Advertisement

Millennials Account for Nearly Half of New Home Loans

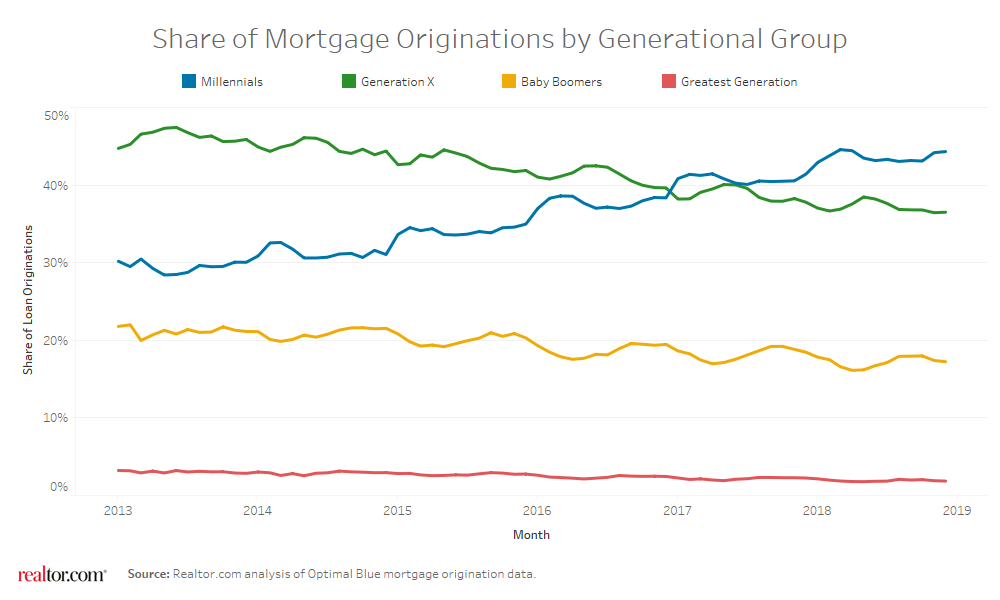

Millennials were the recipients of 45 percent of all new mortgages in 2018, according to new data from Realtor.com. In comparison, 36 percent of all new mortgages went to Generation X and 17 percent to Baby Boomers.

Millennials also accounted for 42 percent of new home loans by dollar volume, compared to 40 percent for Generation X and 17 percent for Baby Boomers. Millennials are also seeking out homes with a lower median purchase price: $238,000, compared with Baby Boomers and Gen Xers spending a median purchase price average of $264,000 and $289,000, respectively. However, Millennial downpayments averaged 8.8 percent as of December 2018, versus 11.9 percent for Generation X and 17.7 percent for Baby Boomers.

"Millennials are getting older, with better jobs and deeper pockets, allowing them to expand their collective purchase power, and hence, their footprint in the market," said Javier Vivas, Director of Economic Research at Realtor.com. "The stereotype that Millennials primarily choose to buy homes and live in large metro areas isn't the reality. Results show Millennials' expansion is more heavily conditioned by affordability than in prior years, so their eyes are set on less traditional secondary markets where homes and jobs are now available and plentiful."

About the author