Advertisement

Mortgage Rates and Credit Availability Rise

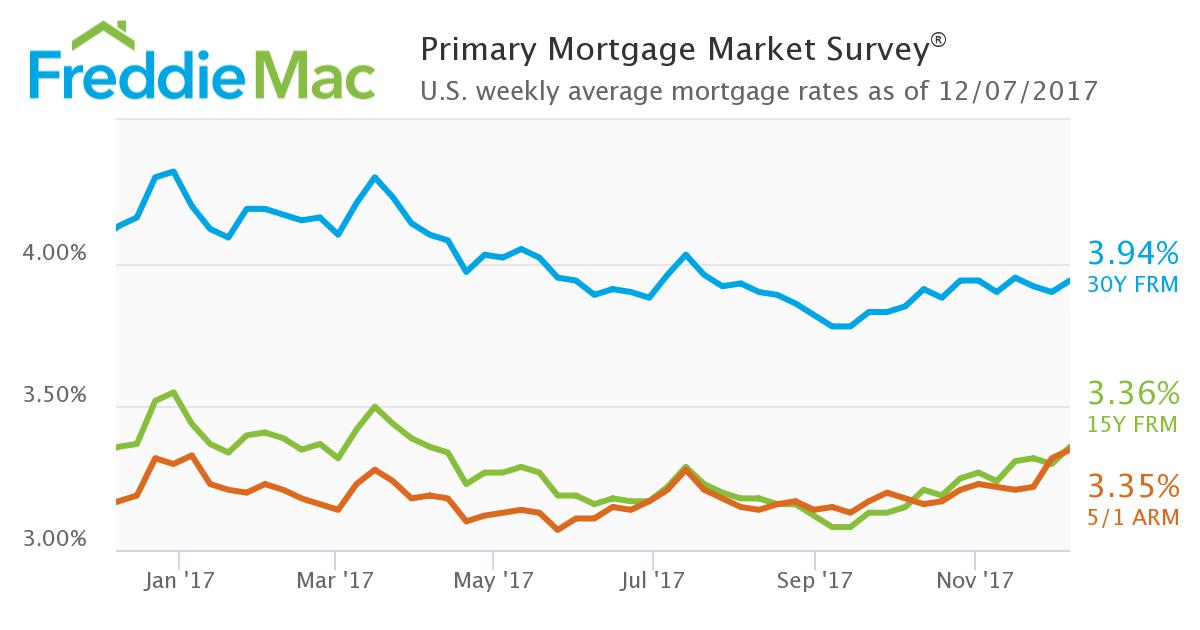

Mortgage rates were up this week, according to the latest Freddie Mac Primary Mortgage Market Survey (PMMS).

The 30-year fixed-rate mortgage (FRM) averaged 3.94 percent for the week ending Dec. 7, up from last week when it averaged 3.90 percent. The 15-year FRM this week averaged 3.36 percent, up from last week when it averaged 3.30 percent. And the five-year Treasury-indexed hybrid adjustable-rate mortgage (ARM) averaged 3.35 percent this week, up from last week when it averaged 3.32 percent.

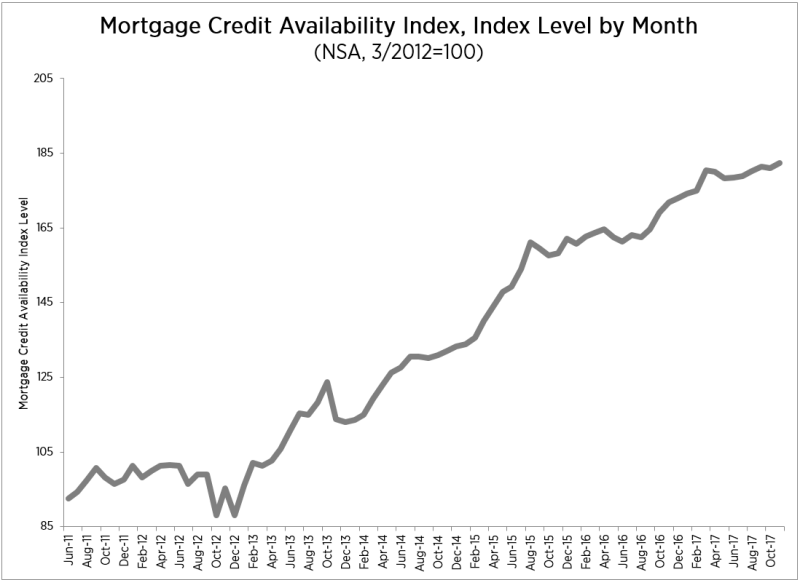

Separately, the Mortgage Bankers Association (MBA) reported that its Mortgage Credit Availability Index (MCAI) increased by 0.8 percent to 182.4 in November. Three of the four component indices saw increases—the Jumbo MCAI (up 3.8 percent), the Conventional MCAI (up 2.8 percent) and the Conforming MCAI (up 1.8 percent)—while the Government MCAI was down 0.7 percent from last month.

"Mortgage credit availability increased in November driven by a net increase in investor offerings, said MBA Vice President of Research and Economics Lynn Fisher. "While the number of offerings for government backed programs—FHA/VA/USDA—declined modestly, conventional offerings increased more strongly over the month among both jumbo and conforming programs."

About the author