Advertisement

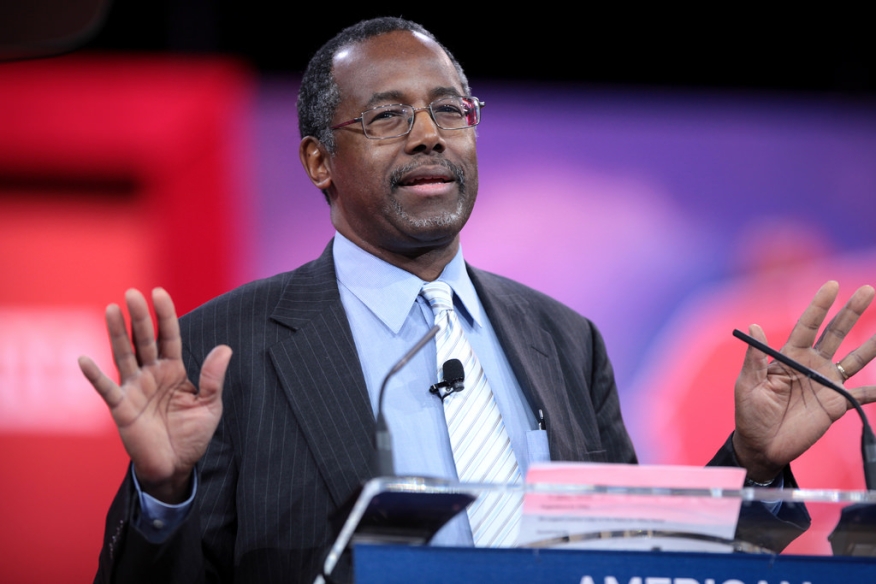

HUD’s Carson Derides “Gotcha” Politics

U.S. Department of Housing & Urban Development (HUD) Secretary Ben Carson is faulting a political culture that is more fixated on exploiting “gotcha” scenarios than discussing serious policy issues.

In an interview with ABC News, Carson’s comments followed a recent situation where he was excoriated on social media for mishearing the housing acronym REO as the cookie Oreo. Although Carson later good-naturedly posed with a bag of Oreos in a photograph on his Twitter channel, he lamented that the brief incident was used to distract from his efforts to highlight HUD’s goals.

“It's silly, you know when we engage in ‘Ha! Gotcha!’ stuff when we have such big policy issues to deal with, and that’s what I want to talk about,” Carson said, adding that the severity of today’s partisan political culture has created an environment of “’you’re evil, you're incompetent, you can't do this, your momma sucks.’ “And I think, 'Give me a break.’”

Carson also used the interview to defend his Department’s planned policy to prohibit illegal immigrants from living with someone who accepts federal housing assistance. Carson insisted this reflects the Trump Administration’s focus of putting people in the country legally “at the front of the line.”

“It's the law and you know we're a nation of laws," he said. "And if the lawmakers don't like it, they need to change it."

Carson also expressed satisfaction with his time at HUD.

“Would it be a lot easier to be in the private sector enjoying life, not having all these rules you have to follow, making tons of money? Yes, that would be much easier,” he said. “But this is something I feel we're called to do. And if all the people throughout our history had taken the easy pathway, where we'd be now?”

About the author