Advertisement

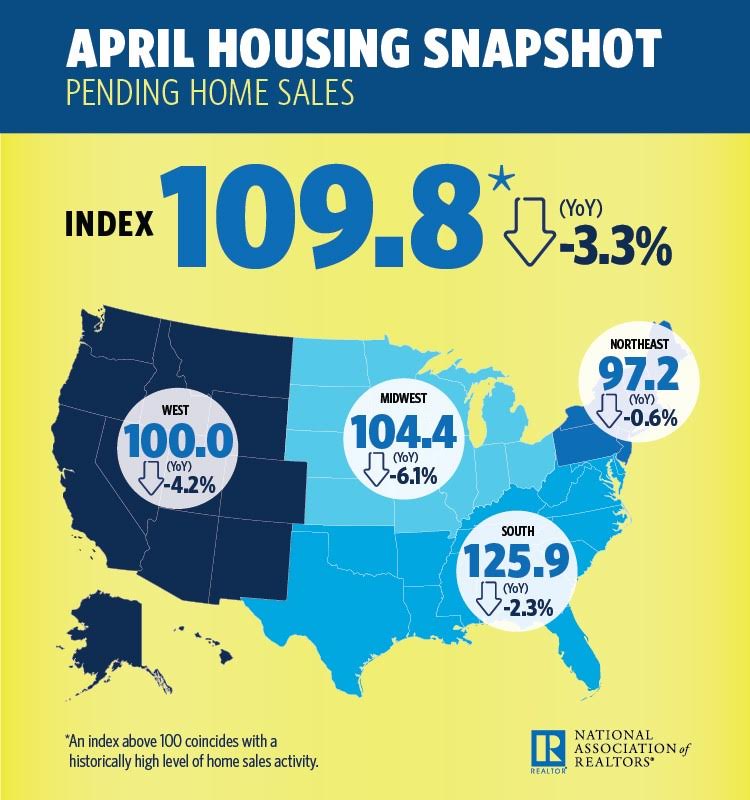

Pending Home Sales Down in April

The National Association of Realtors’ (NAR) Pending Home Sales Index (PHSI) took a 1.3 percent drop last month to 109.8, down from a revised 111.3 in March. The PHSI was also down 3.3 percent from April 2016, marking the first year-over-year decline since December 2016 and the largest slide since the 7.1 percent plummet in June 2014.

On a regional basis, only the West PHSI saw an increase, jumping 5.8 percent from March to April for a 100 level reading—but that is still 4.2 percent below the April 2016 level.

“Much of the country for the second straight month saw a pullback in pending sales as the rate of new listings continues to lag the quicker pace of homes coming off the market,” said NAR Chief Economist Lawrence Yun. “Realtors are indicating that foot traffic is higher than a year ago, but it’s obviously not translating to more sales. Prospective buyers are feeling the double whammy this spring of inventory that’s down nine percent from a year ago and price appreciation that’s much faster than any rise they’ve likely seen in their income.”

About the author