Advertisement

Mortgage Rates Inch Toward Five Percent Mark

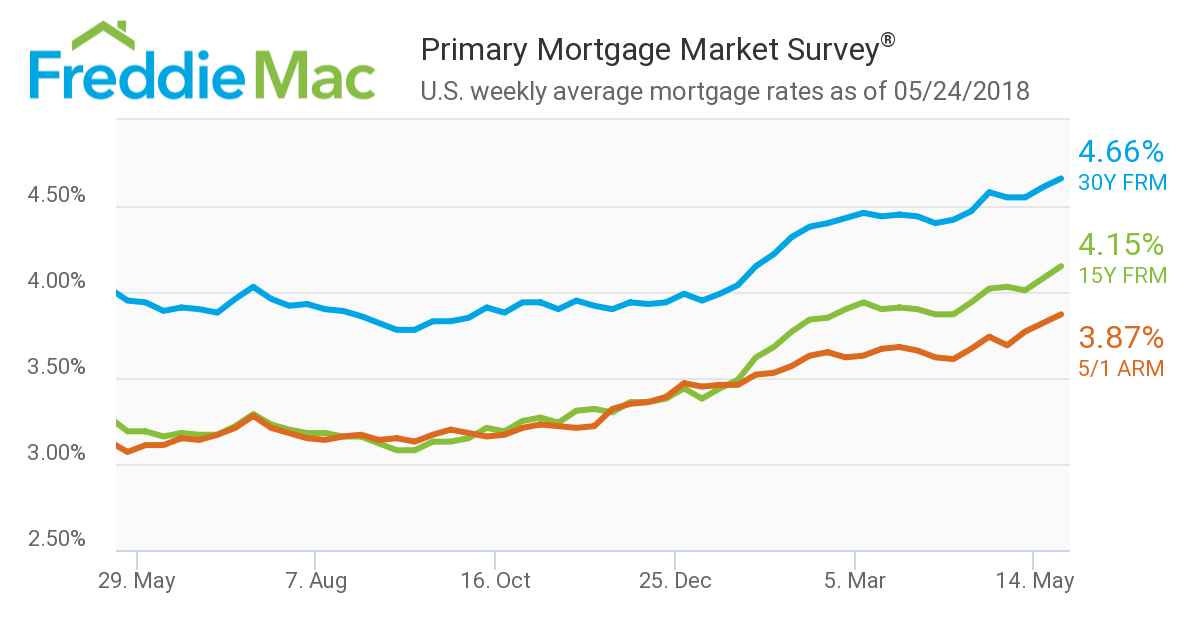

Mortgage rates have reached their highest level since May 5, 2011, according to new data from Freddie Mac.

The 30-year fixed-rate mortgage (FRM) averaged 4.66 percent for the week ending May 24, up from last week when it averaged 4.61 percent. The 15-year FRM this week averaged 4.15 percent, up from last week when it averaged 4.08 percent. And the five-year Treasury-indexed hybrid adjustable-rate mortgage (ARM) averaged 3.87 percent, up from last week when it averaged 3.82 percent.

“Mortgage rates so far in 2018 have had the most sustained increase to start the year in over 40 years,” said Sam Khater, Freddie Mac’s Chief Economist. “Through May, rates have risen in 15 out of the first 21 weeks (71 percent), which is the highest share since Freddie Mac began tracking this data for a full year in 1972. At a time when housing inventory remains extremely low, it’s worth watching whether these higher borrowing costs lead some would-be sellers to stay put in their current home. Inventory shortages would likely worsen if more homeowners decide not to sell out of reluctance of having a new mortgage with a higher rate.”

About the author