony delivered this morning during the first day of his confirmation hearing, Dr. Carson painted a bigger picture where housing was part of the strategy to realign American self-identity.

“We must revisit the ways we do things in order to give people an opportunity to climb the economic and social ladder,” he said. “Right now, social mobility has become stagnant. However, if we think holistically about this—we will know that it’s more than just housing. We must include the areas of healthcare, education, jobs and the skills to do them, in addition to transportation, as we develop the best approach. In order to provide access to quality housing for the elderly, disabled, and low-income we need to work across silos, and I intend to do that at HUD, should you confirm me. I want to make America’s neighborhoods stronger and more inclusive.”

Dr. Carson acknowledged that he would come to HUD without previous experience in housing policy planning, yet he insisted that his medical career prepared him for the intellectual challenges that arise in running a complex agency.

“There is a strong connection between housing and health, which is of course my background,” he continued. “Housing—and housing discrimination—is a social determinant of health. Substandard housing conditions such as pest infestation, the presence of lead paint, faulty plumbing, and overcrowding, which disproportionately affect low-income and minority families, lead to health problems such as asthma, lead poisoning, heart disease, and neurological disorders, according to Brookings. These problems occur across America – in cities as well as suburbs and rural areas.”

Dr. Carson also touched on the Trump pledge to cut away regulations related to lending, which he said created inequality among prospective homeowners.

“Loans are now bifurcated: the well-off have their pick of loans and lenders while many others without solid credit or stable incomes are locked out—one of the reasons the economic recovery was slower than many would have liked,” he said. “Homeownership rates have fallen on a year-over-year basis in every quarter for the last 10 years, and a surge in renting has dropped the homeownership rate to a 50-year low. Banks are loath to participate in low-down payment programs through FHA for fear of getting sued if the borrowers default. So, we need to make sure HUD and FHA are fulfilling their missions to help people build up an asset, like a home, which will help them climb up the rungs of the economic ladder.”

Carson also fended off efforts by Sen. Elizabeth Warren (D-MA) to venture into a speculative discussion of whether the president-elect would be become financially enriched by HUD actions.

“Can you assure me that not a single taxpayer dollar that you give out will financially benefit the president elect or his family?” asked Warren.

“I can assure you that the things that I do are driven by a sense morals and values, and therefore I will absolutely not play favorites for anyone,” he answered.

Warren rephrased her question by asking, “Do I take that to mean that you might manage programs that might significantly benefit the president-elect?” And Dr. Carson answered, “You can take it to mean that I will manage things in a way that benefits the American people. That is going to be the goal. If there happens to be an extraordinarily good program that's working for millions of people and it turns out that someone that you're targeting is going to benefit you know, $10 from it, am I going to say no, the rest of you Americans can't have it. I think logic and common sense probably would be the best way.”

“NAMB and its members are committed to working with Dr. Carson and HUD in developing policies that will expand affordable credit, therefore moving more Americans towards the dream of homeownership,” said Fred Kreger, CMC, president of NAMB-The Associaiton of Mortgage Professionals.