Advertisement

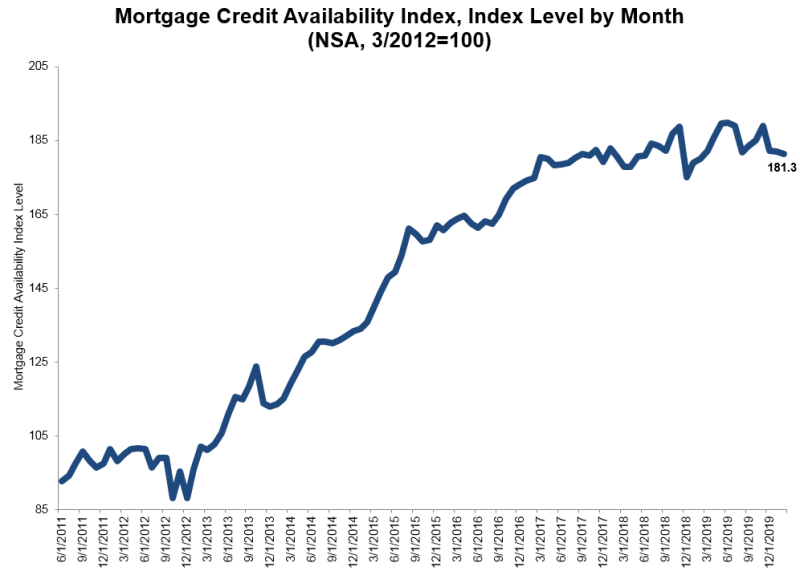

Mortgage Credit Availability Falls in February

Mortgage credit availability decreased in February, according to the Mortgage Credit Availability Index (MCAI), a report from the Mortgage Bankers Association (MBA) that analyzes data from Ellie Mae’s AllRegs Market Clarity business information tool.

The MCAI fell by 0.3 percent to 181.3 in February. A decline in the MCAI indicates that lending standards are tightening, while increases in the index are indicative of loosening credit. The Index was benchmarked to 100 in March 2012. The Conventional MCAI decreased 1.2 percent, while the Government MCAI increased by 0.7 percent. Of the component indices of the Conventional MCAI, the Jumbo MCAI decreased by one percent, and the Conforming MCAI fell by 1.6 percent.

“Mortgage credit supply decreased in February, as both conforming and jumbo segments of the market saw a decline,” said Joel Kan, MBA’s associate vice president of economic and industry forecasting. “There were also reductions in ARM program offerings, as well as in low credit score programs offered by investors. Last month’s activity was the calm before the storm. Mortgage rates dropped steeply in the last week of February and a large surge of refinance activity followed. Investors may adjust their future mortgage credit offerings based on the sudden upswing in demand.”

About the author