Advertisement

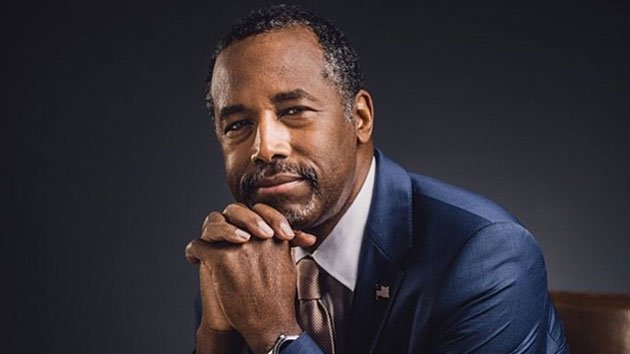

HUD’s Carson Criticizes Congressional Egos on Shutdown

U.S. Department of Housing & Urban Development (HUD) Secretary Ben Carson rebuked congressional leaders for failing to come to an agreement on the partial federal government shutdown.

In an interview with NPR, Carson suggested the legislators were more enamored with their self-importance than governing.

“We can continue to hope that our leaders will recognize that this is an easy problem to solve,” he said. “I mean, just take your ego out of it.”

Carson noted that even though furloughed workers—including 95 percent of HUD’s employees—will get back pay, many of them will not be made “whole” after the shutdown is over.

“These federal workers, I mean, yes I know we're going to give them back pay, but that doesn't take care of the interest if they borrow money,” Carson said. “We really need to think about them, as opposed to some political victory. And it does worry me about the future of our country. If we're going to do everything based on ideology and hatred, I just don't see how we are going to be successful as a country.”

About the author