Advertisement

The Best Day for Selling a Home Is …

Is there a right day for getting the biggest bang for the buck when selling a home? According to a new analysis by ATTOM Data Solutions of single-family homes and condos sold between 2011 and 2018, there are certain days out of the year where seller premiums are 10 percent or more.

The new analysis determined the five best days to sell a home with the biggest seller premiums above market value were June 28 (10.8 percent seller premium), May 31 (10.7 percent seller premium), June 21 (10.7 percent seller premium), June 20 (10.6 percent seller premium) and May 24 (10.5 percent seller premium). The months realizing the greatest seller premiums were June (9.2 percent), May (7.4 percent), July (7.3 percent), April (6.4 percent) and March (6.1 percent); the lowest seller premiums were found in December (3.3 percent), October (3.3 percent) and January (3.7 percent).

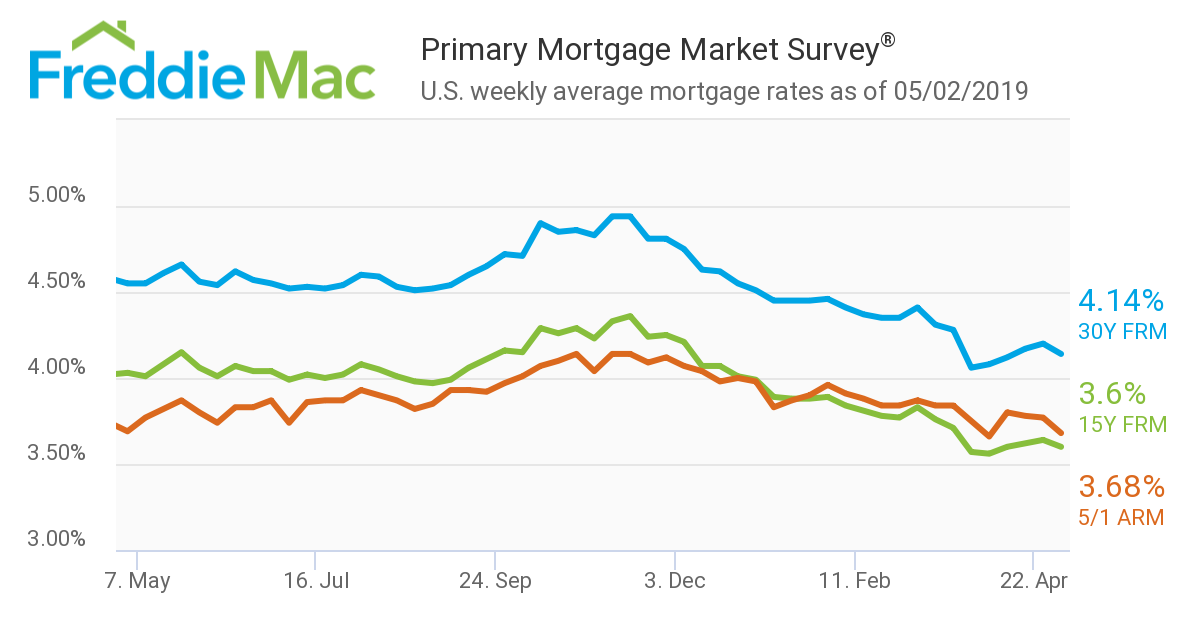

As for those buying a home, mortgage rates continue to drop, according to new data from Freddie Mac.

The 30-year fixed-rate mortgage (FRM) averaged 4.14 percent for the week ending May 2, down from last week when it averaged 4.20 percent. The 15-year FRM this week averaged 3.60 percent, down from last week when it averaged 3.64 percent. A year ago at this time, the 15-year FRM averaged 4.03 percent. And the five-year Treasury-indexed hybrid adjustable-rate mortgage (ARM) averaged 3.68 percent, down from last week when it averaged 3.77 percent.

Sam Khater, Freddie Mac’s Chief Economist, commented that during the summer rates were expected to be “about a quarter to half a percentage point lower than where they were last year, which is good news for the housing market. These lower rates combined with solid economic growth, low inflation and rebounding consumer confidence should provide a solid foundation for home sales to continue to improve over the next couple of months.”

About the author