The

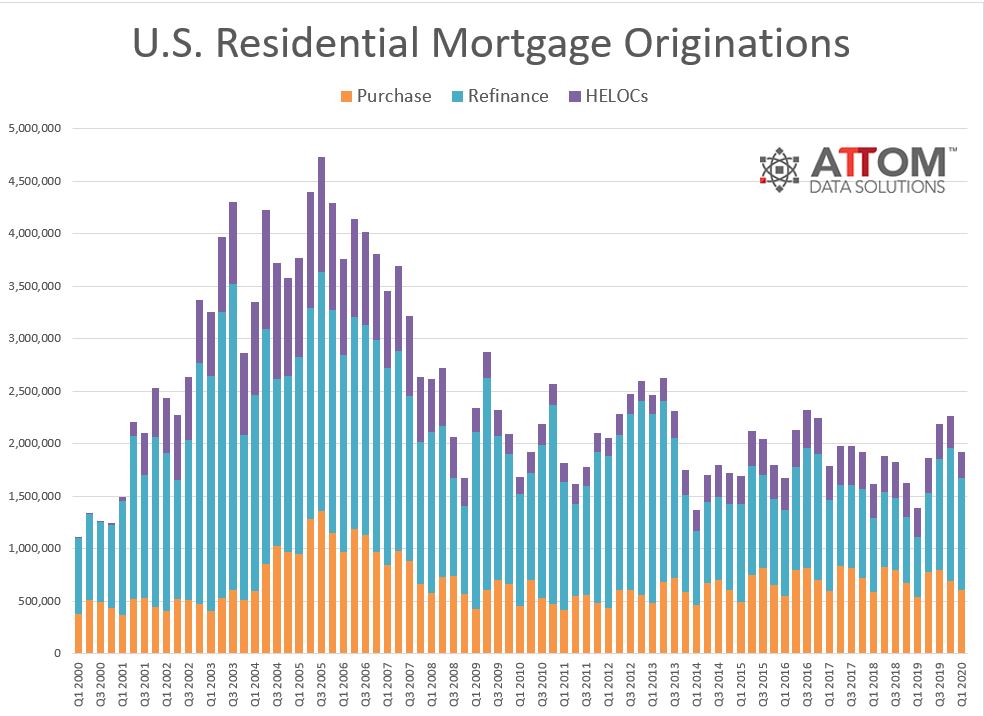

2020 U.S. Residential Property Mortgage Origination Report from ATTOM Data Solutions finds that residential mortgage refinances were responsible for more than half of home loans in the first quarter of 2020. ATTOM's report stated that 1.07 million residential refinance mortgages were originated in the first quarter of 2020. While that figure is a 16% decrease from Q4 of 2019, it represents an 87% increase from Q1 of 2019.

According to ATTOM, the increase is tied to the series of low rates that have driven an estimated $328.5 billion in total volume for the first quarter, a 105% increase from Q1 2019.

"Home-loan data was way up again in the first quarter of the year, with refinancing activity again accounting for more than half the total volume of mortgages. The number and dollar value of home loans marked yet another sign of the how charged up the U.S. housing market continued to be in the early months of the year when everything was still pointing in the right direction," said Todd Teta, chief product officer at ATTOM Data Solutions. "Unfortunately, that is all uncertain now due to the economic fallout from the virus pandemic that could throw the market into a downturn. But at least the market heads that uncertainty with some of the strongest home loans–and by extension, overall market–numbers since the aftermath of the last recession."

The report revealed that refinances increased in some of the largest metros like New York, Los Angeles and Chicago. In addition, purchase mortgage originations are up 13% from a year ago, HELOC originations fell 11% from a year ago and Federal Housing Administration loans dipped 4%.

Actions taken earlier this week by the

Federal Housing Finance Agency will now allow Fannie Mae and Freddie Mac borrowers in forbearance to apply for refinancing and new purchase mortgages once their loans are current, this waiving a previous mandatory wait of 12 months, a move that will allow faster access to the

latest record-low rates.

Click here to read ATTOM's full 2020 U.S. Residential Property Mortgage Origination Report.