Advertisement

Mortgage Rates Plummet to 50-Year Low

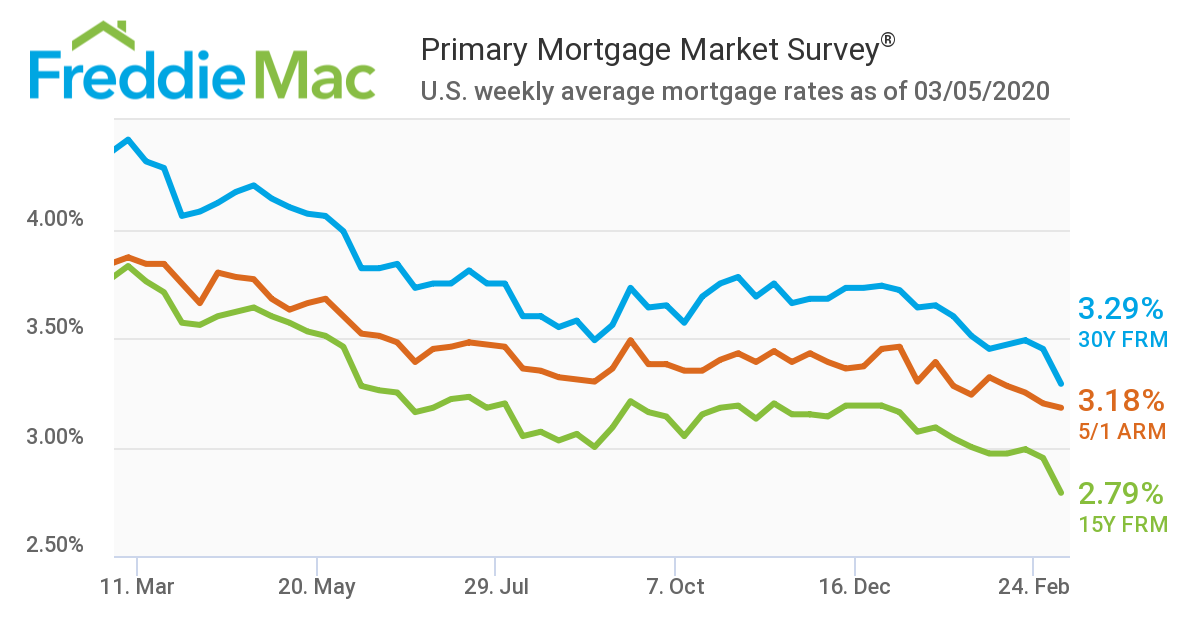

Freddie Mac released the results of its Primary Mortgage Market Survey (PMMS), showing that the 30-year fixed-rate mortgage (FRM) averaged 3.29 percent this week, the lowest rate in the survey’s history which dates back to 1971.

“The average 30-year fixed-rate mortgage hit a record 3.29 percent this week, the lowest level in its nearly 50-year history. Meanwhile, mortgage applications increased 10 percent last week from one year ago and show no signs of slowing down,” said Sam Khater, Freddie Mac’s chief economist. “Given these strong indicators in rates and sales, as well as recent increases in new construction, it’s clear the housing market continues to be a positive force for the broader economy.”

Earlier this week, the Federal Open Market Committee (FOMC) lowered the target range for the federal funds rate by 1/2 percentage point, to one to 1.25 percent over fears of the spread of the coronavirus epidemic.

The 30-year fixed-rate mortgage averaged 3.29 percent with an average 0.7 point for the week ending March 5, 2020, down from last week when it averaged 3.45 percent. A year ago at this time, the 30-year FRM averaged 4.41 percent. Meanwhile, the 15-year fixed-rate mortgage averaged 2.79 percent with an average 0.7 point, down from last week when it averaged 2.95 percent. A year ago at this time, the 15-year FRM averaged 3.83 percent. The five-year Treasury-indexed hybrid adjustable-rate mortgage (ARM) averaged 3.18 percent with an average 0.2 point, down from last week when it averaged 3.20 percent. A year ago at this time, the five-year ARM averaged 3.87 percent.

About the author