Advertisement

Negative Equity Records First Quarterly Growth Since Q4 2015

The total number of mortgaged homes in negative equity increased 1.6 percent to 2.2 million homes or 4.2 percent of all mortgaged properties, between the third and fourth quarters of 2018, according to new data from CoreLogic. This marks the first quarterly increase since the fourth quarter of 2015. The national aggregate value of negative equity was approximately $300.3 billion at the end of the fourth quarter, up from $282.9 billion in the third quarter of 2018 and up $285.9 billion in the fourth quarter of 2017.

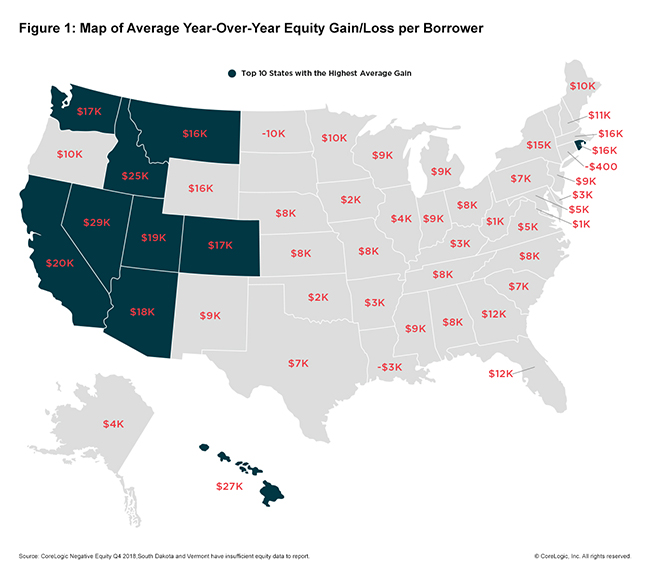

However, on a year-over-year basis, the number of mortgaged properties in negative equity fell 14 percent, or by 351,000, from 2.6 million homes or 4.9 percent of all mortgaged properties in the fourth quarter of 2018. CoreLogic also noted that the average homeowner gained $9,700 in home equity over the 12-month period ending with the fourth quarter of 2018, with the biggest gains recorded in Nevada (an average of approximately $29,400 in home equity), Hawaii (an average of approximately $26,900) and Idaho (an average of $24,700).

“Our forecast for the CoreLogic Home Price Index predicts there will be a 4.5 percent increase in our national index from December 2018 to the end of 2019,” said Frank Nothaft, Chief Economist for CoreLogic. “If all homes experience this gain, this would lift about 350,000 homeowners from being underwater and restore positive equity.”

About the author