Advertisement

Housing Starts and Mortgage Applications Up, Rates Down

Today’s housing market data finds more single-family housing starts and an increase in mortgage applications for new home purchases while mortgage rates take a slight dip.

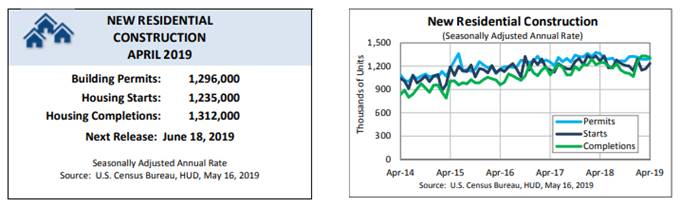

Single-family housing starts in April were at a rate of 854,000, which is 6.2 percent above the revised March figure of 804,000, according to new data from the U.S. Census Bureau and the Department of Housing and Urban Development. Privately-owned housing starts in April were at a seasonally adjusted annual rate of 1,235,000, up 5.7 percent from the revised March estimate of 1,168,000 but 2.5 percent below the April 2018 rate of 1,267,000.

Single-family authorizations in April were at a rate of 782,000, a 4.2 percent drop from the revised March figure of 816,000. Privately-owned housing units authorized by building permits in April were at a seasonally adjusted annual rate of 1,296,000, up by a slight 0.6 percent from the revised March rate of 1,288,000 but five percent below the April 2018 rate of 1,364,000.

Single-family housing completions in April were at a rate of 918,000, a 4.1 percent drop from the revised March rate of 957,000. Privately-owned housing completions in April were at a seasonally adjusted annual rate of 1,312,000, down 1.4 percent from the revised March estimate of 1,331,000 but 5.5 percent above the April 2018 rate of 1,244,000.

Separately, the Mortgage Bankers Association (MBA) reported mortgage applications for new home purchases in April increased 15.6 percent from a year ago and were also up by three percent from March.

The MBA estimated new single-family home sales were running at a seasonally adjusted annual rate of 722,000 units in April, up by 6.8 percent from the March pace of 676,000 units. On an unadjusted basis, MBA estimated that there were 69,000 new home sales in April, an increase of 4.5 percent from 66,000 new home sales in March. The average loan size of new homes increased from $331,794 in March to $338,745 in April, while conventional loans composed 70.7 percent of loan applications, followed by FHA loans at 17.1 percent and VA loans at 11.5 percent.

“There was a healthy increase in new home purchase activity in April, boosted by the strong economic and employment conditions seen in the first quarter of 2019,” said Joel Kan, MBA’s Associate Vice President of Economic and Industry Forecasting. “Applications for new home purchases increased, as did our estimate for new home sales. After two months of declines, MBA estimates that April new home sales were 10 percent higher than last April and reached the highest annual pace since this survey’s inception in 2013.”

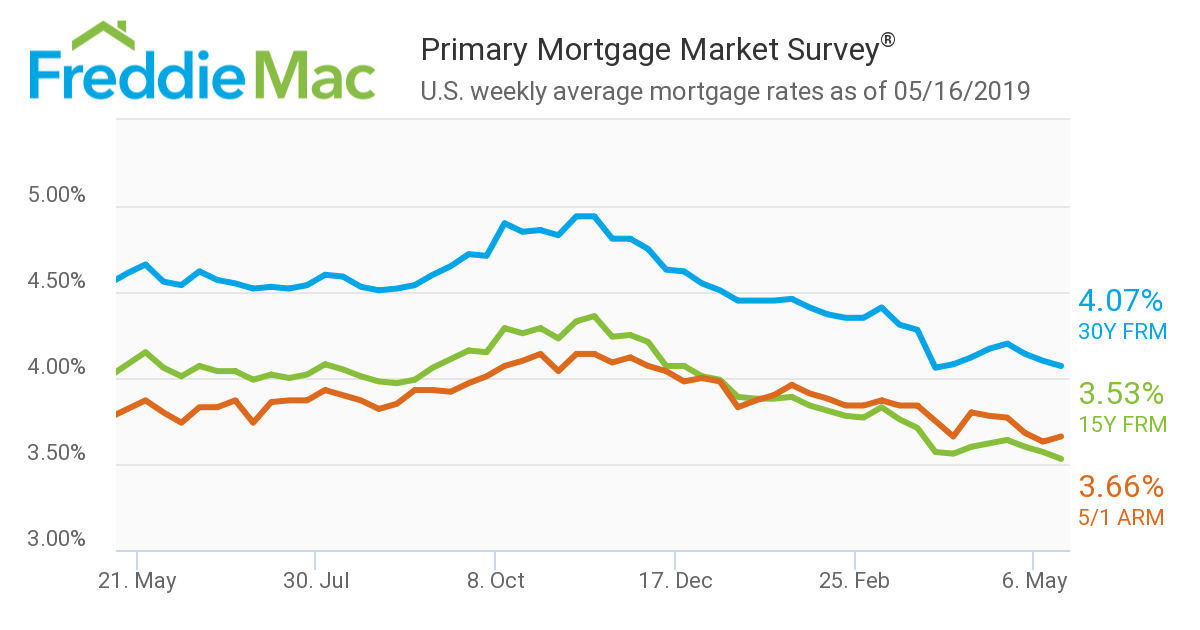

As for mortgage rates, Freddie Mac reported the 30-year fixed-rate mortgage (FRM) averaged 4.07 percent for the week ending May 16, down from last week when it averaged 4.10 percent. The 15-year FRM this week averaged 3.53 percent, down from last week when it averaged 3.57 percent. And the five-year Treasury-indexed hybrid adjustable-rate mortgage (ARM) averaged 3.66 percent, up from last week when it averaged 3.63 percent.

“Modestly weaker consumer spending and manufacturing data, along with continued jitters around trade policy, caused interest rates to decline throughout the yield curve,” said Sam Khater, Freddie Mac’s chief economist. “While signals from the financial markets are flashing caution signs, the real economy remains on solid ground with steady job growth and five-decade low unemployment rates, which will drive up home sales this summer.”

About the author