Advertisement

Housing Reform Liquidity Dominates MBA Annual Speeches

The question of housing finance reform and an ensured continuation of liquidity was front and center at the Mortgage Bankers Association’s (MBA) Annual Convention & Expo in Austin.

MBA President and CEO Robert Broeksmit (pictured right) assured the convention audience that the trade group was “talking with leaders from both parties in Congress and we’re talking with every federal agency imaginable.” Broeksmit made it clear that government-sponsored enterprise (GSE) reform could not be a return to the pre-2008 status quo.

MBA President and CEO Robert Broeksmit (pictured right) assured the convention audience that the trade group was “talking with leaders from both parties in Congress and we’re talking with every federal agency imaginable.” Broeksmit made it clear that government-sponsored enterprise (GSE) reform could not be a return to the pre-2008 status quo.“Our goal isn’t ‘recap and release,’” he said. “We recognize the need to rebuild capital, but we will fight to ensure that before the GSEs are released from conservatorship, we will have reforms in place–by rule and by legislation–that meet our core principles and will remain in place after conservatorship ends.”

Broeksmit acknowledged that “leveling the playing field for private capital could mean a smaller GSE market share, which means it needs to be done with great care. It needs to ensure access to affordable credit–to preserve the mission of the GSEs to serve low-, moderate- and middle-income families–and to make sure there is liquidity nationwide through all market cycles.”

However, Broeksmit insisted that speed should not be given priority over safety in the process. “The name of the game is action and caution,” he continued. “The balance between them is where we’ll find the stability you need. Whether it’s housing finance reform, the QM Patch, or any other issue, our message to legislators and regulators alike is the same: be smart and be careful. Our members, and American consumers, need clear policies and clear timelines. Actions should be gradual and telegraphed– a dial, not a switch. We’re telling them, in no uncertain terms: do not disrupt the market.”

Mark Calabria (pictured left), Director of the Federal Housing Finance Agency (FHFA), told the MBA audience that the GSEs were nowhere near ready to be released from their 11-year-old federal conservatorship.

Mark Calabria (pictured left), Director of the Federal Housing Finance Agency (FHFA), told the MBA audience that the GSEs were nowhere near ready to be released from their 11-year-old federal conservatorship.“One way to think about FHFA’s standards for safety and soundness is: Are Fannie and Freddie equipped to withstand a downturn on the scale of what we saw in 2007 and 2008?” Calabria said. “We know they cannot meet that standard right now. But I believe they are capable of and committed to getting there. In fact, today I think we see the strongest board and management teams in the history of these companies. I will measure progress by looking at whether they are moving in the right direction and as quickly as possible without jeopardizing their mission.”

Calabria admitted that the GSEs were unable to “change their risk profiles overnight,” adding that the recently introduced reforms proposed by his agency and Trump Administration offer a guide to “begin the process of calibrating their risk to their capital levels.” Still, Calabria insisted that the process cannot proceed at a leisurely pace.

“When tailoring risk, we will proceed thoughtfully,” he said. “But this does not mean moving slowly. Small adjustments to the footprint can pay significant dividends in trimming the tails of risk. Matching Fannie and Freddie’s risk profiles to their capital levels is also part of addressing overlaps between the enterprises and the Federal Housing Administration.”

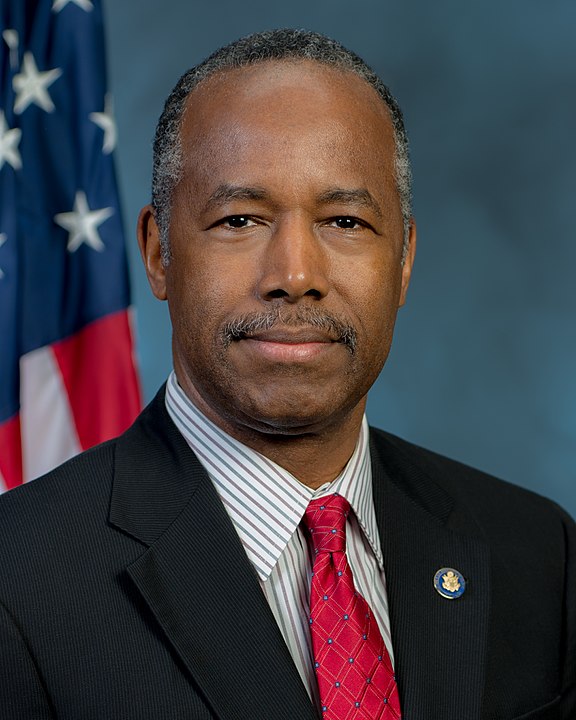

U.S. Department of Housing & Urban Development (HUD) Secretary Ben Carson (pictured right) also addressed MBA Convention attendees on the subject of liquidity, with a focus on Ginnie Mae’s role in the process.

U.S. Department of Housing & Urban Development (HUD) Secretary Ben Carson (pictured right) also addressed MBA Convention attendees on the subject of liquidity, with a focus on Ginnie Mae’s role in the process.“Following the 2008 financial crisis, Ginnie Mae’s outstanding mortgage-backed security guaranty portfolio swelled nearly fourfold to over $2 trillion,” Carson said. “Then, as now, Ginnie Mae has been able to fulfill its mission because of the full faith and credit guaranty of the Federal Government. Ginnie Mae could–if authorized by Congress–extend its explicit guaranty to mortgage-backed securities backed by conventional single family and multifamily mortgages, as the agency already has the experience of administering and managing the growth of its own mortgage-backed security portfolio.”

Carson added that his Department had called on Congress to “pass legislation granting the agency authority to administratively adjust its guaranty fee within a narrow, permissible range. This authority would allow Ginnie Mae to ensure these amounts are high enough to meet its statutory obligations, under even the most extreme circumstances.”

About the author