Advertisement

Fewer Homeowners Are Delinquent on Mortgages

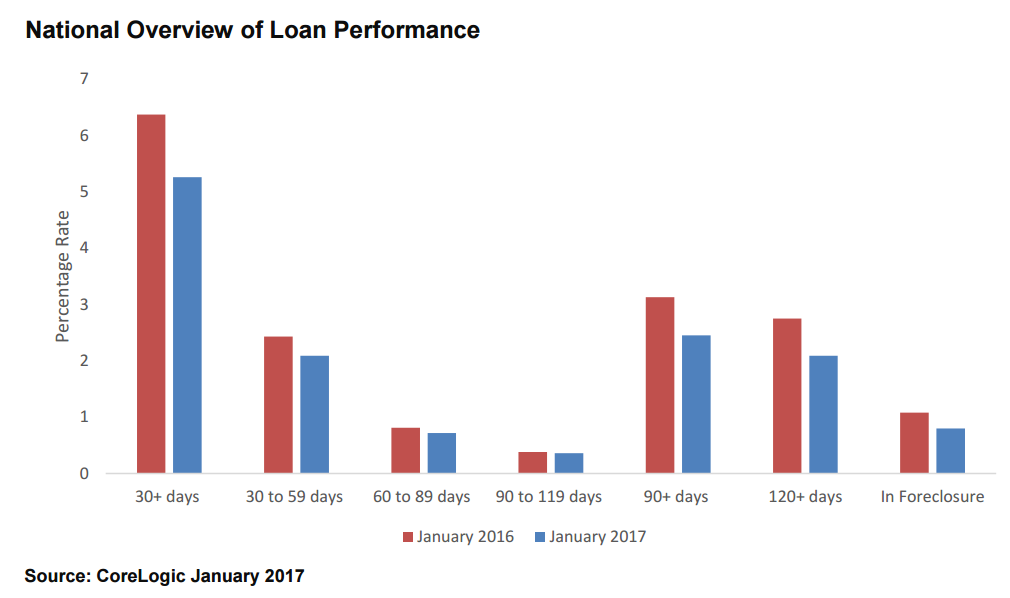

It appears that more people are paying their mortgages on time. According to new data from CoreLogic, 5.3 percent of homeowners were delinquent by at least 30 days or more (including those in foreclosure) on their mortgages in January, a 1.1 percent year-over-year decline from the 6.4 percent level set in January 2016.

The foreclosure inventory rate was 0.8 percent in January, down slightly from the 1.1 percent rate in January 2016, while the serious delinquency rate—defined as 90 days or more past due including loans in foreclosure—was 2.5 percent, down from 3.2 percent one year earlier. Also on the decline were early-stage delinquencies, defined as 30-59 days past due: that rate measured at 2.1 percent in January, below the 2.4 percent level of January 2016. The share of mortgages that were 60-89 days past due in January was 0.7 percent, a scant dip from 0.8 percent one year earlier.

“The 30-plus delinquency rate, the most comprehensive measure of mortgage performance, is at a 10-year low and rapidly declining,” said Frank Martell, president and CEO of CoreLogic. “While late-stage delinquencies remain in the pipeline in selected markets, early-stage delinquency performance is stellar and the lowest it’s been in two decades. The continued improvement in mortgage performance bodes well for the health of the market in 2017.”

About the author