Advertisement

New Data Forecast Details Potential Property Flooding From Climate Change

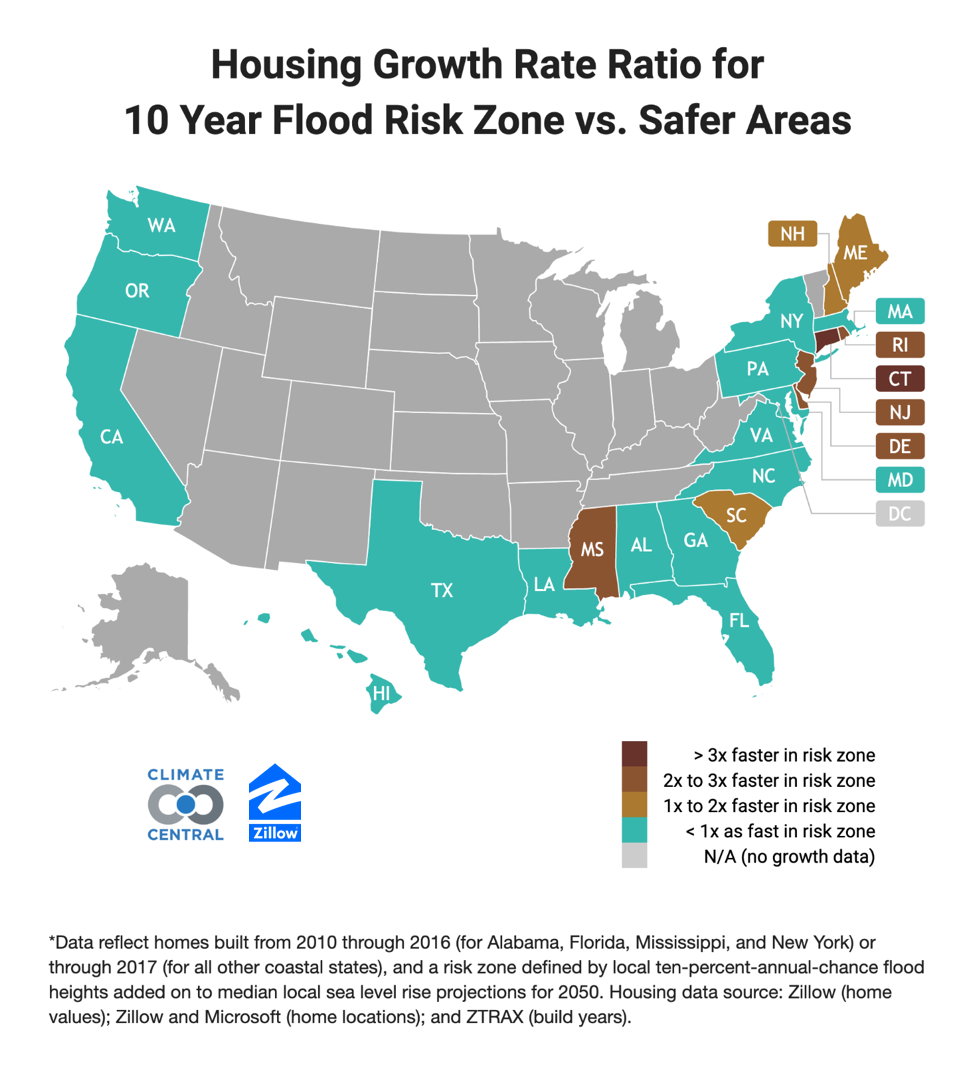

A new study is warning that 20,000 homes built over the past decade are in coastal areas that are at risk for chronic flooding by 2050.

The new analysis issued by Zillow and Climate Control also warned that more than 800,000 homes worth a total of $451 billion could be at a risk by 2050 if rising sea levels continue as a result of unchecked greenhouse gas emissions. Those numbers jump to 3.4 million existing homes worth $1.75 trillion by 2100.

The data analysis also forecasted that Florida would have the most homes in the zone at risk from sea-level rise and 10-year floods by 2100 (1.58 million), followed by New Jersey (282,354), Virginia (167,090), Louisiana (157,050) and California (143,217) if emissions continue unchecked.

"This research suggests that the impact of climate change on the lives and pocketbooks of homeowners is closer than you think. For homebuyers over the next few years, the impact of climate change will be felt within the span of their 30-year mortgage," said Skylar Olsen, Zillow's director of economic research and outreach. "Without intervention, hundreds of thousands of coastal homes will experience regular flooding and the damage will cost billions. Given that a home is most people's largest and longest-living asset, it takes only one major flood to wipe out a chunk of that long-growing equity. Rebuilding is expensive, so it's doubly tragic that we continue to build brand new units in areas likely to flood."

About the author