Advertisement

Median Down Payment for Single-Family Homes Hits New High

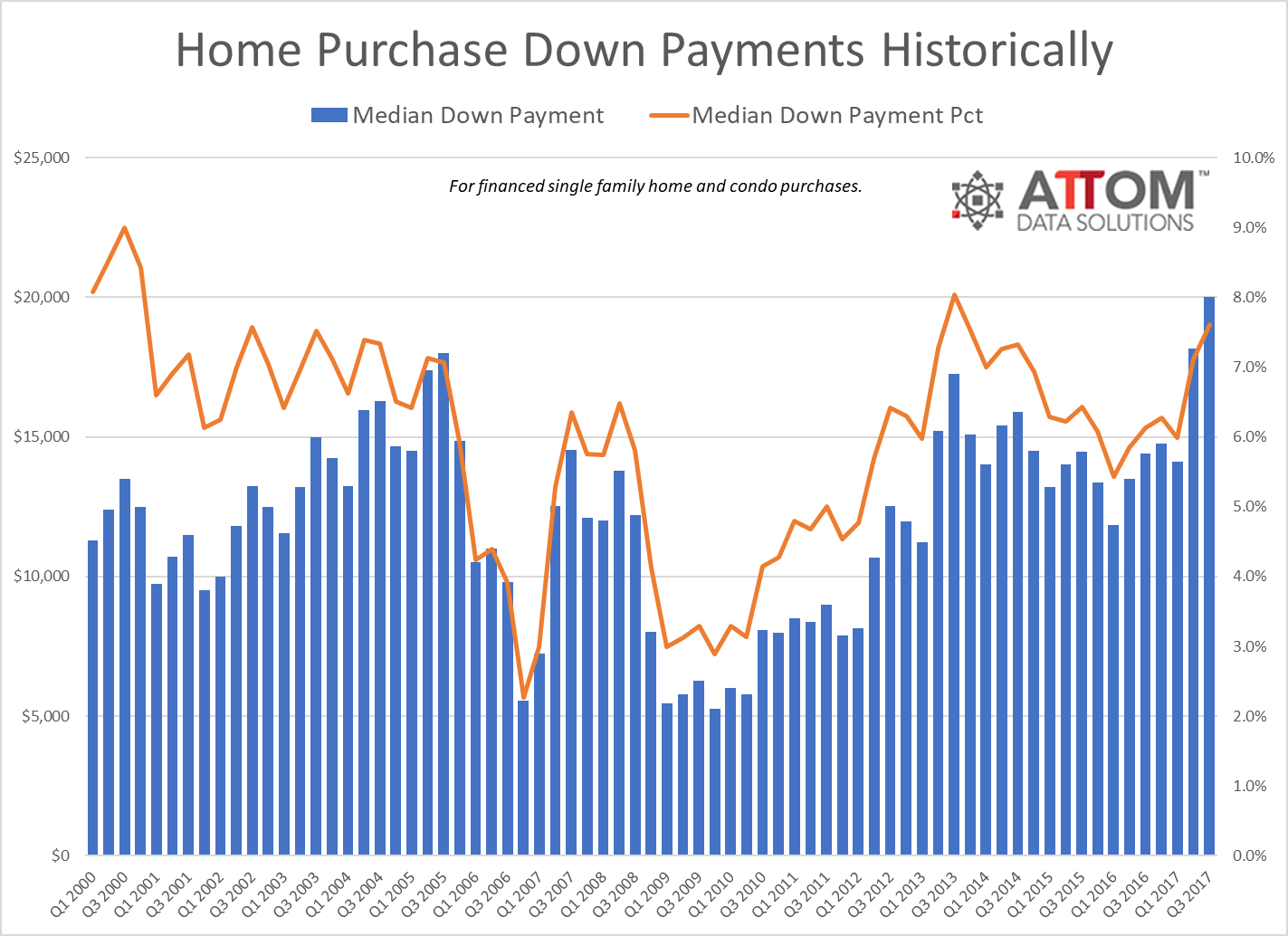

The median downpayment for single-family homes and condos purchased with financing in the third quarter was $20,000, up from $18,161 in the previous quarter and up from $14,400 in third quarter of 2016, according to new statistics released from ATTOM Data Solutions. The third quarter’s median downpayment is the highest recorded by ATTOM since data tracking began in the first quarter of 2000.

The average downpayment of $20,000 was 7.6 percent of the median sales price of $263,000 for financed home purchases in the third quarter, up from 7.1 percent in the previous quarter and up from 6.1 percent in the previous year. This level is the highest recorded since the third quarter of 2013.

The median downpayment was more than $50,000 in 12 of the 99 metropolitan statistical areas analyzed in the report, with the highest levels recorded in four California markets—San Jose ($247,000), San Francisco ($170,000), Los Angeles ($118,000) and Oxnard-Thousand Oaks-Ventura ($105,000)—plus Boulder, Color. ($99,900).

“Buying a home has become a full-contact sport in many markets across the country, and buyers with the beefiest downpayments—not to mention all-cash buyers—are often able to muscle out those with scrawnier savings,” said Daren Blomquist, senior vice president with ATTOM Data Solutions. “Despite the increasingly competitive nature of homebuying, the number of residential property purchase loans nationwide increased to a 10-year high in the third quarter.”

ATTOM added that approximately 2.4 million loans secured by residential property were originated in the third quarter, up 17 percent from the previous quarter but still down five percent from a year ago. Nearly 1.1 million of these transactions involved purchase loans, up eight percent from the previous quarter and up seven percent from a year ago to the highest level since the third quarter of 2007. A total of 981,773 refinance loans secured by residential property were originated in the third quarter, up 28 percent from the previous quarter but down 19 percent from a year ago.

About the author